Welcome to Couples + Money, where we break through the confines of polite conversation. Forget questions about your sex life. We're getting even more personal. Let's talk about what you and your partner are doing—and not doing—with your paychecks.

Every other Thursday, an anonymous couple will get candid with Marie Claire about how they split their finances. We’ll break down what each person pays for individually, what they split, and all the gritty details—from who picks up the bill in restaurants to who picks fights over bank statements.

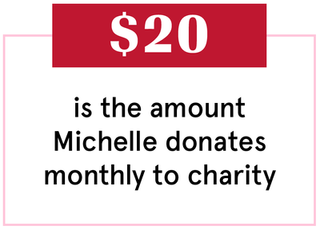

This week, we're talking with Michelle, 25, a nonprofit program coordinator in California who earns $34,320 per year ($2,860 per month) and her partner Luna, 28, an IT document controller, who earns $45,000 per year ($3,750 per month). They've been together three years.

Want to be profiled with your partner in Couples + Money? Get in touch: couples.money@hearst.com.

How It All Happened

Luna: Spring of 2015, we both swiped right.

Michelle: Looking back on it, we were in a relationship from the moment we met. We moved in together in October of 2016.

Luna: We moved into a shabby fifth-wheel trailer, which we later named Aretha. The trailer was owned by a friend and parked in her backyard. We paid $700 each month, and we boiled in the summer and froze in the winter. Aretha was quirky, and had more than a couple issues, but she was our first home and we loved her (but we don’t miss her).

Stay In The Know

Marie Claire email subscribers get intel on fashion and beauty trends, hot-off-the-press celebrity news, and more. Sign up here.

Luna: Three-ish years later, we are now engaged.

Our Dependents

Michelle: No dependents.

Luna: She keeps telling me she wants six kids.

When We Told Each Other Our Salaries

Michelle: We talked about how much we made pretty early on in the relationship. She had just begun working at her company making about $14 an hour and was trying to get hired on permanently, and I was up for a promotion that raised my wage from $17 to $23. We discussed how much we made within the first three months of dating. At this point we had only discussed wages, not debts or bills.

Luna: About five months into the relationship, a job offer came up, and we discussed wages and benefits—the starting pay was $18 per hour, with full benefits. Michelle helped motivate me to negotiate starting pay with my company. We even had practice conversations where she would pretend to be my boss.

Michelle: Since we began talking about money early in our relationship, before it was serious, we continued to be very comfortable talking about money.

Why We Don't Have a Joint Account

Luna: What we’re doing now seems to be working, so we agreed to get a joint account after we’re married. I would like to keep our individual accounts as well.

Michelle: Currently, we put most of our purchases on one credit card, which belongs to her, and I send her money to pay that off. This means a lot of time she has to be my bookkeeper. She doesn’t like feeling like my bill collector.

Michelle: We both want to keep our financial autonomy, but we also realize 90 percent of our finances are already entangled. I'd like to go ahead and join our finances already.

How We Handle The Cost Of Living

Michelle: We always intend to split everything 50-50. At the beginning of our relationship I was making more money and would often cover extra costs of things.

Luna: We've gotten into the habit of charging shared expenses to my credit card.

Michelle: Luna now makes a little more money than I do, and has tackled all of her debt ($15,000 in credit card debt). Because of this, she'll now often cover extra costs for me. There were a couple of months where I could not contribute to groceries. We still always split our large bills—but groceries, gas, nights out, have been split unevenly on more than one occasion.

Luna: Viewing our credit balance weekly helps us check in if we’re okay financially.

How Often We Talk About Money

Luna: Last year, I was determined to pay off all my credit debt. I asked her what her score was—she was hesitant to answer at first—so we could come up with a plan to improve both our credit scores. My credit was in the good range and has now been built to excellent. Michelle’s score is fair, but she is building it up.

Michelle: We are really honest with each other. To the point where other couples think it is odd.

