Investing 101

-

I'm a Financial Expert—This Is Why You Should Consider Investing in Mutual Funds

Gone are the days when you had to call up a broker and make an appointment. There's an easier way to get started.

By Cassandra Cummings Published

-

How to Invest in Wine

Investing in wine isn’t just for uber-wealthy men anymore. More women and young consumers are looking to the alternative asset to turn their love for reds and whites into real returns. Here’s what you should know if you’re thinking about taste-testing wine investing for yourself.

By Kate Storey Last updated

-

What Are the Best Alternative Investments?

From Birkin bags to Banksy NFTs, entry-level and seasoned investors alike must be familiar with these factors to determine whether they should invest in the ever-changing world of alternative investments.

By Jillian Dara Last updated

-

Your Complete Guide to Investing

Features The secret’s out: You can’t save your way to wealth. To build true wealth for yourself, you need to invest. Whether you need a 101 on investing for beginners or action plans to elevate your portfolio, money up with Marie Claire to boost your net worth.

By Tanya Benedicto Klich Last updated

Features -

How to Invest in Your 20s

Your twenties are the perfect time to lay the foundation for a strong financial future. Let’s dig into the places you should invest today—both literally and figuratively—to set yourself up for long-term success.

By Alexa von Tobel Published

-

Your Guide to Picking Stocks: Investing in Fashion and Beauty Retailers

When it comes to fashion and beauty brands, it is our own income—our very own hard-earned dollars—that fuel these industries. Women could and should be profiting from the success of these multi-billion dollar companies through investing.

By Jane Hali Published

-

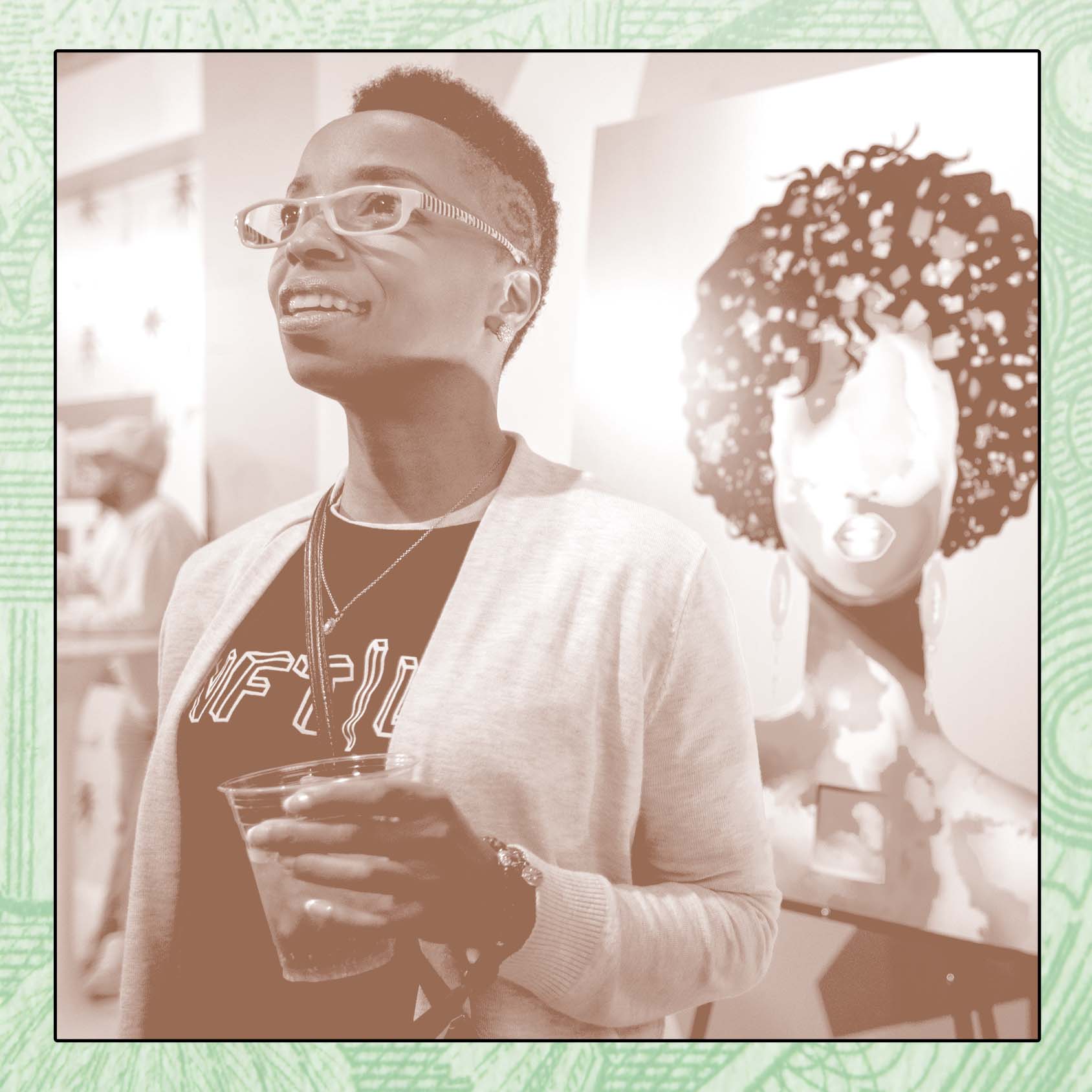

What Are NFTs and Should I Buy Them?

NFTs offer more substance than just a profile picture, and can provide benefits for creators, brands, and consumers. But know the risks and whether you're in the right place to invest.

By Shirin Bucknam Last updated

-

What to Know Before Investing in Cryptocurrency

We’re serving up the basics of blockchain and Bitcoin, the risks and benefits of investing in crypto, what the heck it is and a tutorial for how to get started.

By Shirin Bucknam Last updated

-

Your Guide to the 4 Types of Investments

It all starts with understanding the basic asset classes.

By Jacey J. Cosentino Last updated