The $175,500 Couple Juggling School, a Baby, and Debt

Every other Thursday, an anonymous couple will get candid with MarieClaire.com about how they split their finances. This week, we're talking to a couple who support his school and their baby primarily off her salary.

Welcome to Couples + Money, where we break through the confines of polite conversation. Forget questions about your sex life. We're getting even more personal. Let's talk about what you and your partner are doing—and not doing—with your paychecks.

Every other Thursday, an anonymous couple will get candid with MarieClaire.com about how they split their finances. We’ll break down what each person pays for individually, what they split, and all the gritty details—from who picks up the bill in restaurants to who picks fights over bank statements.

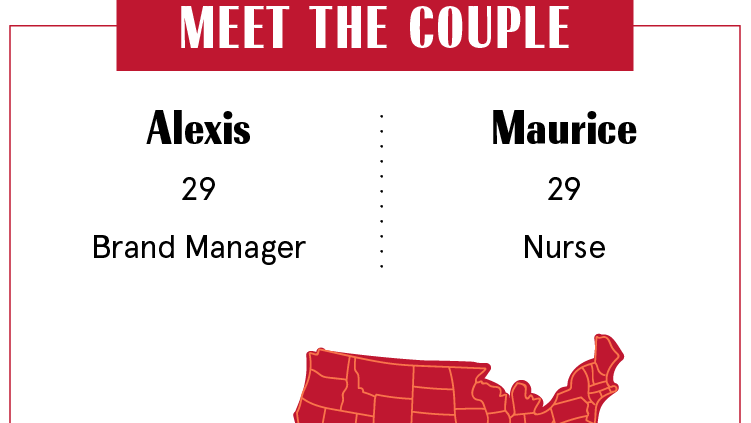

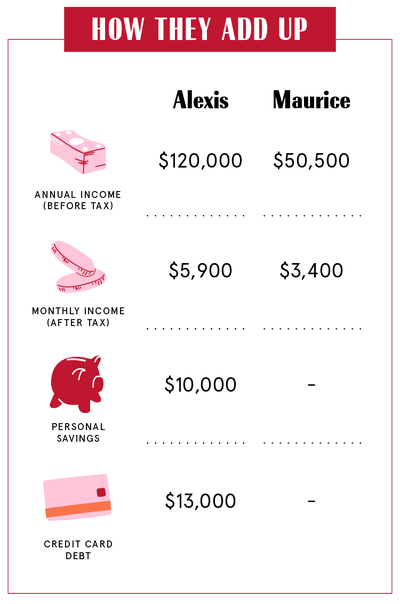

This week, we're talking with Alexis, 29, a brand manager, who earns $120,000 per year ($10,000 per month), and her husband, Maurice, 29, a nurse, who earns $50,501.52 per year ($4,208.46 per month). They've been together 11 years and live in San Bernardino, CA.

Want to be profiled with your partner in Couples + Money? Get in touch: couples.money@hearst.com.

How It All Happened

Alexis: We met our freshman year. I was hanging out in my room with a bunch of girlfriends, and I saw a group of guys walking down the street. We were bored, and I hollered out the window, "Hey, you guys should come hang out with us!"

Maurice: The next day she gave one of my friends her number, and told him to give it to me. Our first date went extremely well—we were driving back to the dorms and we saw a shooting star. She took it as: We're going to be together forever. A lot of times we're together now, we see shooting stars. It's a sign of something, and I'm accepting that sign.

Alexis: Our daughter was a surprise. We were just getting married in 2017, and then I was pregnant. I couldn't have cried harder. I was selfish: "We're not ready. You're still in school. Why have a baby? It's going to ruin it!" His mentality was, "God blessed us with this baby. We're going to make it happen no matter what. Our daughter's going to come first."

Get exclusive access to fashion and beauty trends, hot-off-the-press celebrity news, and more.

Our Dependents

Alexis: People think kids are so expensive, but with active grandparents, that's been a blessing. We never really need to go buy something, because they bring our daughter so many clothes and toys. I gave money, for the past couple of months, to my sister while she was trying to get on her feet. But now she got a second job.

When We Told Each Other Our Salaries

Maurice: It was about rent. And it was always 50/50—that's what I love about her. She's very fair and even when I fall short she's more than willing to pick up the slack.

