The Blogger Couple Who Made $20,000 When the Pandemic Hit

Every month, a couple will get candid with Marie Claire about how they split their finances. This week, we're talking to a couple who lost revenue during the pandemic, but invested wisely.

Welcome to Couples + Money, where we break through the confines of polite conversation. Forget questions about your sex life. We're getting even more personal. Let's talk about what you and your partner are doing—and not doing—with your paychecks.

Every other Thursday, a couple will get candid with Marie Claire about how they split their finances. We’ll break down what each person pays for individually, what they split, and all the gritty details—from who picks up the bill in restaurants to who picks fights over bank statements.

Want to be profiled with your partner in Couples + Money? Get in touch: couples.money@hearst.com.

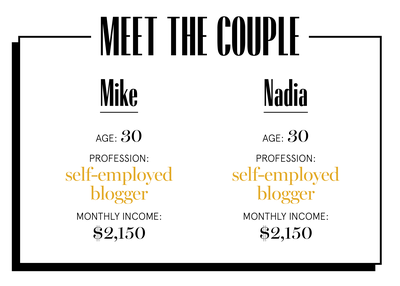

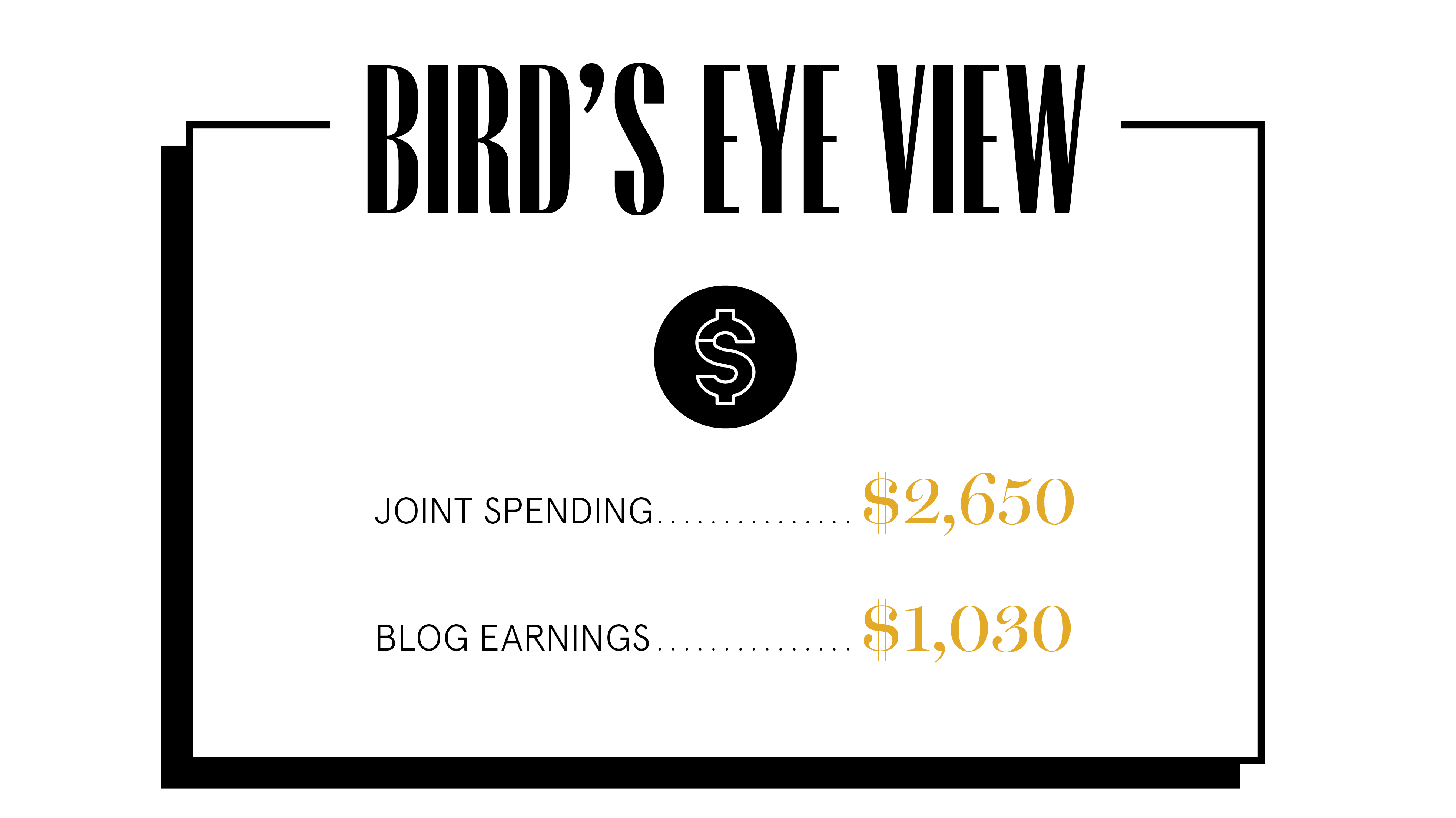

This week, we're talking with Nadia and Mike, both 30, who founded a couples' travel and romance blog called Couple Travel the World. Prior to the COVID-19 pandemic, they made a total of $60,600 per year ($5,050 per month), and now, due to COVID-related impact, make $1,030 per month from the blog. They’ve been together 13 years and live in Atlanta, GA.

How It All Happened

Nadia: Mike and I met at a high school dance when we were 14. My friend dared me to ask the most attractive guy in the room to dance so I scoured the room until I saw Mike.

Mike: We didn’t actually start dating at this point. We didn’t hear from each other for a few years until we randomly started talking when we were 17.

Nadia: We agreed to meet up and the rest is history. We've been attached at the hip ever since and decided to both study law and marketing at university. We were so attached that some of our classmates starting calling us “Couple,” a nickname that would later form part of the name of our travel blog.

Get exclusive access to fashion and beauty trends, hot-off-the-press celebrity news, and more.

