Welcome to Couples + Money, where we break through the confines of polite conversation. Forget questions about your sex life. We're getting even more personal. Let's talk about what you and your partner are doing—and not doing—with your paychecks.

Every other Thursday, a couple will get candid with MarieClaire.com about how they split their finances. We’ll break down what each person pays for individually, what they split, and all the gritty details—from who picks up the bill in restaurants to who picks fights over bank statements.

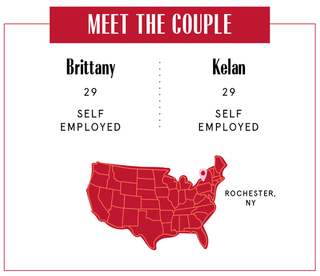

This week, we're talking with Brittany Kline, 29, and her husband, Kelan, 29, who work on a personal finance blog together and pay themselves $65,500 per year ($5,500 per month). They've been officially together 15 years and live in Rochester, NY.

Want to be profiled with your partner in Couples + Money? Get in touch: couples.money@hearst.com.

How It All Happened

Brittany: We're high school sweethearts!

Kelan: We met in a ninth grade ASL class. We ended up getting a group of people from the same class and started to walk together. In class, we sat next to each other and started passing notes.

Brittany: Basically from there it was history.

Stay In The Know

Marie Claire email subscribers get intel on fashion and beauty trends, hot-off-the-press celebrity news, and more. Sign up here.

Kelan: I graduated with a business administration degree, but I was also passionate about becoming a police officer. Eventually, I got a job as a county jail officer—a jail deputy. I did that for 2.5 years and fell into a deep depression because it wasn't what I wanted it to be. Luckily Brittany got hired as a teacher and was able to support us so I could quit my job. I went back to school to become a home inspector, still looking for ways to make money online. I came across personal finance blogs that were making an absolute killing. That's when the idea sparked. In July 2016 we started The Savvy Couple as a passion project to help others. For nine months we were waking up early, working on the weekends. On that ninth month we made $50 through a sponsorship. Within a week I went to Brittany and said, "I'd love to quit my job." The second year, we hit a $10,000 month and I realized we could do this full time, together. I went to Brittany again: "If we could afford it and it made sense, would you want to join the business full-time?" She said, "That'd be amazing!" We started attacking our debt. Within five months, we paid off $25,000 and had some of our biggest months ever blogging. Brittany quit her job that following summer.

Brittany: It's definitely an adjustment living and working together. It's not for everybody, but we find ways to work around different schedules. Consistency is key, and that really helps us as business owners and in life.

Our Dependents

Kelan: We have our daughter, Kallie, who's 18 months, and we also have a small dog named Charlie who's 12.

Brittany: Kallie's budget has definitely evolved. When she was a newborn, we had a lot of help from showers and family. We were lucky that my brother had his daughter before I had Kallie, so we got a lot of hand-me-downs. Now it's still pretty low, $50 a month. That's diapers and stuff she needs. Charlie's about $40 every couple of months. We had an emergency with him a few years ago, so we did have a quite a bit of medical bills. We just used our emergency fund for that.

Kelan: Since we both work from home now, Brittany watches Kallie during the day and then I'll take her later.

When We Told Each Other Our Salaries

Kelan: Talking about our student loans when we moved in together—what we wanted our life to look like. It was our first real conversation about budgeting our money, taking care of debt, understanding student loans. We had a budget with how much money we were making from our side hustles, our jobs at the school, parents helping us out.

Brittany: Fifteen years ago, we started just talking about who was going to treat breakfast that morning on the way to school. I love coffee!

How We Handle the Cost of Living

Kelan: We just moved to an S Corp versus an LLC. So I've started taking a payroll of $66,000 out of the business. I take out as little as we can to live off of, and then keep the money in the business to continue to grow.

Why We Have Joint Accounts

Kelan: We're Christians, and we believe marriage is a one-time thing. We have that very deep bond together—best friends, soul mates—so we trust each other and do it as a unit. As soon as we got married, we opened up joint accounts.

How Often We Talk About Money

Kelan: Being personal finance bloggers, we talk about it daily!

Brittany: We have weekly marriage meetings. It's based on a PDF I saw on Pinterest, and we adapted it. We have a section where we talk about our budget, and open up Mint.com, and take a look at what's happening and how we're working towards our goals.

Kelan: It doesn't take long, 15-30 minutes. We're also talking about our marriage, what we did well together. We try to give each other compliments on things that really worked well, things that we appreciated, and things that we can improve on. Sometimes at the end of the month, we'll go big picture, net worth and investments.

What We Keep Secret

Brittany: We have to, as business owners too, just be very open. Our communication about money is basically what our business model is all about. So, I think it's just something we do naturally.

How We Learned To Budget

Kelan: My parents always involved the kids into the conversations with money, so I was addicted to money and numbers from an early age. When my dad lost his job with Kodak when I was 13, my parents came to us and said, "Listen, Dad lost his job. We have to cut back in certain areas, just for a little bit until he can find another job." They even sat us down with a budget and showed where we're spending money. My dad was always big on having an allowance and a chore chart for us, and he forced us to save 10 percent of it. They brought me to their financial planner meetings for retirement. Around 13-14, I started to look for work. My dad showed me eBay and how you can take items you're no longer using and sell them. I became really passionate about making money online and seeing how much freedom it can bring you. I was always selling stuff on eBay, Amazon.

