The Couple Who Used a Health-Share Ministry for a $1,000,000 Surgery

The latest edition of Marie Claire's Couples + Money series.

Welcome to Couples + Money, where we break through the confines of polite conversation. Forget questions about your sex life. We're getting even more personal. Let's talk about what you and your partner are doing—and not doing—with your paychecks.

Every other Thursday, a couple will get candid with Marie Claire about how they split their finances. We’ll break down what each person pays for individually, what they split, and all the gritty details—from who picks up the bill in restaurants to who picks fights over bank statements.

Want to be profiled with your partner in Couples + Money? Get in touch: couples.money@hearst.com.

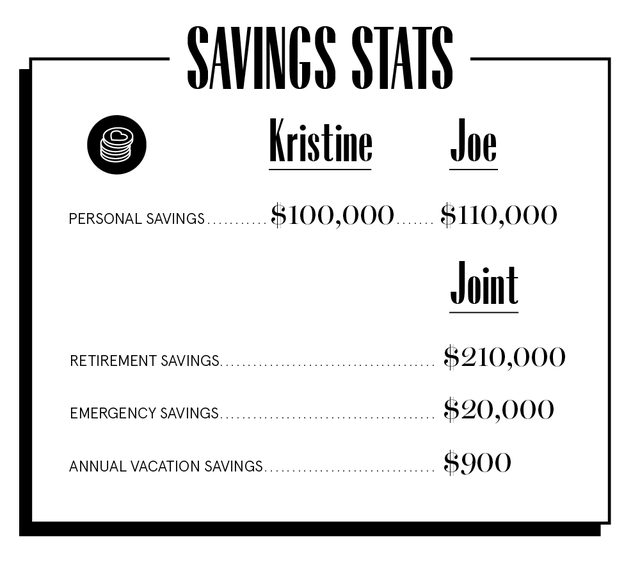

This week, we're talking with Kristine Stevenson Seale, 53, a financial coach and seasonal Turbo Tax agent who makes $42,000 per year ($3,500 per month), and her husband, Joe Seale, 63, an engineer who makes $57,480 per year ($4,790 per month—disability income, post-taxed). They've been together for 14 years and live in Temple, TX.

How It All Happened

Kristine: We were each attending a play at the local community theater in March 2008.

Joe: We got married in late 2012, and we actually moved in together six months later. I was up in the Pacific Northwest at the time.

Kristine: We'd talked about the fact that I'd probably have to quit my job and move. If I couldn't get the kind of job I needed or wanted, we'd be relying solely on his income. I said, "God forbid something should happen to you, you've got to get a disability income replacement policy." Two years later, this tumor started to make itself known. Within 2-3 months, he had an MRI—the tumor had filled the inside of his spinal cord at the brain stem. He had to have surgery right away.

Get exclusive access to fashion and beauty trends, hot-off-the-press celebrity news, and more.

Joe: I'd insured my car and house, but I hadn't really looked at other forms of insurance. I was pretty much biased against it. She comes at that from the other side, and the disability insurance policy turned out to be a real lifesaver.

Kristine: We hadn't had any health insurance for a couple years. But we belonged to a health-share ministry, which fell under an exception to the Affordable Care Act. We had to wait six months before his insurance policy kicked into place. We had no income, but we'd built up an emergency fund of 3-6 months. We also had family members give us money, which was a great blessing. I didn't work for a year because I was taking care of him. The beautiful thing about the health-share ministry is you're cash-pay for your bills. So we got huge discounts: 40-50 percent off. If we'd had insurance, it would've cost almost $1,000,000. We were billed $850,000 but with discounts it was $275,000. We were responsible for the first $300 then with the health-share ministry—his illness was allowable to be shared with all the members—we got 500-600 personal checks. So we were never worried financially. There's so many blessings out of this huge event that could have killed him. And our faith has just grown exponentially.