Mike: We've both always had a huge passion for travel. One of the reasons we've stayed together so long is our mutual interest to travel the world. At university, we invested our part-time wages in blue chip stock on the stock exchange by investing when stocks were low and selling when stocks were high. We made good money because we invested our savings during the global financial crisis of 2008, when stocks were low.

Nadia: In 2013, we both started working in law firms, but we quickly grew tired of the everyday grind. I remember a lawyer once told me that lawyers are caged rats, and that's 100 percent true—you're locked in your office every day for hours. We decided to study a master's overseas in Copenhagen in 2015, but due to the shortage of housing we traveled the world instead and completed the masters virtually. This is when our life as digital nomads and our travel blog began.

Mike: At first, we loved that our blog got us access to free hotels and products, but we knew we wanted to achieve more financial freedom. By just the second year, we were able to live off our blog and spend our days traveling the world. We've lived with no fixed abode and full-time traveled for five years, until COVID-19 put our travels to a halt. Currently, we travel in a renovated campervan.

How COVID-19 Impacted Us

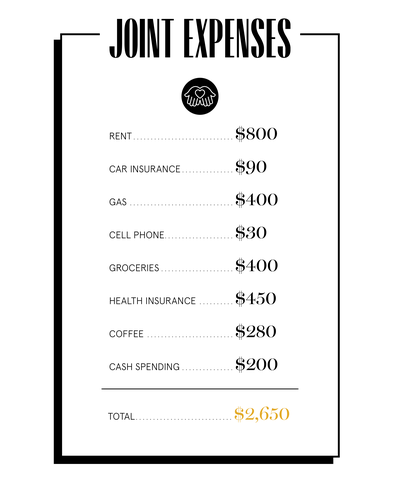

Nadia: Before COVID-19 hit, we were exploring America. Aside from activities, one of our biggest expenses was our virtual office—Starbucks! It's a great place for digital nomads to work for a few hours, as there's a Starbucks every 20 minutes across the whole of America.

Mike: As we have around $1,000 spare each month for savings (after tax), we'd save that. For many years since 2008, we've seldom purchased shares and held our money waiting for an opportune time to enter the market.

Nadia: The share market goes in a 7 year cycle, so generally, every 7 years it will hit another low.

Mike: When we go to invest in anything, we always talk to each other first.

Mike: After COVID-19, our blog went from making $5,050 a month to $1,030. Our ad revenue dropped by 33 percent, as no one's traveling and advertisers aren't spending money.

