Power Pick: Ellevest Financial Planning

Financial autonomy is power.

Welcome to Power Picks, a monthly series on the things that help us navigate our lives, step into our personal power, or simply get us through our day-to-day. Our hope is that by sharing what makes us feel great, we can help you feel great, too.

Money has long been an opaque subject for many people—it’s not taught in schools, and many of us have to rely on how we were brought up by our parents and guardians. Their money habits, whether good or bad, seep into the way we handle our finances.

For my part, I've been managing my finances quite well on my own. But with occasional freelance work, managing my 401(k), supporting my family members, and wanting to live my life on my terms, I realized that at some point I'd need to seek out expert advice—and this isn't a bad thing! Often, women tend to feel pressured to carry the whole world on their shoulders, attempting to balance all aspects of their lives in perfect sync—the age-old problem of "having it all."

Ellevest looks to resolve these issues. It's an investment platform aimed at women to help them manage their money better via articles, workshops, well-designed modules, and one-on-one financial planning. It was created by Sallie Krawcheck after a 25-year stint on Wall Street, after she grew tired of the callous ways investors treated their clients, shutting them out from the knowledge of what their own money was doing. Instead, Ellevest takes the realities of women's lives (like the fact that women live longer than men) into account when looking at and formulating goals.

I started using Ellevest two years ago, after I left my last job and decided to transfer my retirement money over instead of leaving it with my previous company. I didn't know when I would work full-time again, and didn't want to leave my money hanging in limbo with an employer I wasn't with anymore. I knew that money meant autonomy—it's what gives us the freedom to live how we want—but I also knew that I couldn't manage it alone. Seeking financial planning helps a person prepare for unexpected expenses and take steps toward financial empowerment. I recently turned 34, so the thought of an unexpected expense shouldn't scare me.

One of my favorite things about Ellevest's offerings is that it's extremely user-friendly and well-designed—an important factor for an art director. In addition to their one-on-one sessions, they also have weekly Zoom workshops and talks, and even worksheets, if you want to tackle the work on your own. Personally, I use Ellevest Plus, which is $100 per year and provides access to two investing goals: a 401(k) retirement account and general financial guidance. The Full Financial Package, on the other hand, is $2,000 after the platform's membership discount, which is 30 percent off.

The various modules and tools on your personal account page can be broken down into three categories:

Get exclusive access to fashion and beauty trends, hot-off-the-press celebrity news, and more.

