Can Guaranteed Income Help Americans Escape Poverty?

Ciara McDonald, a single mother of three in Jackson, Mississippi, received $1,000 a month for a year. Here’s what happened.

Ciara McDonald lay in a hospital in Jackson, Mississippi, about to give birth to her third child. Her chest tightened. The room began to float. She smelled burning rubber. She asked the doctor to call her sister but couldn’t remember her sister’s name. McDonald ended up delivering a healthy boy she named Caiden, but the symptoms kept coming back. One year later, a doctor gave her a name for it: a panic attack.

“What are you stressing about?” he asked.

“Everything,” said McDonald. “Bills, kids need stuff for school, trying to get stuff done and not being able to.”

“When you’re under stress, go to your happy place,” he said.

“Where is the happy place?” she asked. “I want to go there.”

McDonald tried to envision it, pasting magazine clippings on poster board: a photo of a smiling young Black woman at what looked like a good job; two houses she would own, a starter home and one with grand columns; a pair of SUVs, one for travel and one for every day. She’d heard people talk about their vacations, so she cut out pictures of a cityscape, a water park, and a woman by the sea lifting her hands in a gesture of freedom. She added a bride and groom and the word retirement. She found a beaming Oprah, born to a poor single mother in Mississippi but now doing just fine. She hung the vision board in her bedroom. Caiden tore it down.

McDonald, at 29, was far from her dreams. She was on her fifth go at a GED and studying for an associate’s degree, but she wondered how much longer she could ask friends and family to watch Caiden during class. She had little time to work—now and then she braided hair for $25 to $100 a head—and didn’t get child support; her kids’ fathers were dead, in prison, or refusing to pay. Federal aid helped with rent, health care, a share of utility bills, and food, but she was more than $2,000 behind on car-related expenses and electric bills. When she thought about scrounging up $500 for monthly basics like gas, diapers, and laundry, she sometimes struggled to breathe. She wondered, How do you get somewhere from nowhere?

Get exclusive access to fashion and beauty trends, hot-off-the-press celebrity news, and more.

Ciara McDonald was chosen in a lottery to be one of 20 Black single mothers to receive guaranteed income for a year.

Then, in November 2018, McDonald got a call from Aisha Nyandoro, head of Springboard to Opportunities, a local nonprofit where McDonald had taken a career-readiness class. Nyandoro said she’d picked McDonald’s name in a lottery to get $1,000 a month for a year, as part of an experiment called Magnolia Mother’s Trust that was giving no-strings-attached cash to 20 Black single mothers in Jackson’s low-income housing. When her first check arrived, McDonald had $1.01 in her bank account.

The idea of solving poverty by giving people money isn’t new. In the 1960s and ’70s, thinkers across the political spectrum—including Martin Luther King Jr. and economist Milton Friedman—pushed for a guaranteed income floor. Most proponents define basic income as regular, unconditional cash payments to individuals. Some advocate a universal basic income (UBI), which would give the same amount to everyone, regardless of earnings or wealth. Others favor targeting disadvantaged groups as a way of addressing inequality. Either way, there are no stipulations on what is to be done with the money. Unlike minimum wage and, often, welfare and food-stamp programs, basic income is never tied to work. For the Left, the policy promises to reduce inequality; for the Right, it could replace complicated and costly government programs. But political opposition has meant that, until now, the idea has never taken off.

Support for basic income reached a new high in 2020. With automation threatening to displace millions of workers in the coming decade, the idea has found strong support among Silicon Valley executives such as Elon Musk and Mark Zuckerberg. Andrew Yang got surprisingly far in this cycle’s Democratic primary by promising every adult a monthly “Freedom Dividend” of $1,000. Pope Francis endorsed UBI in his 2020 Easter letter. This spring, as COVID-19 spread around the country and unemployment claims skyrocketed, politicians ranging from Bernie Sanders to Mitt Romney pushed for giving cash to every American. As of press time, President Trump had signed one economic-relief package that, among other things, sent a onetime payment of up to $1,200, plus $500 for each child under 17, to most American adults.