Brittany: Growing up, I had a single mom, working with three kids. She just pulled money where she could when it was needed. It wasn't any kind of system. Seeing everything she went through and how much she sacrificed, that had a really big impact on me. I'm definitely more the saver and trying to find deals, make sure we're always on budget.

Kelan: I'd consider myself the spender in the relationship. Brittany definitely struggles with spending money, but I'm still extremely frugal as well. I'll wear shoes until they have holes in them.

Brittany: We've been together forever—Kelan basically taught me how to drive! We both learned so much from each other. He helped me with learning personal finance, too.

Kelan: I think when you first start blogging, the learning curve is extremely difficult. That's why a lot of bloggers fail. They can't get past that and commit to making it work. Now it's more competitive than when we started. So it's important to pick a niche that you're very passionate about, that you can work on as a hobby. If you're making money from it, that's just icing on the cake. Food blogs, lifestyle blogs, they make a ton of money through ads and display ads. Personal finance, it's through affiliate marketing or creating your own digital products. Each niche has their own way of monetizing.

Our Biggest Fight About Money

Brittany: When Kelan approached me to pay off my student loans, I shut it down. I wasn't going to try to rush and pay it off because I'm such a saver. I didn't want all our money going to this debt—everybody has debt, and it takes everybody that long to pay it off. It took a while to convince me, and I didn't agree with it the whole time it was happening. But it allowed me to quit my job, so he was right the entire time.

Kelan: You're looking for just one answer?? I had money saved up from my side hustle in college, and I purchased a motorcycle. I mean, I talked to Brittany about it, but obviously she wasn't fond of the idea. Once Kallie was born, I did sell it: not really worth it being a dad now. An ongoing discussion we have—I'm notorious for going over my personal budget. It's not crazy, like hundreds of dollars. And Brittany is very good at staying under it. So that's something we joke about, but also discuss how we can improve.

How We Pay For The Non-Essentials

Brittany: We each get $100 a month. We don't have to ask the other one permission to buy anything as long as it's within that. Most of my money goes to coffee! We use our joint entertainment budget for fun stuff we do as a couple, or with Kallie. And other fun stuff like trips has its own budget every month.

What We're Banking On

Kelan: We plan to reach financial independence by 35. That's 5.5 years away and achieved by growing our business and brand. But we're not fond of the idea of not working, we love what we do. We also love going on vacations. Making sure that we're still having fun while we're working hard. We have a goal of purchasing a fifth wheel RV and a truck to travel around the U.S. during the summers or winters. We're also saving up a decent down payment to move either into a new house or build our own barndominium, with a little more land to play around on and be a little bit more secluded from neighbors.

Brittany: We're also going to be in 1-2 years looking to expand our family again. So, that's something on my radar at least. I don't really think longer than that. Kelan's the long-term planner.

Interviews have been condensed and edited for clarity. Reporting and editing by Katherine J. Igoe. Design and illustration by Morgan McMullen.

For more stories like this, including celebrity news, beauty and fashion advice, savvy political commentary, and fascinating features, sign up for the Marie Claire newsletter.

Related Story

Related Story

-

Celebrate Earth Month With Our Feel-Good Fashion Report

Celebrate Earth Month With Our Feel-Good Fashion ReportYour guide to being more sustainable in 2024.

By Anneliese Henderson Published

-

Anne Hathaway Details the "Gross" Audition Request She Once Endured

Anne Hathaway Details the "Gross" Audition Request She Once Endured"Now we know better."

By Meghan De Maria Published

-

The Emotional Ending of 'Baby Reindeer,' Explained

The Emotional Ending of 'Baby Reindeer,' ExplainedNetflix's latest miniseries from Richard Gadd is based on the true story of the comedian and his stalker.

By Quinci LeGardye Published

-

This Mutual Fund Firm Is Helping to Create a More Sustainable Future

This Mutual Fund Firm Is Helping to Create a More Sustainable FutureAmy Domini and her firm, Domini Impact Investments LLC, are inspiring a greater and greener world—one investor at a time.

By Sponsored Published

-

Don't Stress! You Can Get in Good Shape Money-wise

Don't Stress! You Can Get in Good Shape Money-wiseYes, maybe you eat paleo and have mastered crow pose, but do you practice financial wellness?

By Sallie Krawcheck Published

-

The Future of Women and Work

The Future of Women and WorkThe pandemic has completely upended how we do our jobs. This is Marie Claire's guide to navigating your career in a COVID-19 world.

By Megan DiTrolio Published

-

Where Did All My Work Friends Go?

Where Did All My Work Friends Go?The pandemic has forced our work friendships to evolve. Will they ever be the same?

By Rachel Epstein Published

-

What Travel Exec Ruzwana Bashir Wears to Work

What Travel Exec Ruzwana Bashir Wears to WorkThe founder and CEO of experiences booking website Peek.com has the chic casual look on lock.

By Megan DiTrolio Published

-

How to Get a New Job in a Virtual World

How to Get a New Job in a Virtual WorldYour Zoom game has never been stronger.

By Rachel Epstein Published

-

The Best Low-Risk Investments, According to Sallie Krawcheck

The Best Low-Risk Investments, According to Sallie KrawcheckThere's no such thing as a completely risk-free investment, but these five money-makers are pretty darn close.

By Sallie Krawcheck Published

-

The Ultimate Guide to Buying A Car

The Ultimate Guide to Buying A CarIn Marie Claire's latest money column, we break down one reader's plan to make a life-changing purchase. This month, two Capital One pros help Tara, a fintech program manager, figure out how to afford her very first car.

By Megan DiTrolio Published