Nadia: Prior to the pandemic, we'd signed an ironclad contract with a Fortune 500 company, which was paying us a standard rate per month for work completed. They pulled the contract from us with one day's notice, with the work already completed for that month. Our expenses also increased, as we needed to stay in an Airbnb.

Nadia: We were able to use our savings to not only cover our increased expenses but make smart investment decisions.

Mike: The whole share market dropped by 30 percent and some shares by over 70 percent; We knew this was the opportunity we were looking for to buy. So far, we've increased our portfolio by $20,000 by investing during this time.

Nadia: One stock we invested in was Norwegian Cruise Lines (NCLH) at $8. Many people probably think we're mad investing in a cruise line, but we felt that at $8 the shares were massively undervalued. They'd been trading at over $50 just two months ago. We've since sold and taken some profits in this share. The price is now $10, but we sold part of our stock a few weeks ago when the share price hit $16.

Mike: We also purchased stock in other cruise lines like Carnival (CCL) (bought $9, now $14). Another is Nvidia (NVDA), which makes computer processors popular with gamers (bought $220, now $350) because we thought they might generate even more business with brick-and-mortar businesses closed and people sheltering at home. We diversify our risk by buying small positions (as little as $1,000) in many different companies and industries.

Our Dependents

Nadia: We currently have no dependents and no hurry to have kids anytime soon. While we believe we'll have kids one day, we wanted to spend time while we were young enjoying ourselves.

When We Told Each Other Our Salaries

Mike: As we grew up together, neither of us had any money from the beginning. We never really had to have “the salary talk.”

Nadia: Dating from such a young age meant that we always had full access to each other’s accounts. We've always treated our money as mutual. However, we never opened a joint bank account because it's nice to have different accounts to save for different things.

How We Handle the Cost of Living

Nadia: Our cost of living is not a home with a mortgage but hotels and Airbnbs.

Mike: A misconception about traveling the world is that you need a lot of money. What we've found is that if you're savvy, you really can do it on a very limited, normal wage.

[Editor's note: Nadia and Mike did not disclose their average cost of living, including average cost of Airbnb stays, gas, or permit fees.]

How Often We Talk About Money

Mike: Prior to COVID-19, it was necessary to talk about money on a daily basis—that's how we determined what hotels to stay in, what food we could buy, and more.

Nadia: We're always on the same page about money. We're pretty frugal people, so we only spend what we need. Any money we don’t need we reinvest. Most people like to invest in a house, but we feel most comfortable investing in the stock exchange. While we're waiting for a good opportunity, we keep money in cash or term deposits.

What We Keep Secret

Nadia: We don’t keep anything secret, at least on purpose. Sometimes Mike makes a share trade he's forgotten to tell me about and I see the notification pop up in our emails, but aside from that, nothing.

How We Learned To Budget

Nadia: My parents were always really good with money. Despite the fact I grew up in a comfortable middle class family, my mother was very savvy and I learned the importance of saving money from her. She would base her family meals on what was on sale that week in the supermarket and not buy clothes until they went on sale. My dad was addicted to the share market, so I learned a lot about investing from him. I noticed my friends didn't make share trades because they weren't comfortable with this kind of investment; However, if you know when to buy and sell and invest in blue stock shares it can be a very good option.

Mike: My family was also very frugal with money, especially with nightly meals. She often cooked low-cost meal options like potatoes and lentil soup to save money and would ring multiple vendors to find the best price for the Christmas vacation rental.

Nadia: Because we both came from money-conscious families, we rarely fight about money because we're totally on the same page about conserving money to the best of our ability.

How We Pay For The Non-Essentials

Mike: Sometimes things come up. We like to keep our income higher than our expenses and keep funds in the bank for a rainy day. We were driving near Atlanta recently and our tire suddenly shredded to nothing. It cost us $100 for a new tire, which was not in our usual budget at all. Luckily, we were able to take it out of savings.

