The $272,000 Couple Who Live in an RV and Travel Across the U.S.

Every other Thursday, an anonymous couple will get candid with MarieClaire.com about how they split their finances. This week, we're talking to a couple who live out of their RV and work their 9-5 jobs, all while prioritizing travel and experience.

Welcome to Couples + Money, where we break through the confines of polite conversation. Forget questions about your sex life. We're getting even more personal. Let's talk about what you and your partner are doing—and not doing—with your paychecks.

Every other Thursday, an anonymous couple will get candid with MarieClaire.com about how they split their finances. We’ll break down what each person pays for individually, what they split, and all the gritty details—from who picks up the bill in restaurants to who picks fights over bank statements.

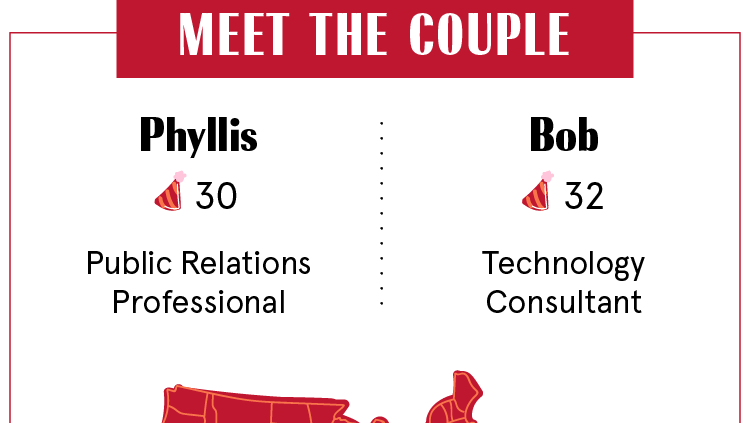

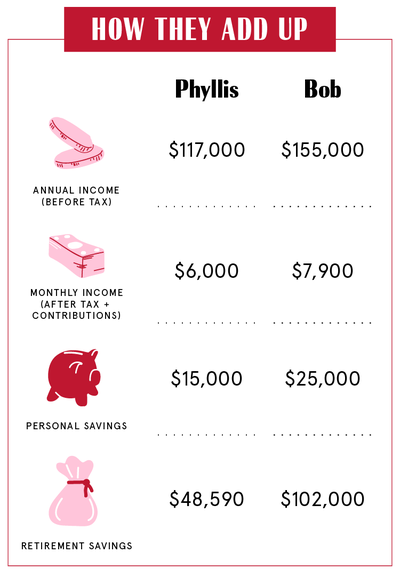

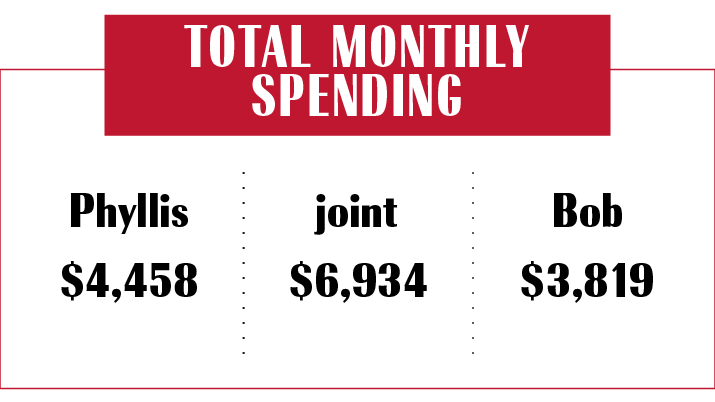

This week, we're talking with Phyllis, 30, a PR professional, who earns $117,000 per year ($9,760 per month), and her husband, Bob, 32, a technology consultant, who earns $125,000 (plus $30,000 in bonus) per year ($12,916.67 per month). They've been together for more than five years and travel around the United States.

Want to be profiled with your partner in Couples + Money? Get in touch: couples.money@hearst.com.

How It All Happened

Bob: We met in college. We dated a bit there, then lost touch. Then we met up again at a mutual friend's wedding.

Phyllis: We were living kind of far apart from each other, and it was a pain. We'd been dating for two years, and I was ready for us to move in. He'd already been working remotely, and we're both paying all this money in rent in New York. We'd been watching RV shows on TV, and we had this fun idea that it'd be great to travel. And he said, "Well, why don't we just do it?" It was really about, Why are we going to spend all this money in rent when we can go and see the country?