Our Dependents

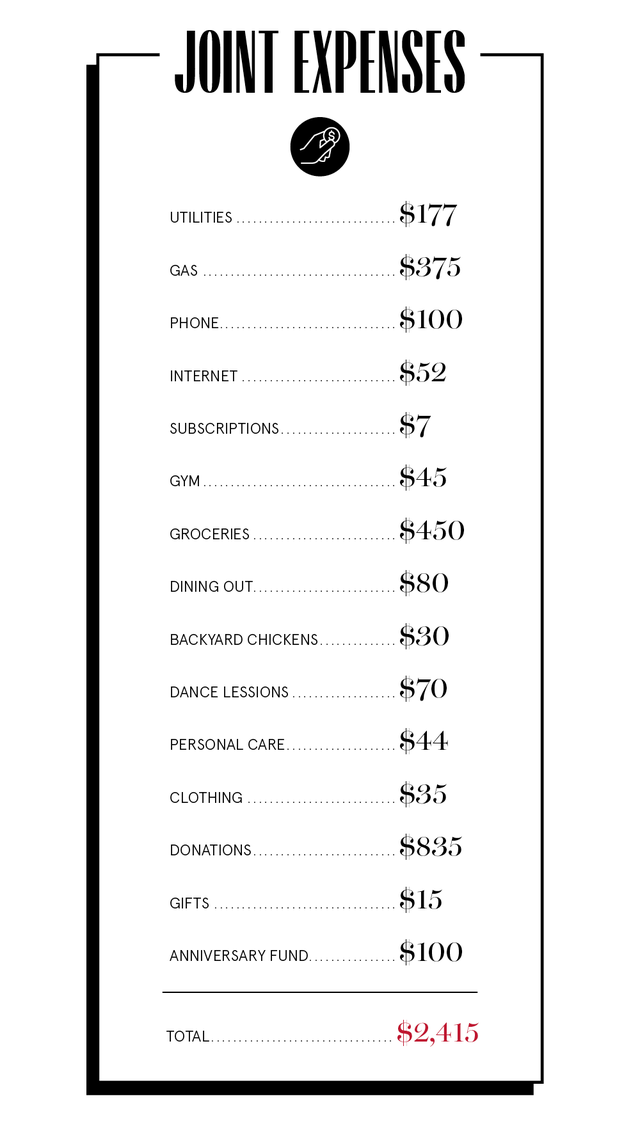

Kristine: We have five chickens in our backyard. We had six but turns out one was a rooster, so cockle-doodle-doo, he had to go away.

Joe: They cost us about $25-$30 a month, but then we don't have to buy eggs.

Kristine: We dog-sit occasionally, but our seven kids are grown, self-supporting, ranging in age from 22 to 36.

When We Told Each Other Our Salaries

Joe: I do remember revealing that I was pretty conservative. I didn't have any debt, and her financial revealings revolved around her car.

Kristine: I was working overtime and living on less than I was making because it was so important to have my debt paid off as soon as possible. I had really committed to that—my credit card debt, some student loans, car loan. He was very supportive: "Wow, good for you. What a great goal."

How We Handle the Cost of Living

Kristine: Nothing's split. It's all one pool of money and we pay our bills, because we're married.

Joe: We're both independent adults. I had those questions in my mind, but she just brought it up. "We need to set up a joint account. Are we going to use my bank or yours?" It caught me off guard a bit, but I agreed. Being married is a spiritual commitment, among other things, and if you want to know where somebody's heart is, find out where their money is. I said, "Yeah, okay, but I want to use my bank."

Why We Have Joint Accounts

Kristine: The hardest part for me was deciding to become joint on his checking account. It was hard to let go of the account I'd had for a long time. It's like, "Who cares? It's just a bank account." But it was an adjustment.

How Often We Talk About Money

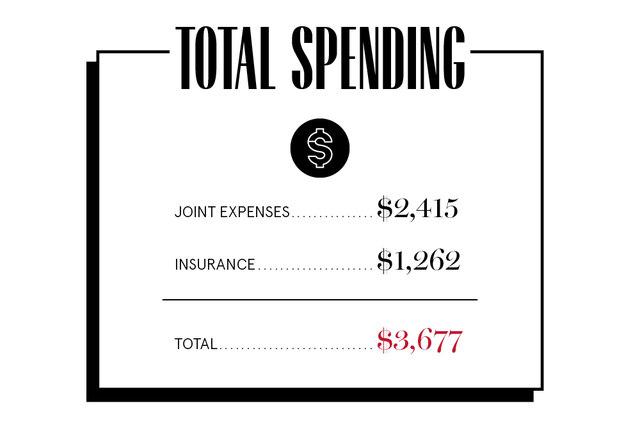

Kristine: A couple of times a month, we try to budget prior to the beginning of the next month. Right now it's 2-3 times a week. We have a small bathroom we've been remodeling, so we're paying our contractors and double-checking the cash.