Some jurisdictions are already starting to experiment with the concept. Startup accelerator Y Combinator is running a study with 3,000 people in two undisclosed states. Stockton, California, became the first American city to start a mayor-led pilot last year, dispensing $500 per month for 18 months to 125 residents. (It was recently extended to 24 months because of the pandemic.) This summer, 16 U.S. mayors—including Jackson’s—announced a coalition to explore guaranteed-income programs in their cities and advocate for the policy federally.

Research from past experiments in the U.S. and abroad has largely debunked the idea that receiving basic income significantly reduces employment. Any declines in work hours have stemmed mostly from young people staying in school longer, mothers spending more time at home, and unemployed people taking longer to accept a new job. Studies over the past 50 years show recipients don’t spend more on alcohol or tobacco. On the contrary, research links these cash payments to numerous benefits: lower poverty, debt, and crime; better nutrition and health-care access; fewer underweight babies; boosted school attendance and test scores; higher earnings and savings; a stronger local economy; less domestic violence; and improved mental health.

Nyandoro hadn’t heard of basic income when she first thought to give poor women cash. Poised and stylish, with a dimpled smile, Nyandoro, 40, conveys a preacher’s clarity of purpose and a den mother’s protectiveness of her pack. She always knew she’d follow her grandmother L.C. Dorsey, a Mississippi sharecropper turned civil-rights activist, and go into community engagement and social-justice work. After getting a PhD in community psychology and doing research at Michigan State, Nyandoro returned to her native Jackson with her husband, an engineer she met in grad school, to work for a community-based foundation.

The capital of the country’s poorest state bears scars from centuries of racist violence and inequality. This is where Freedom Riders were jailed, where a mob assaulted Black students and their white supporters at a Woolworth’s lunch counter, where civil-rights icon Medgar Evers was murdered. The state only ratified the amendment banning slavery in 2013 and only agreed to remove Confederate iconography from its flag this summer. By 2017, after decades of white flight and disinvestment, Jackson’s potholed roads were a campaign issue. The state was threatening to take over failing schools. Nearly one in three residents in the majority-Black city lives in poverty.

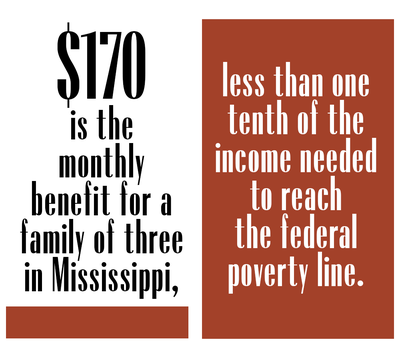

Some years, Mississippi has approved less than 2 percent of welfare applications. (In 2019, that number was 21 percent, still below the national average.) The monthly benefit for a family of three for almost the last 20 years has been $170, less than one tenth of the income needed to reach the federal poverty line.

Nyandoro was determined to find new ways to help Black families in Jackson escape poverty. In 2013, she met a philanthropic family who developed affordable housing and wanted to make a social impact in Mississippi. “For six months, I sat on couches and listened to what families really needed,” she says. She took the information and helped found Springboard to Opportunities, offering services such as after-school care and workforce training to families who lived in affordable housing. But three years in, Nyandoro realized subsidies and services alone couldn’t break the cycle of poverty. People still couldn’t afford a $5 pizza or a $25 science-fair fee.

Aisha Nyandoro, left, line dances at a 2017 Springboard to Opportunities block party.

“We keep saying you have to jump through hoop after hoop to get the carrot. [But] we know the conditional and punitive aspects of our social safety net are not working,” Nyandoro says. “I started talking about ‘How do we just give our mamas cash and trust them to do what they need to do with it?’ ” A friend mentioned UBI. After giving birth to her second child, Nyandoro spent her maternity leave developing a basic-income pilot program. It would be small but radical—the country’s first community-based experiment, paying enough to double many recipients’ incomes.

