The $115,000 Entrepreneurial Couple Using Airbnb to Cover Baby Costs

Every other Thursday, an anonymous couple will get candid with MarieClaire.com about how they split their finances. This week, we're talking to a couple creatively achieving their creative and personal goals.

Welcome to Couples + Money, where we break through the confines of polite conversation. Forget questions about your sex life. We're getting even more personal. Let's talk about what you and your partner are doing—and not doing—with your paychecks.

Every other Thursday, an anonymous couple will get candid with MarieClaire.com about how they split their finances. We’ll break down what each person pays for individually, what they split, and all the gritty details—from who picks up the bill in restaurants to who picks fights over bank statements.

This week, we're talking with Nellie, 32, a director of finance and entrepreneur, who earns $100,000 per year ($8,334 per month), and her husband, Logan, 35, a songwriter and property manager, who earns $14,520 per year ($1,210 per month). They've been together eight years and live in Los Angeles, California.

Want to be profiled with your partner in Couples + Money? Get in touch: couples.money@hearst.com.

How It All Happened

Nellie: We met in Los Angeles through my friend from middle school. I'd just moved in with her after college, and she was dating his brother. She'd tell me, "I think you'd like my boyfriend's brother. He's just your type." Logan and his brother were in a band together, and they'd come over and hang out. We just hit it off. The tragic thing was, as soon as we started dating, my friend and his brother broke up the next week. We ended up needing to move out because it was too difficult for her to hear about me hanging out with the family. Now she jokes that the only reason she dated him was to connect the two of us.

Logan: We got married and then moved in together. The property management is a steady gig that doesn't pay much, but gives us a free apartment in an area of L.A. that's very expensive. My brother and I are working together making an album, but also producing and writing for other artists and making money that way.

Get exclusive access to fashion and beauty trends, hot-off-the-press celebrity news, and more.

Our Dependents

Logan: I noticed that our dog gets more and more expensive. We tried this fancy food, and he loved it. I think it's healthier, though. And we have dog insurance.

Nellie: We're having a baby, so a lot has come up recently: "We have a Prius. Now, we need to get an SUV to fit everything." And we talked about getting a house: "We don't want to go back into debt, but we probably need to keep some money liquid."

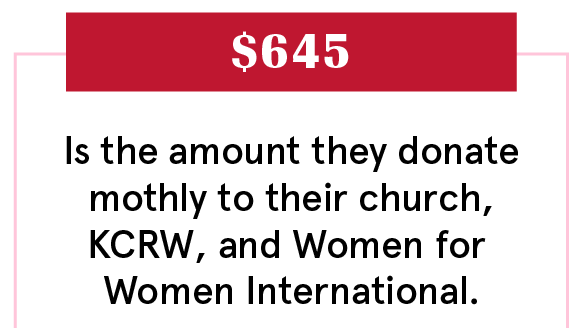

Logan: We have tithes with our church. Actually, we have a broader idea of tithes extended to nonprofits, people that need it, etc. It'll change monthly. We try vigorously to stick to 10 percent of our income. If we mismanage our finances, we don't have that money to pay it forward. Nellie is actually better at that than me. She has in a hierarchy in her head set up for money.

When We Told Each Other Our Salaries

Nellie: I've always worked a corporate job along with my entrepreneurship, so I've always had a steady salary. Logan was focusing on his music career, so, he'd do any jobs that would get him by. But he was really good with his money. I was living paycheck to paycheck because I would spend my money on fun L.A. things. So he always had more money than me. It was really cool. He taught me budgeting.

Logan: I remember, when we were dating, talking about how I wanted to start a Roth IRA. She wasn't really thinking saving as much. I didn't have as much money so I needed to budget.

Nellie: A lot of people do premarital counseling. We did pre-engagement counseling, which I liked because it gives you more freedom to make the right decision. There was a whole section on finances. We shared every detail. They also advised us to have one person in the relationship take the lead on finances. I immediately said, "Logan should do it. He's better."

How We Handle the Cost of Living

Logan: We throw the money in one pot and then spend it.

Nellie: I think the birth's going to cost us $3,500-$4,000, so we decided to start doing Airbnb for the past five months with our guest room. We've been able to get about $2,000 a month from that. We live right by a college, so there's constant interest. Plus, we use the leftover money for buying a crib, that sort of thing. We have to turn the guest room into the nursery now, so we decided to end it, but I wish we'd done it so much earlier. We had no idea. We could have made a lot more.