Alexis: I think it really hit the fan when we first had to file taxes together. I never wanted to tell him how much I made, because I know I make more. I'm also working on not using that in an argument. Sometimes if it's getting nasty, you just want to say, "I bought this!" or "I can do all this without you!" With finances it can be deadly if you throw it at them.

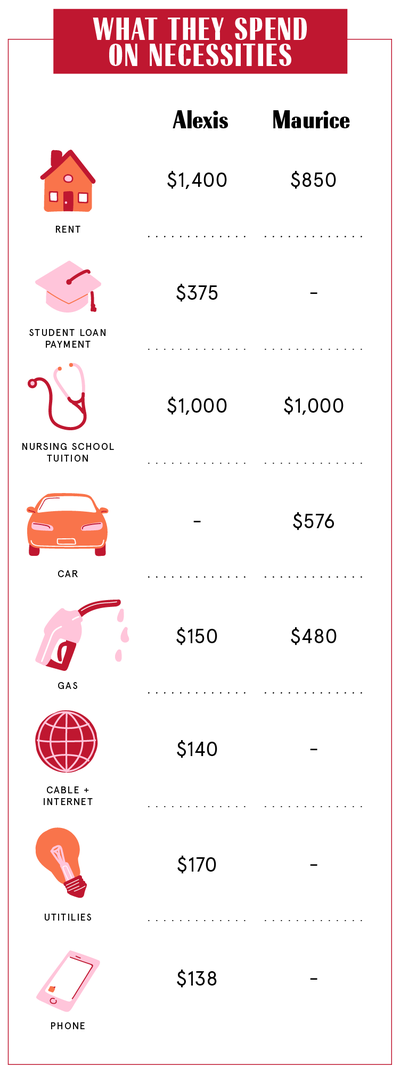

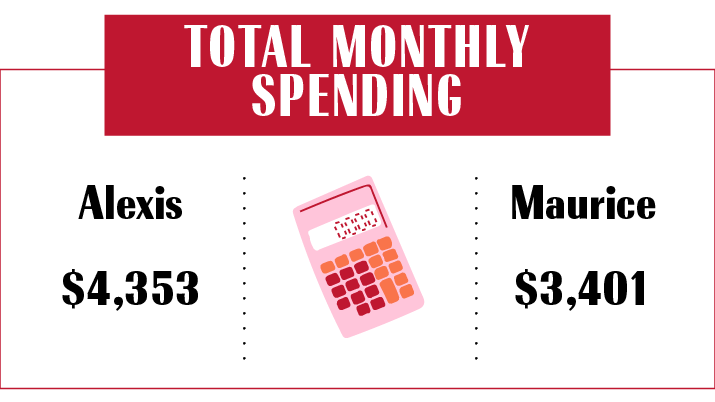

How We Handle the Cost of Living

Alexis: I take on a lot more because he's in school. I said, "You just take your car, insurance, phone bill, and your half of the rent, and a dash of something else. I'll take the rest." I care more for the transparency. Right now, the rough reality is that we're kind of okay, kind of tight, but we're getting by every month.

Maurice: Every single pay period is, "How much do you have to survive with?" It makes you so miserable. Who's going to survive off of 200 dollars for the next two weeks? At this point, it's not even worth trying to figure out.

Why We Don't Have Joint Accounts

Alexis: We had a joint account once, and we closed it. It just got weird. I monitor where money is going, and we don't like touching each other's money. If I know what's hitting on his bank account or where money's going so quickly, I'm going to have a problem, and vice versa. We were like—let's divide and conquer and just have each other's backs.

Maurice: Since I'm stretched so thin, it was making me a nervous wreck. Right now I'm doing much less than what I could and will be doing. I'm trying to postpone that part of our relationship until after school ends in a year. Every parent wants their child to go to college and a part of that will be learning to manage and save money. So joint finances are definitely a priority of mine, just not at the moment.

Alexis: Because Maurice knows that if he sees it he'll spend it, he'll give me money to hide in the house.

How Often We Talk About Money

Alexis: Money comes up every day. I first started helping him with his nursing school tuition in 2016, because he wasn't able to get any more financial aid. He's driving into the city five days a week. He'll wake me up in the morning and say, "Can you cash app me $20 for gas?" because he's constantly spending money on gas, food, tuition, and bills.