Nyandoro called it Magnolia Mother’s Trust, after her grandmother’s favorite tree. She raised funds from individual donors and the Economic Security Project, started by (among others) Facebook cofounder Chris Hughes. The experiment included optional access to a social worker and classes on topics the participants requested, like saving and budgeting. Only Black mothers who headed their households and lived in low-income apartments were eligible. “Poor women of color in this country have been systematically victimized and villainized at every turn, yet the mainstream narrative is ‘You’re a welfare queen,’ ” Nyandoro says. “There’s nothing queenly about living in poverty.”

Nyandoro says she had no expectations for how participants would spend the money. “It’s about allowing them to be the authors of their lives,” she said. “My hope is, whatever their heart’s desires are, those will be met.”

As a little girl, McDonald dreamed of becoming a lawyer. The youngest of five siblings, she bounced around relatives’ homes after a drug-resistant infection left her mom unable to work. At 12, she started braiding hair for money and buying her own clothes and school supplies. Senior year of high school, she couldn’t enroll because of mix-ups about her district and some misplaced books—side effects of having no fixed address. She kept doing hair, worked at Popeyes, and began seeing a boy from the neighborhood. She got pregnant and had to drop out of a GED course when doctors put her on bed rest.

By the time McDonald gave birth to Deasia, her daughter’s father was out of the picture. She went on welfare, which required her to participate in a work program or complete community service. Doing light clerical work at the welfare office got her just $146 a month (plus daycare vouchers and $300 for transportation). She found a seasonal gig boxing formula at Scotts Miracle-Gro, then a more lucrative job selling insurance, but after nearly a month, her employer skipped town without paying her.

When McDonald was 22, she started dating a friend of her oldest brother. He went to prison around the time she gave birth to her second child, a son, Dekarrion. Over the years, she enrolled in three more GED programs but had to drop out each time because she lacked reliable childcare and dependable transportation. In 2016, McDonald's mom bought her a car thanks to a financial settlement in a legal case. But then Caiden came along, and McDonald focused on surviving on the $200 to $300 she made braiding hair each month. Welfare was too risky; failing once more to meet conditions could result in the loss of her food stamps. Working outside the home wasn’t an option without someone to watch her kids.

The housing complex where Ciara McDonald lived while participating in a basic-income pilot program.

When Caiden was about 18 months old, McDonald enrolled in a community-college program to earn a GED while studying for a degree in medical billing and coding. Her first semester, she was on track to earn straight As. She could finally see doors opening, but—with no income or reliable daycare—everything hung by a thread. One small crisis and she’d be trapped again.

Then Nyandoro handed McDonald an envelope containing a $1,000 check with her name on it. “A lot of worries disappeared,” McDonald says.

The next afternoon, she pulled into a Texaco station in her white Chevy Impala, with her hair in a bun and a T-shirt that said “Life Is Lit.” Caiden sat in the back seat crinkling an empty bag of Lay’s. Dekarrion, now a 6-year-old with a sweet smile, jumped off a school bus and climbed in beside his brother, clutching a Captain America backpack. McDonald drove toward a cluster of squat buildings ringing a playground. She passed a No Weapons sign and swiped a key card at the gate. Deasia, who wore a pink headband over braids, ran out from a door papered with snowman gift wrap. The 10-year-old helped her mom carry in the day’s haul from Walmart: four plastic folding chairs, a shower curtain, bath mats, hand towels, bath towels, microfiber cloths, contact-lens solution, decorative contact paper, a set of three rugs, Febreze, a $25 iTunes card that would let McDonald access Facebook and her banking app, and Turtle Wax glass cleaner to wipe dead bugs from the windshield. She also got some toy cars, Uno playing cards, and a doll of Jack-Jack from The Incredibles (a Christmas gift Caiden managed to open before they made it home). The total came to $319.25.