Why We Have Individual & Joint Accounts

Logan: We use Mint. We also have Simple Bank: A digitized version of the envelope system, built directly into your bank. So, if you're going to have to fix the car, you just make a goal, and Simple would just take out a few cents or a dollar every night. That's at the heart of our budgeting at this point.

Nellie: When you log in it looks like you have X amount. Really, you have a lot more in these savings accounts but you only look at what's actually available. It's really cool and helpful.

Logan: For a while after we were married, we still had separate accounts. Actually, we still have separate accounts, but two years ago we got a joint account together for most expenses.

How Often We Talk About Money

Nellie: At least once a month we'll sit down together. He'll lead it, going through the budget and seeing how we're doing. And he does it almost daily himself with his apps.

What We Keep Secret

Nellie: With Simple, whenever either of us spends money it sends a notification to both of us: "$20 at the gas station." You can turn that off if you want, but we always know what the other one's doing because of that.

Logan: I think today with the world we live in, she makes more money than me and I'm totally fine with that. But I feel sometimes people from the older generation or my own generation might judge me for that. There's that kind of conflict there, even though in our relationship it's no problem whatsoever.

Nellie: I feel like free rent is part of what he's contributing. Our apartment would be $3,000 a month. I'm really happy with our setup.

How We Learned To Budget

Logan: I was actually bad at math, so I took a high school consumer math class instead of trigonometry. They talked about Roth IRAs, and I just thought the idea of compound interest was so cool. I always had that mindset of not spending money as readily.

Nellie: My parents always tried to teach me budgeting. If I got an A at the end of the quarter, they'd give me $100, and so on. Besides that, I had to work and save up for pretty much everything myself throughout high school. I worked for my parents' company and Circuit City—I could spend it however I wanted, but they encouraged me: "Now you know the value of money because you worked for it."

Logan: I've definitely hurt for money in the past, but not to the point where I feel it's making my life horrible. I feel very lucky. My parents got divorced and they cited money as the biggest reason. It probably was on my radar growing up. Even though money isn't the most important thing to Nellie or me, we both have a healthy respect for it.

Our Biggest Fight About Money

Logan: We honestly don't fight about money. Part of it is because we have as much as we need and a little bit more to save. That's as much as we need to be happy. The only thing I can think of is, when we were setting up a budget, she couldn't give me a number for her facial products even though I was pushing for one. It got more heated than I expected, and it feels stupid now. I think I'm going to just let that one go.

How We Pay For The Non-Essentials

Logan: We have a budgeted amount that we usually spend per month. We're not the best at sticking to the numbers, but most months, it'll be right around where it's supposed to be.

Nellie: Since we've been married, we went on a three-week vacation in Europe, with the attitude of: let's just enjoy it because you don't always get to take a trip like this. We ended up coming back with $5,000 in debt. We decided, "Going forward we should be better about saving in advance and giving ourselves a budget."

Logan: We had a soft goal of traveling somewhere every year. Now that we're having the baby, we'll see what happens.

What We're Banking On

Nellie: Once we figure out daycare we'll probably start budgeting for that, and then the other big thing is the house.

Logan: We just had the baby shower. We're starting to realize this baby needs so much money. I'm starting to appreciate people that just get what they need because it works and it doesn't have to be the best quality. We still try to support companies and corporations that we feel like are socially and environmentally responsible. We're trying to figure it out for ourselves, now that we're supporting another person, how to feel comfortable ethically and also monetarily.

Nellie: My dream is to scale back my full time job next year and then try to give it a go with my entrepreneurial work. A lot of Logan's family members are involved in helping start up a treatment center for addiction. We (mostly him) have been actively helping get that off the ground. Our goal would be to transition to me doing full-time entrepreneurship, him doing that and music full time. That's what we're working towards with our financials.

Interviews have been condensed and edited for clarity. Pseudonyms have been used. Reporting and editing by Katherine J. Igoe. Design and illustration by Morgan McMullen. Animation by Hayeon Kim and Colin Gara.

For more stories like this, including celebrity news, beauty and fashion advice, savvy political commentary, and fascinating features, sign up for the Marie Claire newsletter.

RELATED STORIES

Dedicated to women of power, purpose, and style, Marie Claire is committed to celebrating the richness and scope of women's lives. Reaching millions of women every month, Marie Claire is an internationally recognized destination for celebrity news, fashion trends, beauty recommendations, and renowned investigative packages.