Career advice

What you need to know to build a successful career, straight from Marie Claire editors.

Explore Career advice

-

Meet the Millennial Women Buying Their Own Engagement Rings

There's nothing wrong with it. So why does it feel so uncomfortable?

By Kristin Canning Published

-

The Most Interesting Pieces of Career Advice We've Ever Given

A look back at three decades of tips to help women get ahead at work.

By The Editors Last updated

-

They Got Everything They Wanted Professionally by 30. Then What?

Reaching an all-time career high at a young age comes with a lot to celebrate—and a lot of pressure, too.

By Halie LeSavage Last updated

-

Are Millennials Secretly Rich?

New data claims the generation is wealthier than previously thought. But why doesn't it feel that way?

By Abigail Libers Published

-

5 Steps to Money Mindfulness

Sponsor Content Created With TD Bank

It's simpler than you think.

By Eileen Ambrose Published

-

Work Wives Are Going Extinct

They're becoming less common as remote and hybrid work get more prevalent. But is now the time when we need them the most?

By Samhita Mukhopadhyay Published

-

Boredom Helped These Founders Build a Bathing Suit Brand

Laura Low Ah Kee and Shannon Savage left their executive roles to try something new.

By Sara Holzman Published

-

What Will It Take to End Stay-At-Home Mom Shame?

“Our culture around caregiving is ripe for reexamination.”

By Neha Ruch Published

-

Ella Emhoff Never Intended to Be an It Girl—All She Wants Is to Knit

The second stepdaughter and former fashion model opens up about her true passions: art, knitting, and community.

By Emma Childs Published

-

3 Women on How They Unleashed Their Potential and Followed Their Professional Dreams

These inspirational stories will have you ready to leap into your dream life.

By Marie Claire Published

-

These Women Own Sports

Seriously, though. As interest in the WNBA, NSWL, and other female leagues grows, so too, do the number of women investing in pro sports teams.

By Mattie Kahn Published

-

Runner Alexi Pappas On Chasing Something New

"I realized that where I was going had never been gone before. I needed to stop trying to define what this was."

By Nikki Ogunnaike Published

-

What It Takes to Bootstrap Your Own Art Gallery in New York City

It took Lin Tyrpien more than a decade to find her calling. When she realized she wanted to run her own creative space, the real work began.

By Jenny Hollander Published

-

What It's Like to Launch a Bookstore in the Land of Book Bans

The Lynx opened in Gainsville, Florida as a foil to the state's legislation in support of censorship.

By Marie Claire Editors Published

-

How Moleskine's CEO Daniela Riccardi Inspires Dreamers

Learn about the trailblazer's approach to success.

By Anneliese Henderson Published

-

This HR Executive Used an Intensive Money Course to Bounce Back From Bankruptcy and Pay All Cash for a $76,000 Farmhouse in Rural Maine

Years later, renovations are still going, but the financial freedom has made it all worth it.

By Marie Claire Editors Published

-

Fawn Weaver Is All About the Whiskey Business

The founder of Uncle Nearest spirits is doing more than just raising a glass—she's raising awareness.

By Kovie Biakolo Published

-

For MAC's Newest Executive, Diversity Is a Superpower

"Every aspect of the brand needs to be touched by what the world looks like. "

By Gabrielle Ulubay Published

-

The Founder of Bearaby Wants to Bring Nap Culture to Corporate America

Kathrin Hamm encourages Bearaby employees to luxuriate in a mid-day, guilt-free snooze.

By Michelle Eigenheer Published

-

The Most Common Mistakes People Make On Their Taxes, According to Experts

"There is no shame in asking for help on your taxes."