Bob: Moving into the RV was the first time we lived together. But I didn't really think too much about it beyond purging our stuff. But she's told me how she was real nervous about it. We recently had this conversation—she mentioned, "What was your exit strategy if things went wrong?" And I was like, "What do you mean? We'd just figure it out."

Get exclusive access to fashion and beauty trends, hot-off-the-press celebrity news, and more.

Phyllis: Obviously, moving in together into a very small space, and there's a lot more that goes into living in an RV. Where to stay, the driving, a lot of other stressors. But honestly it could not have gone smoother. I think we'd probably have the same exact type of relationship if we were living in an apartment. And we'll probably be on the road for the next three years.

Our Dependents

Phyllis: We'd love to get a dog, but a lot of national parks don't allow them on trails. It'd be tough—sometimes both of us are traveling for work.

Bob: I help support my parents a bit when they need it. But I don't have a regular expense for them.

When We Told Each Other Our Salaries

Phyllis: We probably went a full year. He was obviously living in a nicer apartment, but I don't think either of us had an exact number in mind. I remember when I did tell him, he was pretty surprised at how much less I made. At the time our difference was much greater than it is today; I couldn't always spend the money to do things that I could now.

Bob: I don't like talking about money with anyone, you know? That's changed. Initially, it was just a natural reaction. But she never asked me. If it came up in conversation, I would kind of dance around it. A year in, I think she called me out, and I was like, "All right, well, I make this much." It's no big deal, you know?

How We Handle the Cost of Living

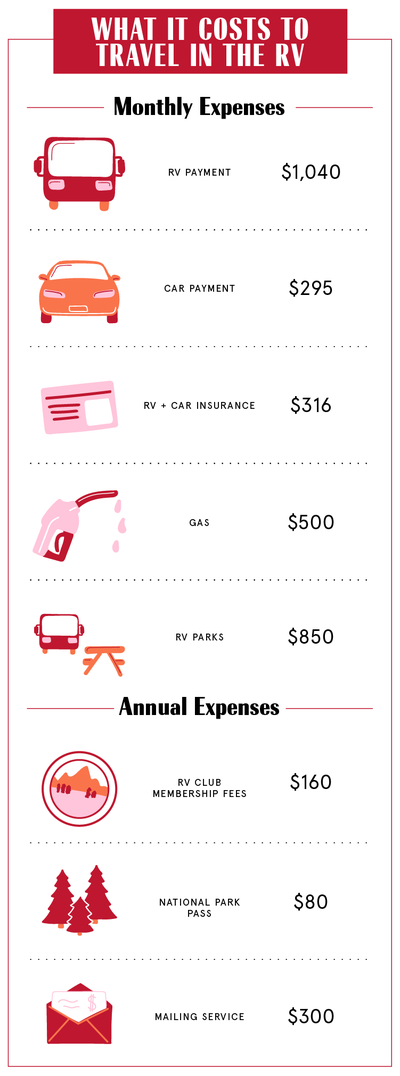

Phyllis: We have a joint checking account and a credit card that we're authorized users on, which is a relatively new development. We figured we might as well be getting points. Everything falls under joint: RV payment, car payment (we tow a car), insurance, restaurants, groceries, gas for both vehicles, which is quite high (over $100 easily every time), internet, upgrades/repairs, everything.

Bob: We always joke, "Oh my God, I can't believe we spent this much on food or a vacation this month."

Phyllis: We originally thought we'd spend less on things like RV parking, for example. I think we initially thought it'd be $700 a month. We try to balance it out: stay in a park for a couple of weeks that's a bit more expensive, $250-300 a week, but then also stay in federal land that's free, or state parks, which are much cheaper. Typically things balance themselves out. But I think we do spend a little more than we'd anticipated. It also depends on which region we're in. We also have to think about services that are nationwide, like gym membership.

Why We Have Joint Accounts

Bob: When we decided to move in together, I said, "Here's what I think our monthly core expenses will be. Let's get a joint checking and put in half. Every time we go over, we each contribute half of what we went over. And if we don't, we have something left over to use for whatever later."

Phyllis: Whatever else I have is my money, and whatever he has is his money to spend however we see fit.

How Often We Talk About Money

Phyllis: We really don't. This whole exercise is very eye-opening: Oh, this is what we spend our money on!