Deasia grabbed a knife and started cutting the cardboard labels off of the new chairs. The family had been reduced to a single broken one. McDonald rolled out the rugs in her bedroom and hallway, covering the stained carpet. They were Tiffany blue, her favorite color, to match the throw blanket, wall decals, and curtains. She grabbed a roll of sticky paper in faux marble and sat on the couch. McDonald got to work cutting sheets of paper and fitting them across the scratched-up coffee table, a gift from her GED instructor. “I get a lot of my ideas out of here,” she said, pointing to issues of Traditional Home and Good Housekeeping. McDonald wanted her kids to feel settled, the way she never had. “[You] try to have your house look like a home,” she said.

The edges weren’t straight, so she unpeeled and tried again. “Gotta make sure all the bubbles are out,” she mumbled. She patted and patted the paper, struggling against air pockets that shifted like whack-a-mole. She stepped away to look. “How did I do?” she asked no one in particular. “Not perfect, but good for a first time.”

That morning, McDonald paid her phone bill, bought new eyeglasses—her current ones were held together with glue—and shared a foot-long turkey sandwich with extra bacon, a strawberry Fanta, and chocolate-chip cookies with Caiden. On her to-do list: Get wipes and toddler clothes and a space heater for her mom. Later, she’d pay her overdue light and gas bill, get the car serviced, and buy Christmas presents for her kids.

Running out of gas, not having money for laundry, saying no to school picture day—those stressors were gone. She’d put Caiden in daycare. She’d cook sloppy joes and pork chops and, for her birthday, go to the Mexican place with big portions. Maybe she’d travel outside the state for the first time in years, take the kids to Disney World or Six Flags. She would save for emergencies.

Unlike many antipoverty programs, this one had no rules on what you could buy, where you could go, or what you had to do and when. There was just cash to spend however McDonald thought best. She hardly told anyone because she didn’t want opinions. It would be her choice.

As the months passed, Nyandoro watched McDonald and the other women in her program spend their checks. “They did flashy, exciting things like going to the dentist and paying off hospital bills, payday loans, and student loans,” she says. Several recipients went back to school. One became a certified phlebotomist. Another traveled to see her father for the first time in 20 years. Nyandoro saw moms pay for tutoring, school supplies, and fun outings for their kids. Many bought groceries to cook at home more and borrowed less money from loved ones or predatory lenders. A woman who worked as a waitress called in sick when she had strep throat. “Other times, she would have had to power through because missing one or two days from work can have a significant impact on your paycheck,” Nyandoro says.

Recipients who had jobs during the pilot lost $300 to $400 in monthly benefits, such as welfare and rent subsidies, because of the extra income. No one stopped working or looking for work. “These women are often required to work if they want to receive benefits, but [they think], ‘It’s not a job that pays a living wage’ or ‘I am working in the home because I have children’ or ‘I’m taking care of my aging parents, but you’re not considering that work,’ ” she says. “When white women choose to stay home to raise kids, they’re celebrated.”

Aisha Nyandoro at a 2015 fundraising run organized with local middle and high school students.

Guaranteed-income programs often attract scrutiny about spending on the “right” things, but Nyandoro says that’s beside the point: “At the end of this experiment, will all the women be on equal footing? No. Are some of them making decisions that will put them in a better position to achieve some of the dreams they have for themselves and their families? Yes. Does that mean the decisions other folks are making are wrong? No. They are making the best decisions they can with the skills and tools and support they have.”

The important thing for Nyandoro is that the women were given choices in the first place. She sees basic income as a foundation and not a substitute for other parts of the social safety net. Her ultimate goal is policy reform. “This isn’t something philanthropy can sustain,” she says. “We need to put policies in place that recognize that all families have agency and need to be trusted. All families want to work, and we need to expand the definition of work. Despite all we’re doing, we aren’t moving the needle on poverty.”