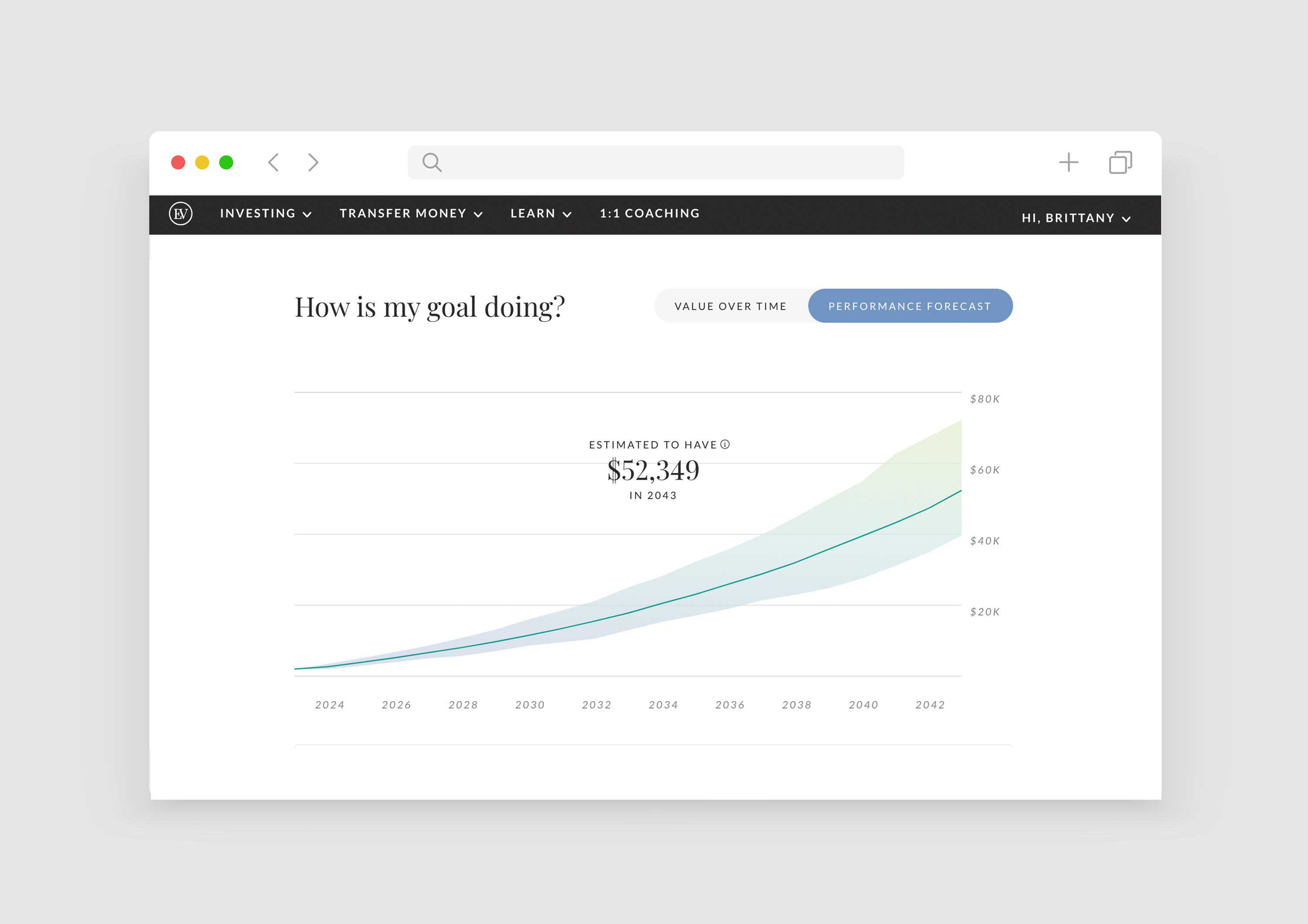

- How's My Money Doing? breaks down the potential of your money if you stay at the same savings rate and shows the various potential over time.

- How Much I Need and When I Need It breaks down financial goals into accessible language (i.e. how much money you're aiming to save, your goal age, and whether or not your current saving habits put you on track).

- What Am I Invested In? features a portfolio breakdown in a pie chart with interactive elements, and each portion of your investments features a drop-down showing what companies your money is invested in.

An Ellevest module of money projection over time.

When I started, I was matched with Samantha, a senior planner with 15 years of experience, and given a link to a financial module to link my accounts and explain my goals ahead of our meeting. I chose the standard retirement age of 65 and added a goal of a cash reserve of $15k for emergencies. Samantha and I had two hour-long conversations—one for her to get to know me and my lifestyle, and another to walk me through my financial plan.

She started our first meeting with a single question: "Why now?"

The question cuts to the heart of a person's motivation. Is it fear? Is it reaching the next chapter of your life? Is it wanting to live a non-traditional life and figuring out how to fund it?

It's a big step to open up your accounts to a stranger. I had anxiety about someone looking at my money habits. Some of my habits are noble (like saving 30 percent of each paycheck), but I felt embarrassed that this person was going to see much I spend on consumables, like taxis and dinners out, and that there are some weeks I get down to $100 or so of fun money near payday. I'm a single woman and have no kids, but somehow my money had been gobbled up by shifting expenses or a lack of cognizance of what was flowing in and out.

However, that's what Ellevest is here for. I was honest about my apprehension, and Samantha was quick to emphasize that she had no preconceptions of how I had to act or behave, and that it's important to turn the stress of feeling out of control over my finances into a vehicle that drove me to do better for myself.

Self-care is not just bubble baths and face masks, it's also doing the hard work and discipline to set yourself up for success. Autonomy is success; being an adult in charge of her future is success.

After hearing a bit about my life circumstances and goals, Samantha created a financial roadmap for my life over the next 30 years and gave me steps on how to build a sturdy financial foundation. Some of the scenarios included if I decided to stay in New York for the rest of my life, if I decided to move back to my hometown to be closer to family, or if I bought a home property in my hometown to live with my mother. Also, if early retirement was in my future ("early" meaning age 55, with freelance gigs on the side—after all, once a creative, always a creative). Samantha laid out each "lever" I'd have to pull to make each of these a reality, with dollar amounts and the timeline needed for each.

One of the biggest advantages of this session was a professional telling me what to focus on while taking my life into account. I have a bit of credit card debt from the period in between freelancing and starting at Marie Claire, and have built-in paranoia about future emergencies so I hoard money to the detriment of paying down debt or even buying nice things for myself, like vacations or upgrading my professional wardrobe. Lots of spending decisions in a week lead to fatigue, and Samantha emphasized that it's important to spend with your values and set up accounts in a way that's aligned with the way you live. For example, I have multiple accounts that are automated—a certain amount goes into a separate savings account each paycheck, and I have a separate account for bills, but that's it. Those are both nebulous amounts of money not being put to work, so Samantha suggested I open up more accounts to turn into non-monthly goals, such as saving up for gift-giving during the holiday season.

Automating everything and letting one account just be for fun money is very much in alignment with who I am, as I mostly want to have a good time and spend freely. I love a long night of holding court with my friends at a restaurant—and that's okay!

Ellevest is offering 15 percent off a financial planning session for Marie Claire readers. Use the code POWERPICK.

Brittany Holloway-Brown is the art director of Marie Claire, where she is responsible for all things visual and for ensuring the brand’s visual voice stays consistent and forward-looking.