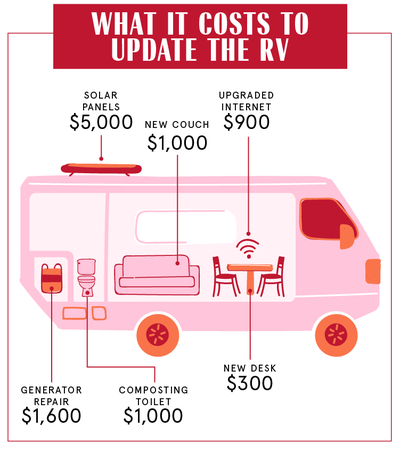

Bob: I usually take ownership of all the bills, figuring out how much we have in our account, how much we need. But I think as far as attitudes, we're on the same page. Like we just upgraded our internet connectivity and that was $1,000 bucks. So I went to her and said, "We need to upgrade, I think it's going to cost this much. Are you cool with me putting this on our card?" And we'll have that conversation.

Phyllis: If somebody did want to live this lifestyle, there are so many different levels. You could pretty much live completely off the grid and spend next to nothing, whatever your rig costs and your gas. We've done a lot of upgrades so we can be more off the grid—solar panels and a composting toilet. Those things cost money, but in the long run they'll save us money and time. So I'd definitely recommend it, but it's a lot of work. You're driving a lot, you're fixing stuff a lot. Things break constantly.

What We Keep Secret

Bob: She and I both have backgrounds of growing up very poor, and very well off, at different points in our lives. So we're open about that. She knows I have student loans that'll take me a while to pay off. We know how much is in each other's 401(k) and savings. So I don't think there's anything we don't talk about.

How We Learned To Budget

Bob: I learned from having parents who were not really smart about money. I was never taught how to manage a budget. So I had to learn really fast. When I was first getting into the corporate world, it's kind of a taboo thing. Even with my family at home, I'm the first one to go to college and make any real money. At one point when I told them what I was making, there was surprise and expectations came along with that. But as I've gotten older, I have a few friends where we openly talk about what we make, what sort of investments we want, how to negotiate a career, that stuff.

Phyllis: I think I was always pretty frugal. Even as a kid, I was the one who'd save all of my change in a giant crayon piggy bank. I guess I learned through school, my parents, but I've never been one to necessarily keep a spreadsheet or do anything super strict. I just always try to make sure all of my bills are paid off right away. I don't currently have any debt. The only things I'm paying off are our car and RV. So even though I don't have huge savings, I think that's still something to feel good about. Otherwise, in my adult life, I've been much more about spending, especially given our lifestyle. It's a little difficult to save.

Bob: One of the things that keeps me up at night is having to support our parents. Neither are very financially sound. I don't know if she thinks about it as much as I do. Hopefully it's the distant future.

Our Biggest Fight About Money

Bob: We fought about how to categorize some of our spending for this article! Like, "Why are you categorizing it like this? You should spread that cost over the 12 months!" But we've never said, "No, I don't want you to buy that." Or, "We have to be able to afford this vacation next month and you shouldn't do that."

How We Pay For The Non-Essentials

Phyllis: They say when you buy an RV it takes two years to wear in, and that's totally true. The first two years, a lot of things we fixed or upgraded ourselves. We ripped out some of the furniture and put it in a regular couch. We now have standing desks. So a lot of the things that we wanted to modify, we've done at this point.

What We're Banking On

Bob: I've always had the goal of starting my own business. That's not a goal that Phyllis has. She's very happy in her job and the money she's making. I'll never be happy with the money I'm making. I'll always want more and figure out what's the next thing.

Phyllis: We've been talking about starting to save for when this journey ends and buying a house. We don't know where yet. So we have a plan to try to start saving towards a goal of $100,000, and getting a joint savings account.

Bob: Because of this exercise, we looked at it and said, "Wow, we should be saving way more." Until recently, the future was way too far away for us to think about anything other than what we're doing now. We just came up with this goal in the last month or two.

Phyllis: Otherwise, most of our money just goes towards experiences, vacations, and the time we spend in these individual places while we're traveling.

Interviews have been condensed and edited for clarity. Pseudonyms have been used. Reporting and editing by Katherine J. Igoe. Design and illustration by Morgan McMullen.

For more stories like this, including celebrity news, beauty and fashion advice, savvy political commentary, and fascinating features, sign up for the Marie Claire newsletter.

RELATED STORIES

Dedicated to women of power, purpose, and style, Marie Claire is committed to celebrating the richness and scope of women's lives. Reaching millions of women every month, Marie Claire is an internationally recognized destination for celebrity news, fashion trends, beauty recommendations, and renowned investigative packages.