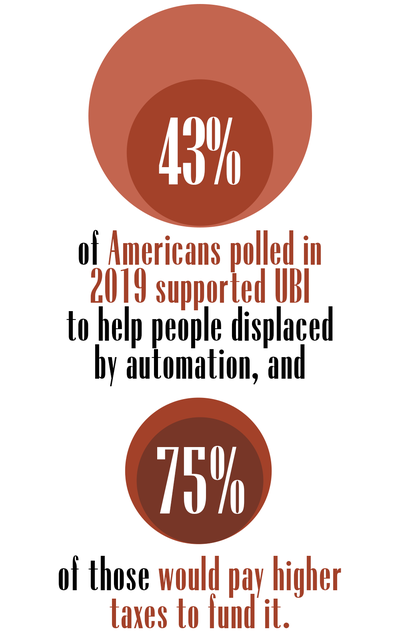

In March, Magnolia Mother’s Trust launched a second round of the pilot, with 80 women, including a control group and quantitative study; 30 additional participants were added last month. Across thousands of articles and books on basic income, evidence of its positive effects already abounds. So do ideas for funding it, including taxing corporations, the ultrawealthy, financial transactions, or carbon emissions, imposing higher payroll taxes, or starting a value-added tax (as many countries in Europe have). Americans seem receptive to the idea. A 2019 poll by Gallup and Northeastern University found that 43 percent of Americans supported UBI to help people displaced by automation, and three fourths of those would pay higher taxes to fund it.

“There is a lot of appetite for it,” says Juliana Bidadanure, assistant professor of philosophy at Stanford University and faculty director of the Stanford Basic Income Lab. “People are economically insecure, stressed, and frustrated; they want bolder policies.” Federal stimulus checks and widespread joblessness have made the concept more politically palatable, but a single payment is a far cry from the regular cash disbursements that define basic income. To embrace guaranteed income, this country would have to overcome an enduring suspicion of poor people.

For centuries, Americans have tended to link poverty not to structural problems but to personal failings, whether moral, cultural, or genetic. “The ‘benefits scrounger’ rhetoric is a defining feature of this country,” Bidadanure says. “Damaging stereotypes can make it difficult to make progress if we are still stuck there, not trusting individuals are going to do the right thing.”

At the same time, endemic racism resulted in most Black Americans initially being left out of programs like Social Security and federally insured mortgages, and it has undermined support for universal health care. Black applicants are still denied mortgage loans at far higher proportions—and pay higher interest rates for them—than their white counterparts. “Large swaths of the American safety net and wealth-building programs were designed to exclude, punish, and discipline the descendants of the country’s slaves,” journalist Annie Lowrey wrote in the 2018 book Give People Money: How a Universal Basic Income Would End Poverty, Revolutionize Work, and Remake the World.

Nyandoro doesn’t necessarily believe in basic income that is truly universal, one that gives the same amount to Ciara McDonald and Bill Gates. But Bidadanure thinks that’s the path to overcoming stereotypes about “undeserving free riders.” Alaskans have rallied around a 40-year-old program that pays every resident of the state an annual dividend from invested oil revenues—for the last two decades, an average of $1,375—the closest thing to large-scale UBI that exists. “Everyone having a stake in the system might be the key to reducing stigma,” Bidadanure says. “If it becomes harder to demonize recipients and use rhetoric of division, then it also becomes harder to undermine support.”

For now, the money is only temporary. One Monday morning in November 2019, McDonald swerved around potholes lining her street and parked outside Hinds Community College. She slung on her backpack and trudged to a trailer propped up on cinderblocks. Inside the classroom, McDonald followed along as the instructor talked over the buzz of a lawnmower. “What is the correct code for percutaneous transhepatic portography?” McDonald ran her finger down a page. “75885,” she called out.

McDonald had made it to class, but the day wasn’t exactly going as planned. Three days earlier, as she tried to start her car after a trip to the grocery store, it wouldn’t go into drive. It needed a new transmission control module. Price tag: $1,286.17. When she saw the number, she cried.

