Sponsor Content Created With Marshalls

5 Smart Money Moves For Financial Security

Top insights from author and finance expert Erin Lowry during Power Play Philadelphia.

Marie Claire brought its Power Play summit to Philadelphia on September 17 and 18, gathering visionary women to champion this year's central theme: Perseverance. The two-day event, presented by Marshalls, marked the second Power Play summit of the year and brought together a dynamic lineup of speakers from entertainment, sports, tech, and business.

For the first time in Power Play history, the second day of the event was opened to the broader Philadelphia community. This was made possible through a partnership with The Marshalls Good Stuff Social Club, the retailer's purpose-driven platform designed to give women access to the tools, resources, and communities needed to unlock the lives they want to live. The event invited ambitious guests to engage in a day of impactful programming, networking opportunities, and immersive activations designed to bridge the gap between their vision boards and their realities. Here are our top insights from this inspiring day.

On day two of Power Play Philadelphia, Marie Claire's new financial empowerment franchise Money Talks was brought to life onstage. Author, speaker, and finance expert Erin Lowry is on a mission to help women understand the importance of financial health, so she led a session where attendees broke into small, facilitated groups to discuss three money-related prompts. The session ended with a Q&A, during which attendees shared insights from their group discussions. We've rounded up some of the most helpful insights for you below.