What We're Banking On

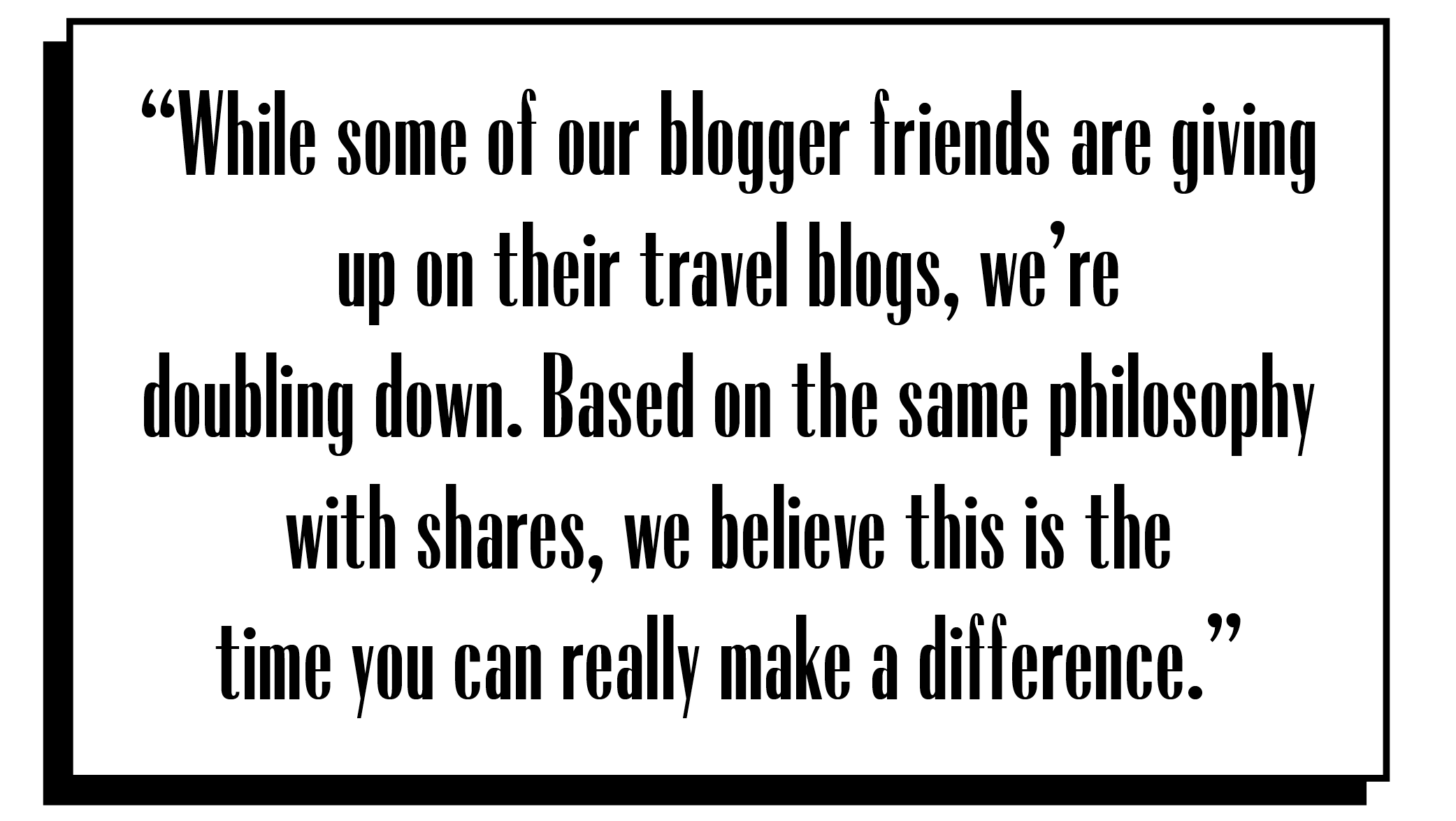

Mike: We still believe in our travel blog and its ability to make money. We believe, one day in the future, travel will bounce back and so too will the income.

Nadia: While some of our blogger friends are giving up on their travel blogs, we're doubling down. Based on the same philosophy with shares, we believe this is the time you can really make a difference. While others are burying their heads in the sand, we're pumping out articles in the hopes of cashing in on this work in (hopefully) the not-too-distant future!

Interviews have been condensed and edited for clarity. Reporting and editing by Katherine J. Igoe. Design by Morgan McMullen.

RELATED STORIES

Dedicated to women of power, purpose, and style, Marie Claire is committed to celebrating the richness and scope of women's lives. Reaching millions of women every month, Marie Claire is an internationally recognized destination for celebrity news, fashion trends, beauty recommendations, and renowned investigative packages.