Maurice: I've made it a personal goal to initiate those conversations so that I can let her know, "I'm paying attention to what we used to go through, versus where we are now."

What We Keep Secret

Alexis: Debt. I'm constantly looking at my credit card getting higher, and he knows that. I just know when he gets out of school we're going to be able to pay it off. Also, either Maurice's mom or his dad used his name and got him a credit or a cell phone bill when he was younger, just to build his credit, and they didn't do right by it. So I got to be understanding.

Maurice: I know what she deserves and I know the sacrifices that she's made. There were times I didn't want her to know my finances because they weren't where I'd want them to be. I learned the hard way that you can't be like that.

How We Learned To Budget

Alexis: My mom has always had an 800 credit score; She says that to me every day. She's always telling me, "Invest this," telling me about the markets. My dad, on the other hand, is so discreet about his finances. He says, "I used to run up my credit card trying to be Superdad, and I'm in debt." My mom's retired, my dad still works. Maurice, on the other hand, his dad is around but just not present in his life. His mom has a great job, but she's always had to be a single mom. So they use payday loans—it's natural for them. I had to learn to not put my nose up at them hustling.

Maurice: Alexis is a positive role model. And she's a planner. She's like, "Let's avoid those consequences and do things strategically."

Alexis: In the African American community you don't talk about money. It's hustling to get the check and living day to day, or it's super aspirational that you're going to be as rich as Beyonce by next year. I wish I had more examples, or a support system, or more people who I can confidently talk about money to.

Our Biggest Fight About Money

Alexis: The other day, he was like, "I'm going to take money out of my retirement." I'm like, "What the flip? No! We file taxes together!" He did that one year without telling me. I said, "I would've given you the money." I hadn't realized that he wanted to feel comfortable about providing for his family.

Maurice: I'm a bit short-tempered compared to her. Whenever we're talking about finances and things go a little left, I shut down. She doesn't like that. I have to step back and say, "Don't raise your voice because all she's trying to do is be constructive."

How We Pay For The Non-Essentials

Alexis: I took him on his first airplane ride a couple of years ago. And I primarily pay for those things. He wouldn't do it if I didn't pay for them and make him go. So when we went to Coachella, I put it on my credit card. We love concerts, that's our biggest ticket item. If we go out for drinks, he'll pay. Sometimes, I'll give him my credit card while we're out with friends, so he's paying for drinks on my credit card. I've made fun a priority, because if we didn't, all we'd be doing is sitting there getting angrier at the fact that he's in school.

Maurice: It started off by me paying, then that transitioned to half and half, and then to her footing the bill, to, "No, let me pay this one time." If we both want to go out and have quality time, we'll figure out a way to do that.

What We're Banking On

Alexis: We both want to get a house, right after he graduates from school and gets his RN and job. We need to go out of the country—he's never been—before we have our next baby. I want to build a college fund for my daughter. I want to start investing in different stocks: I started using Robinhood.

Maurice: The first goal for me would be to pay off my debt. I want to help her get her credit card balance way down. That's something I feel like I owe her.

Alexis: One thing that's hard for a Black woman who's strong-minded is to get out of that mentality of: "Don't try me because I can handle this shit all by myself." Submission, and financial submission, is hard for me. I'm trying to prepare myself for how to react when he does get back on his feet. For six years I've been the breadwinner. What happens when the playing fields are even? My thought process is to stop thinking about it as in me or him.

Maurice: I literally thrive for the moment that I get to save her day. When she needs me so bad and I'm able to do it, that's what keeps me motivated. I wouldn't change any of this—everything that could have broken us, hasn't. That makes me excited for our future.

Interviews have been condensed and edited for clarity. Pseudonyms have been used. Reporting and editing by Katherine J. Igoe. Design and illustration by Morgan McMullen.

For more stories like this, including celebrity news, beauty and fashion advice, savvy political commentary, and fascinating features, sign up for the Marie Claire newsletter.

RELATED STORIES

Dedicated to women of power, purpose, and style, Marie Claire is committed to celebrating the richness and scope of women's lives. Reaching millions of women every month, Marie Claire is an internationally recognized destination for celebrity news, fashion trends, beauty recommendations, and renowned investigative packages.