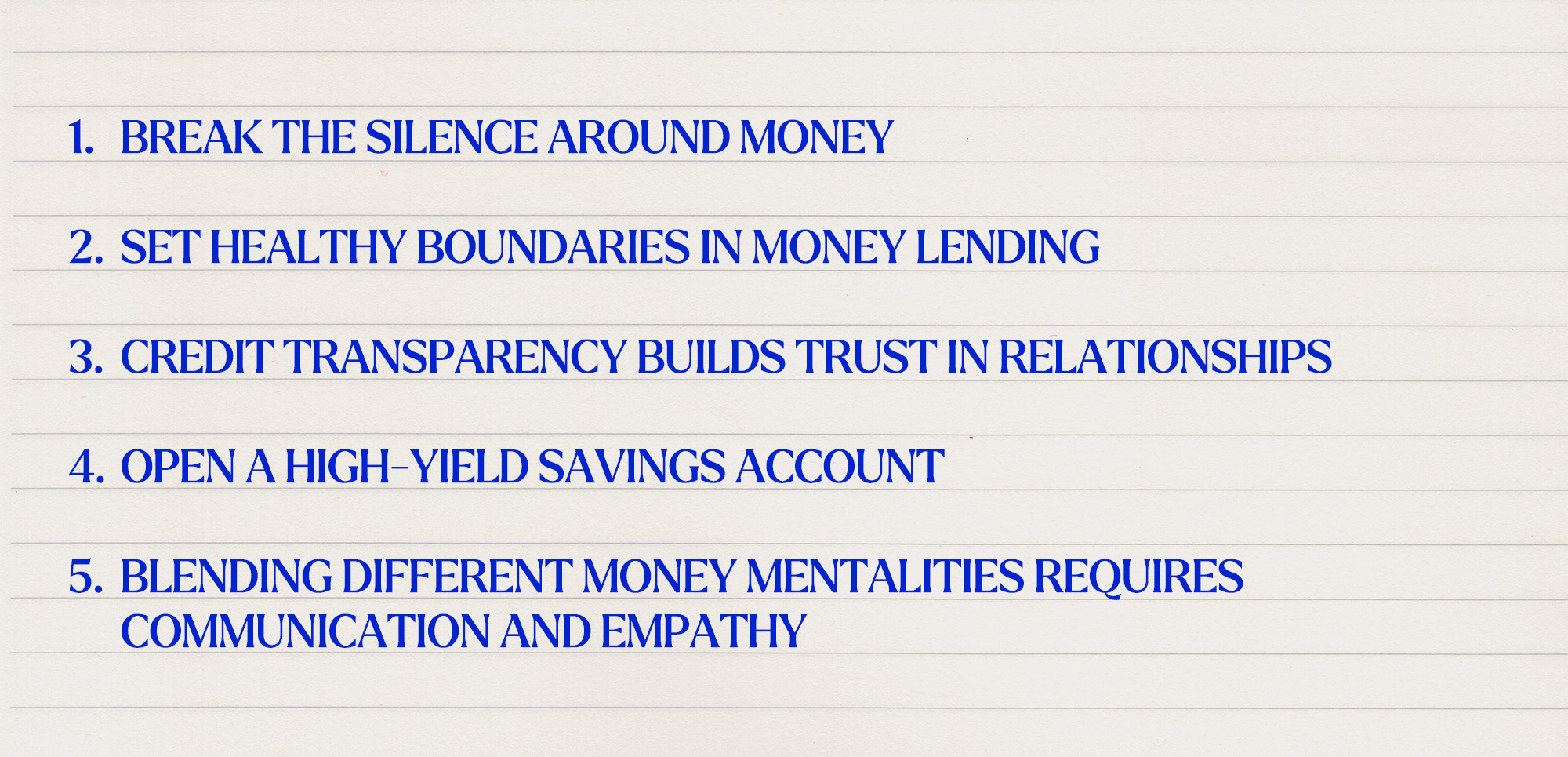

Our top takeaways:

1. Break the Silence Around Money

"Money is very much psychology. It's how we relate to things. It's how we think about things. It's how we interact. And in order to be good at money, we also need to learn how to talk about money. Because who benefits from us staying silent about money? It's certainly not us, especially a room full of women, because being quiet about money is what allows … systemic issues like wage gaps to persist. It makes it harder to set boundaries around our personal finances." — Erin Lowry

Open, honest money conversations reduce stress, improve control over finances, and address bigger systemic issues.

2. Set Healthy Boundaries in Money Lending

"If you are going to loan somebody money, it better be a gift. And there are a couple of reasons why this is true. First of all, if you reframe it as a gift in your head, you're only going to give an amount that you can afford to give. You really need to make sure that you are never loaning a loved one money that's going to put you in a financial bind. The other thing you can offer to do is pay very specific bills for them. Making sure that you don't let resentment seep into your relationship is another really important part about setting incredibly healthy boundaries." — Lowry

Treat loaned money to loved ones as a gift, only give what you can afford to lose, consider paying bills directly, and communicate clearly to avoid resentment.

3. Credit Transparency Builds Trust in Relationships

"If you're going to move in [with a partner], you should both be printing out your credit reports and having a conversation. The reason that's so important is because some people do grow and do change over time, and sometimes things have an explanation. Other times they do not." — Lowry

Sharing credit reports before cohabitation fosters understanding, allows room for growth, and prevents surprises or judgments.

4. Open a High-Yield Savings Account

"It is really important that you are introspective about spending on the things that are incredibly important to you, so you can lavish on the things that matter for you and let the rest of the noise go—because that's the way that we can also live a very rich life, a very whole life, a very fulfilled life. Now, when it comes to the actual, practical methods of saving up for goals, one of the most important ones is knowing how much you want to save…be hyper specific when you set a goal. Give it a timeline, give it a very specific amount. Whatever it is that you want to save up for...be very specific about it and please put it in a high-yield savings account!" — Lowry

When saving for goals, be extremely specific—define the amount, the purpose, and the timeline. Then, keep that money in a high-yield savings account to help it grow.

5. Blending Different Money Mentalities Requires Communication and Empathy

"One of the really important things about getting married is learning how to communicate about money. It keeps getting cited as one of the largest stressors for individuals and for couples. It's a leading cause for divorce. So you should understand your person's blueprint, how they react to money, and why that's a really important conversation to have early in a relationship." — Lowry

Especially in marriage, understand each other's financial backgrounds, use active listening to avoid misunderstandings, and allow space when emotions run high.

Discover more about Power Play Philadelphia and The Marshalls Good Stuff Social Club here.

Get exclusive access to fashion and beauty trends, hot-off-the-press celebrity news, and more.

Marie Claire is committed to celebrating the richness and scope of women's lives. We're known for our award-winning features, thoughtful essays and op-eds, deep commitment to sustainable fashion, and buzzy interviews and reviews. Reaching millions of women every month, MarieClaire.com is an internationally recognized destination for celebrity news, fashion trends, beauty recommendations, and renowned investigative packages.

-

Andrew’s Arrest Has Been \201cCatastrophic\201d for Sarah Ferguson

Andrew’s Arrest Has Been \201cCatastrophic\201d for Sarah FergusonA source says the former duchess is "in a bad way" following her ex-husband's historic arrest.

-

London Fashion Week Street Style Is a Masterclass In the Year's Most Stylish Hair Trends

London Fashion Week Street Style Is a Masterclass In the Year's Most Stylish Hair TrendsTaking notes from across the pond.

-

Kendall Jenner Reunites With Her Signature 2016 Sneakers: Adidas Superstars

Kendall Jenner Reunites With Her Signature 2016 Sneakers: Adidas SuperstarsYou're up next, Gigi Hadid.