Luna: During credit card debt discussions, student loan debt topic came up as well. I was telling her that my money was going to be tight for a while with the big credit card payments. Michelle understood, but seemed embarrassed to tell me about her $15,000 student loan debt—because I was so motivated to pay off my debt, and she was still pushing hers aside.

Michelle: This wasn’t a conversation we had until after we moved in together, a little more than a year after we met. She took it really well. I would help cover the costs of date nights and extra things so that she could complete her goals. She is now just as supportive with me as I chip away at my student loan debts.

INTERESTED IN SAVING AND INVESTING? CLICK HERE

How We Learned To Budget

Michelle: My family was never great with money. My parents lived within their means, but never saved well. During the recession, we had two cars repossessed and lost our house. This was around my junior year of high school.

Luna: I was not good at budgeting and saving during my teenage years and early '20s. I made my payments on time but only did minimum payments, which got me into some heavy credit debt.

Michelle: After we lost our house, my parents struggled to find a place for us that would accept their credit history. We finally found a small apartment and moved all five of us and our three dogs in. My older brother and I both worked to help, but there were times when my parents still couldn't afford our normal amount of groceries. We relied on friends and family for assistance when things were at their worst.

Luna: I burned through money for school, books, traveling, music festivals, etc. After a while, I started paying attention to where my money was going. I had about $14,000 in credit card debt spread over three credit cards. Whoops.

Michelle: I did not learn great budgeting skills growing up, and I don't always manage my money well. I'm that person that will buy everyone a round of drinks, but will also wear holes into my shoes before considering buying new ones.

Luna: I was committed to paying my debt off during the first year (1.99 percent APR), and I made at least $500 payments per month. Some months I made over $1,000 in payments. This came up with Michelle pretty quickly, since suddenly I had no "fun money."

Michelle: It wasn’t until sharing finances with Luna that I learned how to manage my money better to help me be able to spend money on extra things.

What We Keep Secret

Michelle: There is nothing we don't talk about.

Our Biggest Fight About Money

Michelle: We have the occasional argument about how to best spend our money. When she has money and wants something for the both of us, she wants to just be able to do it.

Luna: When we got engaged, money discussions turned into “our money” instead of “my money." That was definitely a first for me. A couple of big purchases on my end brought up the topic. I think the biggest purchase I made without talking to her was a couch for our new apartment.

Michelle: Sometimes, having to pony up my share of these purchases overwhelms me. Like after we moved into our new studio, when we had to make several large furniture purchases.

Luna: I had the money and I wanted it. I’m not used to needing approval. This led to an argument.

Michelle: We had a plan to pay all of the purchases off in two months. She was able to pay her portion off early, and then wanted to focus on decorating the kitchen. Our fight was basically me telling her I needed to pump the brakes on spending, and her not wanting to live in a half-finished studio.

Luna: We both agreed to put money aside for our common goal (our wedding), which we are spending $40,000 on.

How We Pay For The Non-Essentials

Luna: If we’re out together, we will typically split hotels, Ubers, meals, drinks. Any solo trips/nights out and clothing, we pay for individually.

Michelle: We pay for everything with a single credit card when we are out together. Once we take a look at the damage, we split everything 50-50. We don’t get crazy about who should pay for what. Even when only one of us is drinking or purchased a souvenir, we don’t really get nit-picky. We split as much as we can and we consider every part of a night out together to be a shared experience with shared costs.

What We're Banking On

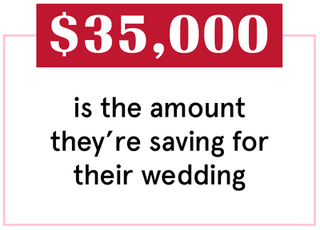

Michelle: We'll be getting married in October. We chose to have a big wedding—about 200 guests in Paso Robles. We're both going to be wearing wedding dresses and having full bridal parties. We want it to be quite the event.

All our extra money for the next year will be going towards paying for the wedding, which we expect to total around $35,000 when all is said and done. My parents will be helping where they can, but probably only about $5,000.

