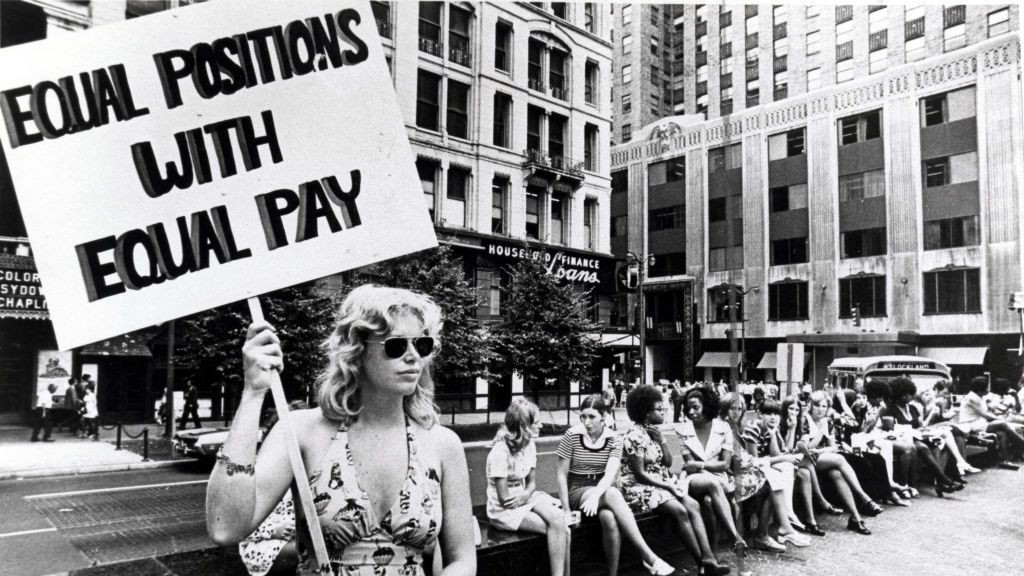

What Equal Pay Day Gets Wrong

The day marks how far into the year an average woman must work to earn what the average man earned the year prior. In her first finance column for Marie Claire, Sallie Krawcheck shares why Equal Pay Day also isn't measuring up.

Equal Pay Day is the day in 2021 that represents how far into the year the “average woman” must work to earn as much as a white man made in 2020. It’s the day on which we traditionally bemoan the gender pay differential, celebrate women who have “made it,” share the research on the positive power of diversity, and give advice to those who aren’t quite there yet on “how to win at work.”

But can we please...not? Equal Pay Day misses the point. In fact, it misses a whole bunch of points. Let me count the ways: First, Equal Pay Day in 2020 was March 31. This year, it’s March 24. So that indicates that the gender pay gap improved during 2020.

No. Way.

Sallie Krawcheck, the CEO and Co-Founder of Ellevest

In a year in which one in five women left the workforce—and in which those women who stayed in the workforce lost productivity, and in which men are being promoted at three times the rate of women—I don’t know if Equal Pay Day should really be in April, or June, or October. And even if the date did slide up a week, the pay gap sure didn’t get better, and it most certainly didn’t shrink for Black women, whose unemployment rate is running at 8.4 percent and whose equal pay day is deemed to be sometime in August. Or for Latinx women, whose equal pay day is set in October, while the unemployment rate among Latinx women is more than 9 percent.

Equal Pay Day has historically been a day in which we shower women with advice on how to get ahead—to work harder, to be more ambitious, to be less ambitious, to know their worth, to lean in, to ask for the raise like this, to “you go girl” like that, and to close their confidence gap. So much ink has been spilled on this, and yet we don't seem to be getting anywhere.

That’s because if changing women were the answer, this battle would be over. We’ve spent our entire adult lives conforming to society’s expectations of us. So, if it were *just* an issue of changing the way we work, then there would be no gender money gaps. Instead, women keep trying to walk the tightrope of working harder only to be rewarded less than their male counterparts... while shouldering a disproportionate amount of unpaid labor at home, not to mention, a ragged social safety net.

To add insult to injury, when children or parents get sick and women are forced to step out of the workforce or reduce their hours to care for them, our society tends to frame this action as her “choice.” But is it a choice to stay at home if her company doesn’t provide adequate (or any) parental leave? Or if the parental leave they provide is just for her, but not for her partner (thereby putting her on the so-called “mommy track” while her spouse is at work and viewed as more present—and committed—to his career)?