McDonald’s last cash payment had arrived earlier that month. On one hand, she felt much closer to her goals. It cost about half of each check, but putting Caiden in daycare helped her finally earn a GED. She was on her way to being the first of her siblings to finish college. She got out of debt and took the kids skating, bowling, and to the zoo. Dekarrion celebrated his birthday at Chuck E. Cheese, and Caiden’s party had two bounce houses and a Batman cake. On Valentine’s Day, her childhood friend Elliott Sawyer proposed. Months before, McDonald had told him she was too busy for love, but he had worn her down with how well he treated her kids. Sawyer worked as a bricklayer; his income was small and could be seasonal. Still, with help from relatives, they threw a wedding for about 200 people that August. Their families prepared baked tilapia and Oreo pie, and she carried a bouquet of artificial flowers in red and Tiffany blue. The newlyweds used his mom’s reward points for a weekend at a Gulf Coast hotel, McDonald’s first real vacation.

Ciara McDonald, center, with Springboard staffers Marshand Crisler and Kira Johnson at her 2019 GED graduation.

One thing McDonald couldn’t do was save. The extra income cut her food stamps in half. She felt the cash was worth it, but there wasn’t much left after monthly bills. “When I started, things would come up, and I would have to go back and mess with the money,” she said. Then in February, McDonald chipped in to help pay for flowers for her great-uncle’s funeral. That same week, her mother, who had no health insurance, went to the hospital with shortness of breath and was diagnosed with Stage III throat cancer. McDonald drove her mom to her doctor’s appointments and split the cost of medicine with her sister. McDonald says the pilot program kept her in school, but by the time her car went out, she was down to just a few bucks.

She had planned to apply, after class, for a job at TC’s Uniforms, where a relative made $15 an hour. With her GED, McDonald qualified. But without her car, she was back in reactive mode. McDonald climbed into the SUV she’d borrowed from her mom and stared through a windshield cracked by a stray bullet. First, she drove to an ATM to withdraw cash her aunt lent her to fix the car, then to Food Depot for $5 fried catfish. At home, she did her niece Tutu’s hair for her birthday, as promised. Next, McDonald jetted across town to take her cousin Kamesha to work (as McDonald’s mom usually did). Then, she dashed to the Springboard to Opportunities office for a letter confirming her checks had stopped. She needed to submit the letter to the welfare office that day to get recertified for food stamps, but when she pulled up to the massive brick building, the gates were locked. She checked her phone. “It’s Veterans Day! So why did the paper say the 11th?”

There wasn’t time left to take Caiden to get his shots. (He couldn’t go to daycare in the meantime.) McDonald got home just in time for Deasia and Dekarrion to arrive from school. Later, McDonald would make taco salad, check the kids’ homework, get them to bed, finish her schoolwork, then sleep briefly before getting up at 5 a.m.

“Before, I couldn’t get a job, I couldn’t expand my education, I couldn’t do anything more than what I was doing,” McDonald says. “Now that I’ve gotten up where I’m supposed to be, I’m going to start going from one thing to another. I’m just not going to stop.”

Tomorrow, maybe the car would be ready. Maybe she would get to TC’s Uniforms. If not, then the next day.

In December, McDonald’s husband found a job as a detention officer at a county jail. In January, McDonald, now 31, started working full-time at a daycare center, earning $9 an hour. Due to COVID-19, she recently decided to quit and homeschool her children. Thanks to online classes, she is on track to graduate from college later this year. The family moved out of their subsidized apartment and rented a three-bedroom house in South Jackson. At the end of May, they adopted a Yorkiepoo puppy named Coocoo.

This story was updated on July 29 to reflect new information regarding the length of the Stockton program and the number of participants in Magnolia Mother's Trust's second program.

A version of this story appears in the Fall 2020 issue of Marie Claire.

Katia Savchuk is an award-winning journalist based in Oakland. Her work has appeared in Mother Jones, Pacific Standard, Forbes, The Washington Post, Cosmopolitan, and many other publications.