By Danielle Campoamor Published

-

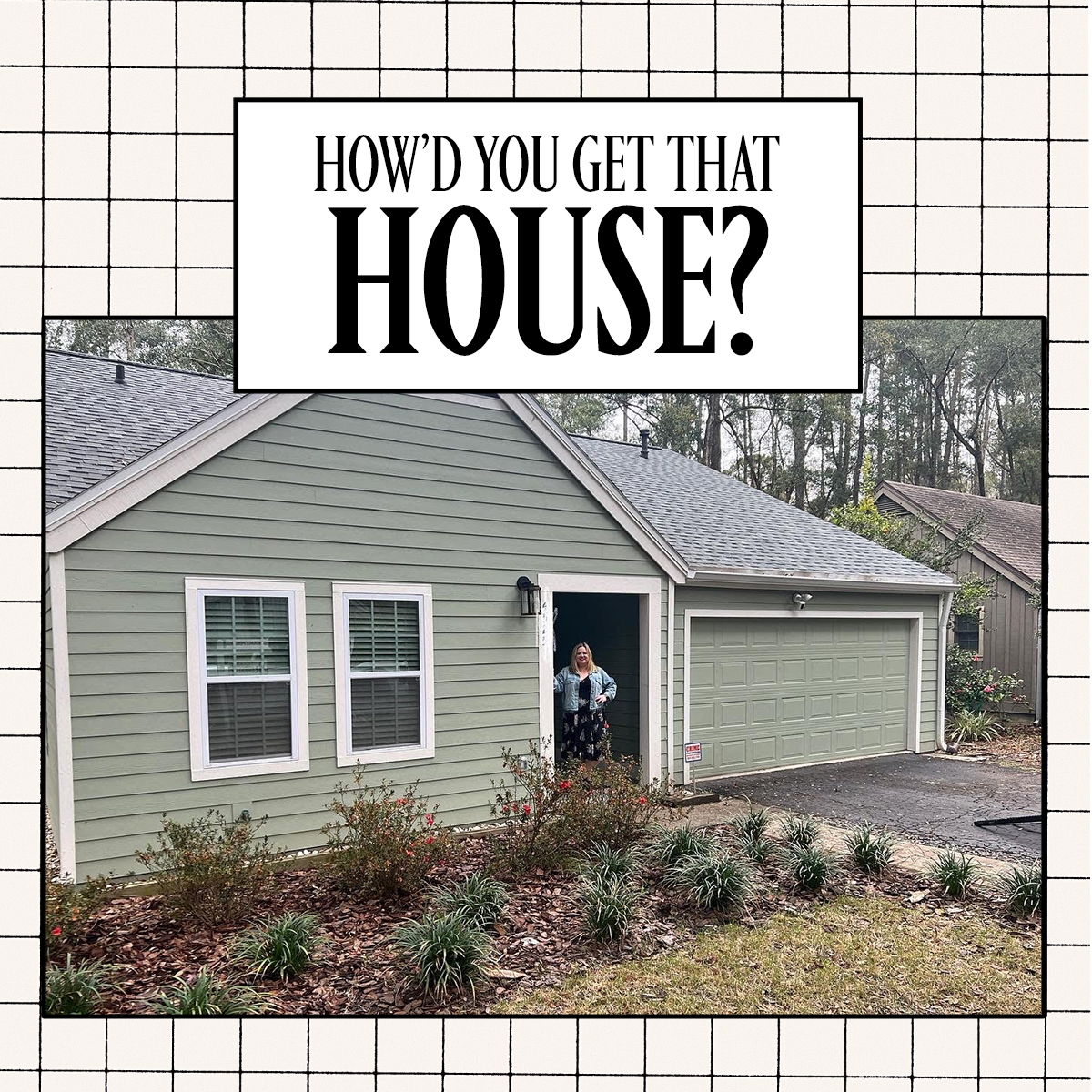

This Marketing VP Swapped NYC for Gainesville, Florida to Afford a $250,000 Two-Bedroom Cottage

"I didn't want to 'wait' until I had a partner."

By Marie Claire Editors Published

-

For Deepica Mutyala, Entrepreneurship Is Worth the Sacrifice

The Live Tinted founder talks having it all—but not all at once.

By Gabrielle Ulubay Published

-

Meet "Loud Budgeting," Gen Z's Answer to Smart Spending

The TikTok trend encourages "loud" conversations about personal finance.

By Jill Nielsen Published

-

The SoulCycle Founders' Next Act? Tackling the Loneliness Epidemic

Founders Julie Rice and Elizabeth Cutler call Peoplehood "a workout for your relationships."

By Tanya Benedicto Klich Published

-

Welcome to "The Big Stay"

The Great Resignation is over. Now, it's time to recalibrate your career priorities.

By Ellen Taaffe Published

-

Self-Doubt and Sacrifices—Dorsey’s Meg Strachan Gets Candid About Launching Her Jewelry Company

“Have we made it? From the outside, perhaps. Internally, we are working really hard to make it every single day.”

By Emma Childs Last updated