Welcome to Couples + Money, where we break through the confines of polite conversation. Forget questions about your sex life. We're getting even more personal. Let's talk about what you and your partner are doing—and not doing—with your paychecks.

Every other Thursday, an anonymous couple will get candid with MarieClaire.com about how they split their finances. We’ll break down what each person pays for individually, what they split, and all the gritty details—from who picks up the bill in restaurants to who picks fights over bank statements.

This week, we're talking with Lucy, 32, a freelance writer and editor in Fort Myers, Florida who earns $50,000 per year ($3,500 per month), and her partner, Jasper, 32, a manufacturing engineer who earns $75,000 per year ($6,200 per month). They've been together three years.

Want to be profiled with your partner in Couples + Money? Get in touch: couples.money@hearst.com.

How It All Happened

Lucy: I was living in New York, and I had alcohol issues. A month after my 30th birthday, I decided to move down to Florida, where I'm from, and move back in with my parents. Try to figure out my next steps. He was one of the first people I started talking to on Bumble, and our first date was a week after I got to Florida.

Jasper: We met on Bumble on a Wednesday morning, and then we had our first date on the Saturday.

Lucy: We said "I love you" after a month, and we moved in together after a month and half. So it was pretty quick, but it was just one of those things where we just knew.

Stay In The Know

Marie Claire email subscribers get intel on fashion and beauty trends, hot-off-the-press celebrity news, and more. Sign up here.

Jasper: Then we realized: "Hey, we're kind of living together, so we might as well make it official."

Lucy: I just had never really connected that much with someone. He was everything I had ever wished for in a partner—he had all of that, plus seven million other amazing qualities that I never thought I wanted or needed. Or even thought about.

Our Dependents

Lucy: Two cats and a border collie.

When We Told Each Other Our Salaries

Jasper: We were lying in bed, talking about stuff, and finances came up. She was comfortable enough at that point to ask how much I made. And I knew her situation because she's—I'm sure you can tell—a lot more talkative than I am.

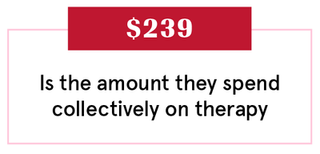

Lucy: About a month after moving in, we more or less combined our finances. At the time, I was just getting my feet after going through my alcohol issues, so at first we decided to split our finances based on how much we made, percentage-wise. But we realized early on that he's really not good at tracking finances. It just gives him a lot of anxiety.

Why We Have A Joint Account

Jasper: It's really just our natural egalitarianism.

Lucy: We really wanted to feel like a team, and it's something we talk a lot about. Being on each other's teams and really putting that kind of effort into our relationship. That includes the tough stuff—like, we both have anxiety, I have other mental health issues—all of that.

Jasper: I guess we're just big proponents of being equal partners in this, and we both feel pretty good about that.

Lucy: A joint account makes it easier for me—since I'm managing all our money—to have access to all of it.

How We Handle The Cost Of Living

Jasper: We came to agree that splitting things down the middle was the most reasonable way to do things. It would just be too complicated to split things by what we make compared to each other. That would just breed inequality, fights, and issues down the road.

Lucy: Ninety percent of our expenses are "together" things, so we just don't see the point in separating everything. All of our spending decisions really are made together. He doesn't love talking about finances super deeply, like the specific numbers, because it stresses him out...but we do talk about all that stuff a lot. It's all "our" money. We don't have savings separate, even.

What We Keep Secret

Lucy: I don't really think we do keep anything secret. I know that when we both got into the relationship, we both had credit card debt. And we've taken care of that together.

Jasper: I don't have any secret gambling problem or anything like that.

Lucy: He tells me his credit score, mostly 'cause he's excited that it's really good. He's checked my credit score, and I'm just like “Oh, cool, whatever. I don't care."

Jasper: I think we've always been pretty honest with each other. We got the skeletons in the closet out early.

How We Learned To Budget

Jasper: We had a reasonable, modest lifestyle growing up—nothing fancy but nothing too poverty-adjacent. As soon as I started getting out on my own, I struggled with money. There were some depression and anxiety issues during college, and that made my credit history a little rocky.

Lucy: My parents were immigrants. They worked very, very hard to never let me feel like I was missing out. I know that we were on food stamps when we first got here, but I never really knew how hard they had to work to provide for me and my brother. Even though we definitely were not in a good place for many years in my early childhood, I really grew up with a sense of security. I never really felt like I wanted much.

Jasper: I didn't ever have a formal budget process until I met Lucy.

Our Biggest Fight About Money

Lucy: I'm definitely much more the "spender" than the "saver" in the relationship. Obviously, that does cause some difficulty and arguments.

Jasper: I'm more inclined to just pay off debt and catch up. I'll sacrifice going out now in order to just feel less anxious about debt and interest rates and all of that. She would prefer to enjoy her life now, and not worry so much about the future.

Lucy: It's definitely a recurring argument. I like to call of it more of...a difficult discussion.