Get exclusive access to fashion and beauty trends, hot-off-the-press celebrity news, and more.

So, all of that.

But my biggest beef with Equal Pay Day is that it’s focused on the wrong gender money gap.

What's the Gender Wealth Gap?

Please allow me to redirect your attention from the pay gap to the gender wealth gap. Let’s not solely focus on what women earn in comparison to men (which matters), but instead on what women have and keep in comparison to men (which matters even more). You may have heard the sayings “wealth begets wealth” and “inequality begets inequality.” Those forces are at work here, and they’re causing women to lose ground when it comes to growing their overall net worth.

While the gender pay gap has been measured at 82 cents to a white man’s dollar—and was moving, pre-pandemic, in the right direction—the gender wealth gap is 32 cents to a white man’s dollar. That means women’s assets are just 32 percent of what white males have. Black and brown women have just one penny to the dollar of white men. Even before the pandemic, this stat was moving in the wrong direction; it was getting worse.

There are a lot of reasons why the gender wealth gap is so much wider than the gender pay gap. To start, women spend less time in the workforce (because women take more career breaks, which again, isn’t always a true “choice”); women spend more money on their children than men do; and, of course, women pay the pink tax. But that’s not all.

There's an Investing Gap, Too

Women keep the majority of their money in the bank, while men invest the majority of theirs. That means those men have benefited from the stock market’s historical 9.8 percent average annual return, while women have earned close to nothing on the money they have in the bank (and less than nothing after inflation). This might not make much difference over the course of one year, or two years. But year after year after year, as stock market returns compound on themselves, it can cost women a literal fortune. For some women, we could be talking hundreds of thousands (or millions) of dollars over their lifetimes.

And a Debt Gap.

There’s also the “gender debt gap.” Women have more debt outstanding than men do—more credit card debt and more student loan debt—and they pay more for it. Women also pay higher rates on small business and personal loans than men. So women have not only missed out on the positive compounding of investments; they’ve also been walloped by the negative compounding effect of interest rates on debt. They’ve been losing ground in building their nest egg, coming and going.

Now, before we frame this as yet another “choice” made by women in managing their money, remember that the investing industry is male-dominated: 86 percent of all financial advisors are men and 98 percent of mutual fund dollars are managed by men. You don’t have to look far—in fact, no further than the GameStop trading frenzy, or even the massive, snorting, angry bull statue near the New York Stock Exchange—to get the hint that the industry is a touch…masculine. No wonder women have stayed away in droves. (This is why I founded Ellevest, the first investing and financial company built by women, for women.)

That’s … a Lot. What Can We do?

The best we each can by controlling what we can control. Keep asking for that raise or promotion; keep taking that business risk. But if your company’s C-suite doesn’t include many people who look like you? Well, you may want to stack the deck a bit more in your favor the next time you change jobs, if you can. Check to see if the company you’re interviewing with has reported out their gender and racial pay gaps, and then worked to close them. Do they have paid family leave for primary and non-primary caregivers? Do they require forced arbitration agreements for sexual harassment (or, worse, are they still operating as if #MeToo never happened)?

You can also control what you do with the money you do earn—use it strategically, as much as possible, to leverage your greater pay into greater wealth. Pay down your debt in the order that saves the most money (high interest rates first), build yourself an emergency fund, contribute to your 401(k) or IRA, and invest to build wealth. None of that’s as fun to talk about as the time you got your crusty old boss to finally give you a raise. But taking financial steps like that is the number one driver of women’s confidence in their ability to achieve their financial goals.

Getting ourselves into better financial shape doesn’t mean we can’t give other women a boost: Let’s spend and invest our money more intentionally by buying from or investing in women-led businesses. (Ellevest even has a debit card cash back program that identifies women-run businesses and provides cash back rewards for shopping at them.)

So on this Equal Pay Day—in the midst of a She-cession and as money remains women’s number one source of stress—let’s remember that yes, pay matters; but building a nest egg matters even more. And that we can’t change things if we work alone.

Sallie Krawcheck is the CEO and cofounder of Ellevest, a financial company built by women, for women. She is the former CFO of Citi, and the former CEO of Merrill Lynch and of Smith Barney.