The $400,000 Immigrant Couple Who Started With Nothing and Have $3 Million in Savings

Every other Thursday, an anonymous couple will get candid with MarieClaire.com about how they split their finances. This week, we're talking to an immigrant couple who now have significant assets.

Welcome to Couples + Money, where we break through the confines of polite conversation. Forget questions about your sex life. We're getting even more personal. Let's talk about what you and your partner are doing—and not doing—with your paychecks.

Every other Thursday, an anonymous couple will get candid with MarieClaire.com about how they split their finances. We’ll break down what each person pays for individually, what they split, and all the gritty details—from who picks up the bill in restaurants to who picks fights over bank statements.

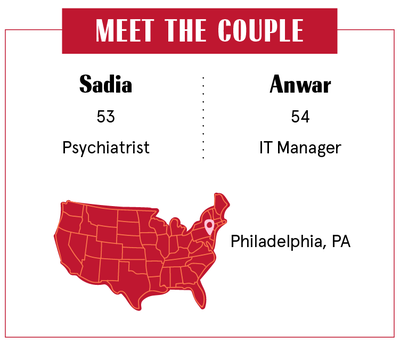

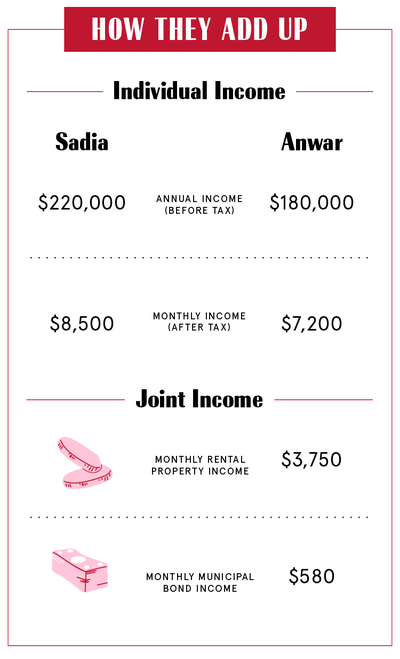

This week, we're talking with Sadia, 53, a psychiatrist, who earns $220,000 per year ($18,333.33 per month), and her husband, Anwar, 54, an IT manager, who earns $180,000 per year ($15,000 per month). They've been together 28 years and live in Philadelphia, PA.

Want to be profiled with your partner in Couples + Money? Get in touch: couples.money@hearst.com.

How It All Happened

Sadia: Our marriage was arranged back home in Pakistan. I saw him just once before we were married. My parents told me, "This is somebody we feel is the right match for you." I said, "Okay!"

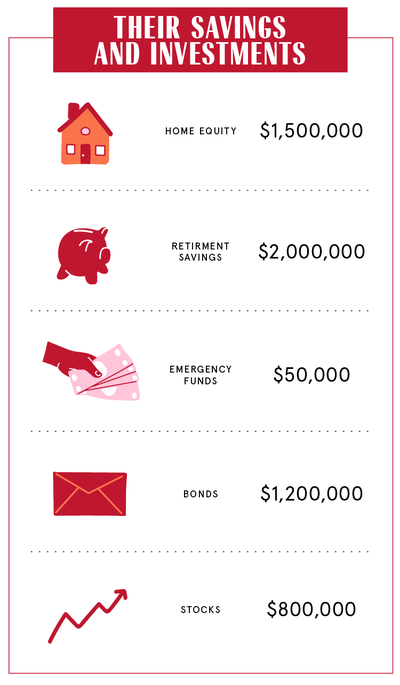

Anwar: I came to the U.S. in 1986, did my master's, and was working here. Then, once we got married, she came here. Both of us came with no money but a good education. With consistent saving and investment, we've been able to raise kids and have a net worth north of $3 million.

Our Dependents

Anwar: We have three boys. One of them is in college, one's a senior in high school, and one's in middle school.

Get exclusive access to fashion and beauty trends, hot-off-the-press celebrity news, and more.