Jasper: That's something we continually struggle with—understanding each other's lifestyle preferences and then adapting to them, or sort of the meeting in the middle.

Lucy: He likes to travel, too but he's like, “But if we don't travel we can pay the stuff off sooner.” I'm like, “But if we don't travel, I might murder somebody, and you're the closest person."

Jasper: Occasionally, one of us will feel anxious about money and we'll have our argument about our spending habits.

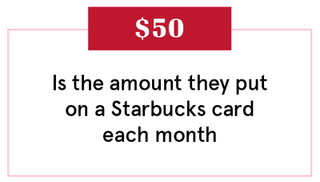

Lucy: A big thing is that I'm an extrovert, but I work from home. So I just need to be around other people. I mean, my pets are adorable, but they're not chatting with me.

How We Pay For The Non-Essentials

Jasper: I think we probably budget maybe three-quarters of what we earn.

Lucy: We're really not great about saving for the fun stuff.

Jasper: Occasionally, they'll be a thing here or there that we just impulsively spend money on. We like couples massages.

What We're Banking On

Lucy: The biggest thing is the baby. We're not pregnant right now, but we are starting to actively try.

Jasper: We also want to get rid of our current, like, ankle-biting, nagging debt.

Lucy: This includes having a real emergency fund, so that I can maybe take some time off post-baby and not have to work through the first few months.

Jasper: I just-test drove a Tesla a couple weekends ago, and now I can't stop thinking about it.

Interviews have been condensed and edited for clarity. Pseudonyms have been used. Reporting by Amanda Mitchell. Design and illustration by Morgan McMullen. Animation by Hayeon Kim, Colin Gara and Danny Ratcliff.

For more stories like this, including celebrity news, beauty and fashion advice, savvy political commentary, and fascinating features, sign up for the Marie Claire newsletter.

RELATED STORIES

-

Olivia Rodrigo Finds the Perfect Spring Dresses at Reformation

Olivia Rodrigo Finds the Perfect Spring Dresses at ReformationShe's worn the brand twice in the past week.

By Julia Marzovilla Published

-

Curiously, Just as Meghan Markle Sends Samples of Her New Strawberry Jam Out, the Buckingham Palace Shop Starts Promoting Its Own Strawberry Jam on Social Media

Curiously, Just as Meghan Markle Sends Samples of Her New Strawberry Jam Out, the Buckingham Palace Shop Starts Promoting Its Own Strawberry Jam on Social MediaThe clip promoting the Buckingham Palace Shop’s product—we cannot make this up—is set to Mozart’s “Dissonance Quartet.”

By Rachel Burchfield Published

-

Zendaya's Latest 'Challengers' Serve Is Nearly a Century Old

Zendaya's Latest 'Challengers' Serve Is Nearly a Century OldThe 1930s-era dress may have been pulled months ago.

By Halie LeSavage Published

-

Where Did All My Work Friends Go?

Where Did All My Work Friends Go?The pandemic has forced our work friendships to evolve. Will they ever be the same?

By Rachel Epstein Published

-

So You Want a Postnup

So You Want a PostnupNo, they’re not planning to divorce, yet more couples are facing the awkwardness of getting their marital finances in order—after they say “I do.”

By Emma Pattee Published

-

The Two Moms Who Took a Year Off to Travel—Then COVID-19 Happened

The Two Moms Who Took a Year Off to Travel—Then COVID-19 HappenedEvery other Thursday, a couple will get candid with Marie Claire about how they split their finances. This week, we're talking to a couple who decided to travel full-time just before COVID-19.

By Marie Claire Published

-

Warning Working Moms: Your Partner Is Your Glass Ceiling

Warning Working Moms: Your Partner Is Your Glass CeilingBestselling author and essayist Caitlin Moran warns in her new book More Than a Woman that a mother’s career is only as good as the man or woman she marries.

By Jo Piazza Published

-

The Unemployed Couple Squatting in Their Brooklyn Apartment

The Unemployed Couple Squatting in Their Brooklyn ApartmentEvery other Thursday, a couple will get candid with Marie Claire about how they split their finances. This week, we're talking to a couple who haven't paid rent on their apartment in months.

By Marie Claire Published

-

The Blogger Couple Who Made $20,000 When the Pandemic Hit

The Blogger Couple Who Made $20,000 When the Pandemic HitEvery month, a couple will get candid with Marie Claire about how they split their finances. This week, we're talking to a couple who lost revenue during the pandemic, but invested wisely.

By Marie Claire Published

-

The Couple Who Used a Health-Share Ministry for a $1,000,000 Surgery

The Couple Who Used a Health-Share Ministry for a $1,000,000 SurgeryThe latest edition of Marie Claire's Couples + Money series.

By Marie Claire Published

-

The $266k Couple Whose Wife Created an App to Track Their Spending

The $266k Couple Whose Wife Created an App to Track Their SpendingThe couple make $266,000 a year.

By Marie Claire Published