Joe: Our budget's in EveryDollar. She handles the details, so she's sitting at the computer asking, "What expenses do we have coming up this next month?" I'll say, "There's this prescription," or "My truck's going to need new tires." She'll do the same thing.

What We Keep Secret

Kristine: We're very open. I'll get a check from my parents for birthday money and I'll say, "What am I going to do with this money, honey?" And he's like, "You can decide, babe, it's all yours."

Joe: I have a "private" checking account, but she totally knows about it. It's an attempt to squirrel away some money so I can buy her something nice. It's one of those open secrets, but I try not to talk about it.

How We Learned To Budget

Joe: I grew up on a cotton farm in West Texas. My mom and step-dad were Depression-era babies, and we were just as tight as could be financially. We weren't poor, but we were certainly not well off. They started paying me to work on the farm when I was five. I got $0.25 an hour. We opened a checking account, and they'd pay me and show me how to deposit. By the time I was 10, I was making deposits and writing checks under their supervision. By the time I graduated high school, I had overhauled a car on my own dime and labor. I went off to college with a Navy scholarship, so that covered most of my expenses, but I had a big savings account. I hardly ever spent anything.

Kristine: I wanted a horse at 11-12, and my parents said, "When you turn 13, you can get a horse." I knew if you wanted something you had to save money for it. My mom had me get out a piece of paper and make two columns—needs and wants—for all the things I thought I needed to have my horse. That was 40 years ago but it made a very deep impression on me. But I fell off the bandwagon when I was 19. I got a job in Manhattan working for a large investment company as a secretary, and one of the things we were reviewing was the credit-worthiness of various companies. I had all this information at my fingertips. I realized, "Oh, I know how to get a credit card!" So, I got my first—from JC Penney, a $200 limit. Fast forward to 39-45, it was an up and down, love/hate relationship, charging, paying it off. Minimum payments, constantly in debt.

Joe: I got married when I was 22, and over the course of 18 years, we piled up a fair amount of debt. By the time the divorce came along, I inherited that. It took me several years to work my way out, but by the time I met Kristine, I was debt free.

Kristine: One day I was driving to work at the IRS, my life was in the toilet. I'd begun to listen to Dave Ramsey's show. I heard this couple do this "We're debt free!" scream on the radio, and I literally burst into tears. "I don't want this to be me. I want to be debt-free!" That's when I got serious about it, right before I met Joe.

Our Biggest Fight About Money

Kristine: Food, our grocery budget. It's not so much a fight as it's "Oh my God. How did we spend this money?" $400 a month is a reasonable budget for two adults. I get some organic, we're very careful with food we eat, we eat what we buy. We usually end up $475-500. It's remained a mystery. We've kind of accepted it.

Joe: Early on, maybe after we'd been married six months: Who's going to handle what? Who's going to pay what? How are we going to do a budget? It was very difficult to meld our styles together. I tend to let go of the details a little sooner and look at things more broad stroke. At some point, I said, "You know what? This is her system. It's going to be better if I get on board."

How We Pay For The Non-Essentials

Kristine: We don't actually budget in entertainment. We still have fun, but it's pretty simple. I'm going to Australia with my daughter, and I've been saving for an overseas trip for years. I need about $500 more. It was my birthday this month, and I said, "How about we put $200 for my birthday?" Then, "Want to take a dance lesson this month?" "Okay, great. Let's put $70 aside."

What We're Banking On

Kristine: We never actually took our honeymoon, so we're planning that when Joe finishes his master's degree in 1.5 years. But we put a pause on that. Our car replacement fund. And really, truly, retirement. We've maxed out our IRAs as quickly as possible at the beginning of the year. We have other things in our house we want to redo. We move at the speed of cash, which is slower. But it's really nice. Our contractors give us the bill, and we just peel off the hundreds. Sometimes they'll take $100 off as a cash discount. Cash has power. It's amazing.

Interviews have been condensed and edited for clarity. Reporting and editing by Katherine J. Igoe. Design by Morgan McMullen. Illustration by Studio Patten.

For more stories like this, including celebrity news, beauty and fashion advice, savvy political commentary, and fascinating features, sign up for the Marie Claire newsletter.

Related Story

Related Story

Dedicated to women of power, purpose, and style, Marie Claire is committed to celebrating the richness and scope of women's lives. Reaching millions of women every month, Marie Claire is an internationally recognized destination for celebrity news, fashion trends, beauty recommendations, and renowned investigative packages.