Sadia: Our parents: My mom is around, and his parents are still alive. They don't live with us, but we do support them.

When We Told Each Other Our Salaries

Anwar: Right after our marriage. She was starting her residency, and she knew she'd be working after that.

Sadia: He said, "Why don't we turn the house to one income and save the second income (mine)? In a few years we'll have enough money to buy our own house." I agreed.

How We Handle the Cost of Living

Anwar: From my perspective she doesn't take care of as much—but that's just me. I'm sure she has a different perspective! Initially, when we bought the second house, we were splitting the mortgage. When we shared expenses, we'd argue because I was paying all the credit cards. I said, "Rather than just nickel and diming and seeing what expenses are yours or mine, I don't want to have money conversations at the end of every month. You take care of your credit cards, I'll pay the mortgage, so we have fewer touch points where we have to discuss money." It was more my decision than hers.

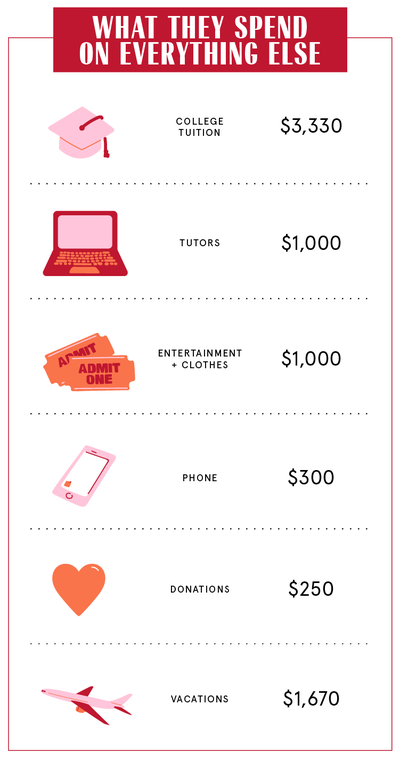

Sadia: I run the house, I do the groceries, I take care of the kids' needs: their books, clothing, lessons. I also support my oldest son in college. My husband takes care of the bills. We only have one mortgage—the rest of them are paid by their own rent. Other bills like water and sewage, he pays. Big items like cars or televisions we usually split.

Anwar: In terms of what to purchase, how much to spend, we're both sharing that information, but where to put our money, what stock to buy, how to diversify, she leaves that up to me.

Sadia: He's the one who makes all the plans. I'm the one who agrees. To some extent, I'm also interested in the details. I want to buy a house in Philadelphia so I can manage it myself. I'd like to buy a little, older house and renovate it, so I've asked him to look for a property I can rent out.

Why We Have Joint Accounts

Anwar: We pretty much have separate accounts. Her paycheck goes into her account, which is just in her name. I have my own individual account as well, but my paycheck goes into a joint account. I use it to pay bills; she doesn't really access it.

Sadia: In the beginning, when I gave him all my money, he ran the household. At the time I was naïve and didn't know much about the system here. But then after I knew a bit more and he felt more comfortable putting more responsibility on me, I guess I accepted more.

Anwar: When she started working, those paychecks went into our joint account. But then she said, "I feel like I don't have control," so now it's mostly separate. We have a lot of transparency. I have access to all of her accounts, I check the statements, keep track of our investments. That's not true on the flip side.

Sadia: Since he's more into numbers and finances, I never hide any expenses. He knows, even if I don't tell him, because he does the numbers. I don't really ask him where he spends his money. I have an idea; He doesn't hide. At the same time, I don't ask, "What are you doing with your money?" I rely on him a lot. I trust that whatever he's going to do is right for us.

How Often We Talk About Money

Sadia: We talk about budgeting and how to save and spend wisely at least once or twice a month. He'll bring me a new idea for one of our properties. We've already paid one off, and we're paying more than we have to for the other mortgages. After a few years, we'll have all that rental money to spend—maybe for our children's college fees.