We'll also be attending the wedding of a friend in Costa Rica in March this year. Luna's going to be a bridesmaid. We've budgeted about $5,000 for this trip. Those two big costs are what we're working towards now.

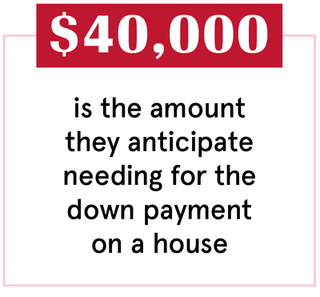

Luna: Next: Buying a house. Since we currently live in Southern California, we know that house prices are ridiculous. Since we will be first-time home buyers, we want to have around $40,000 for a down payment. After the wedding, this will be priority numero uno.

Interviews have been condensed and edited for clarity. Pseudonyms have been used. Reporting by Amanda Mitchell. Design and illustration by Morgan McMullen. Animation by Hayeon Kim.

For celebrity news, beauty and fashion advice, savvy political commentary, and fascinating features, sign up for the Marie Claire newsletter.

-

Amid Dire Reports About His Health, the Palace Issues a Wide-Ranging Update on King Charles

Amid Dire Reports About His Health, the Palace Issues a Wide-Ranging Update on King CharlesThe news was accompanied by a never-before-seen photo of the King and Queen Camilla, taken the day after their 19th wedding anniversary this month.

By Rachel Burchfield Published

-

Anne Hathaway Says This ‘The Idea of You’ Sex Scene Is the “North Star” for “Cinematic Sex”

Anne Hathaway Says This ‘The Idea of You’ Sex Scene Is the “North Star” for “Cinematic Sex”The actress said it “makes it about her pleasure.”

By Danielle Campoamor Published

-

Zendaya Says She's Waiting for the "Right Timing" to Release New Music

Zendaya Says She's Waiting for the "Right Timing" to Release New Music"If there was a moment, maybe I would, you know, put out a little something."

By Danielle Campoamor Published

-

Where Did All My Work Friends Go?

Where Did All My Work Friends Go?The pandemic has forced our work friendships to evolve. Will they ever be the same?

By Rachel Epstein Published

-

So You Want a Postnup

So You Want a PostnupNo, they’re not planning to divorce, yet more couples are facing the awkwardness of getting their marital finances in order—after they say “I do.”

By Emma Pattee Published

-

The Two Moms Who Took a Year Off to Travel—Then COVID-19 Happened

The Two Moms Who Took a Year Off to Travel—Then COVID-19 HappenedEvery other Thursday, a couple will get candid with Marie Claire about how they split their finances. This week, we're talking to a couple who decided to travel full-time just before COVID-19.

By Marie Claire Published

-

Warning Working Moms: Your Partner Is Your Glass Ceiling

Warning Working Moms: Your Partner Is Your Glass CeilingBestselling author and essayist Caitlin Moran warns in her new book More Than a Woman that a mother’s career is only as good as the man or woman she marries.

By Jo Piazza Published

-

The Unemployed Couple Squatting in Their Brooklyn Apartment

The Unemployed Couple Squatting in Their Brooklyn ApartmentEvery other Thursday, a couple will get candid with Marie Claire about how they split their finances. This week, we're talking to a couple who haven't paid rent on their apartment in months.

By Marie Claire Published

-

The Blogger Couple Who Made $20,000 When the Pandemic Hit

The Blogger Couple Who Made $20,000 When the Pandemic HitEvery month, a couple will get candid with Marie Claire about how they split their finances. This week, we're talking to a couple who lost revenue during the pandemic, but invested wisely.

By Marie Claire Published

-

The Couple Who Used a Health-Share Ministry for a $1,000,000 Surgery

The Couple Who Used a Health-Share Ministry for a $1,000,000 SurgeryThe latest edition of Marie Claire's Couples + Money series.

By Marie Claire Published

-

The $266k Couple Whose Wife Created an App to Track Their Spending

The $266k Couple Whose Wife Created an App to Track Their SpendingThe couple make $266,000 a year.

By Marie Claire Published