What We Keep Secret

Anwar: One thing we haven't talked about is wills. We know we need them, but it came up in the past and we had disagreements on how we should set it up. We just haven't talked about it lately.

How We Learned To Budget

Sadia: Way before I was married, I'd save my money. For example, my mom gave me spending money for medical school. Everybody got a little allowance—I was usually the one who'd save it. Of four daughters, three of us are physicians and one has master's in physics and computer engineering, but I was the one who always had the money, if I wanted to buy something special for myself.

Anwar: When I came to the U.S., I didn't have any money. My parents just gave me enough for tuition for the first semester. I really struggled through that first year, and I think that taught me. I got a scholarship that paid for my entire tuition. When I was in Pakistan, looking at other people who was successful gave me an ambition to get to a point where I don't have to worry about money. Working because you like what you do versus working to make your living expenses.

Sadia: My parents were college teachers. We had money, but we didn't have everything we wanted. Growing up, we learned the value of money: If you want something, you have to work hard for it. And we did.

Anwar: The rigor of ongoing contributions into retirement accounts since 1995 has really, really helped over the years. Also, being able to invest across different categories—stocks, bonds, real estate—and not putting all our eggs in one basket helped us, for example, when the stock market crashed in 2008. A lot of our friends got scared and got out, and they missed out. We've kept an even keel with the asset allocation we're comfortable with.

Sadia: We're Costco people. I also try to look for sales for certain items—I'd rather wait for a few months than paid the full amount. We're trying to train our kids the same way. I think value for money is important.

Our Biggest Fight About Money

Anwar: I think she expects that I should share more of the expenses. In my mind, it should be more 50-50. I think it's because we're from an Eastern background—and this is just my perspective—in our culture, men are supposed to take of the woman.

Sadia: If we're buying a car, I might like him to pay for that. Then he'll tell me, "No, we have to split," or "I don't have that much money." Sometimes I feel that he does have money and he's not telling me, because he invests a lot of his money.

How We Pay For The Non-Essentials

Sadia: We never, ever spend money we don't have. For example, if we're going on a vacation, we never do it if we don't have the money.

Anwar: We took a nice vacation last year abroad. That's one big expense we share. Other than that, we eat out a little bit, but it's mostly common vacations.

Sadia: I love clothing, and I have a lot of it. There are a couple of times I go over budget, but I'll never spend money I don't have. Sometimes he says I shouldn't be buying a piece of jewelry because I don't need it. Of course I don't need it, but I want it! It's not all the time—maybe once a year.

Anwar: I'm very data-driven. I literally keep track of my electric and gas bill every month since 1995. I joke with my kids, "I can tell you how much I spent on gas 20 years ago in July." That mentally tells me where we are if we're planning big vacations or buying a car.

Sadia: If one month I bought a few outfits, or kids' stuff, I make sure I don't do any extra spending for the next couple of months to make up for that.

What We're Banking On

Sadia: We're paying our oldest son's tuition from one of the rental properties that's paid off. Next year we'll be paying our second son's tuition with that money, and our oldest will get a loan for grad school.

Anwar: Outside of that, the only debt we have is $200,000 on our primary residence and $100,000 on an investment property I have. Our goal is to try to pay those up.

Sadia: He wants to retire in the next 10 years. I don't. I like to work, and I want to work until I can't. I think his plan is to manage the properties and be his own boss.

Interviews have been condensed and edited for clarity. Pseudonyms have been used. Reporting and editing by Katherine J. Igoe. Design and illustration by Morgan McMullen.

For more stories like this, including celebrity news, beauty and fashion advice, savvy political commentary, and fascinating features, sign up for the Marie Claire newsletter.

RELATED STORIES

Dedicated to women of power, purpose, and style, Marie Claire is committed to celebrating the richness and scope of women's lives. Reaching millions of women every month, Marie Claire is an internationally recognized destination for celebrity news, fashion trends, beauty recommendations, and renowned investigative packages.