A New Couple, A Newer Home, and 2 Paychecks

The latest edition of Marie Claire's 'Couples + Money' series.

Welcome to Couples + Money, where we break through the confines of polite conversation. Forget questions about your sex life. We're getting even more personal. Let's talk about what you and your partner are doing—and not doing—with your paychecks.

Every other Thursday, an anonymous couple will get candid with MarieClaire.com about how they split their finances. We’ll break down what each person pays for individually, what they split, and all the gritty details—from who picks up the bill in restaurants to who picks fights over bank statements.

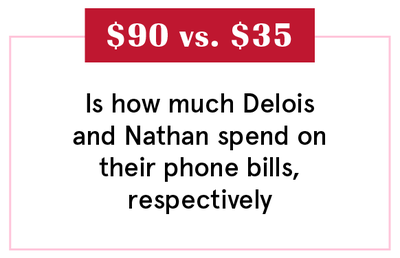

This week, we're talking with Delois, 32, a customer service agent in Michigan who earns $36,000 per year ($3,000 per month) and her partner, Nathan, 32, a financial aid officer at a college who earns $55,000 per year ($4,583 per month). They've been together one year.

Want to be profiled with your partner in Couples + Money? Get in touch: couples.money@hearst.com.

How It All Happened

Delois: We met on Bumble. Honestly, I wasn’t super into him at first. I thought he was rather tiny-looking and I was gonna break him.

Our Dependents

Delois: I have a 9-year-old daughter, and we all live with our cat. My kid is a money pit, because children are money pits. And the older they get, the more money you spend. My child is her own person. And people cost money.

When We Told Each Other Our Salaries

Nathan: We laid the groundwork for that conversation, like, super-early in our chats. We were flirting so hard and Delois said, “Okay, marry me,” because she found out I admire Colin Kaepernick or something. I said, “Okay, we’re married. Now gimme all your money.” She was like, “LOL—I’m broke ¯\_(ツ)_/¯”

Get exclusive access to fashion and beauty trends, hot-off-the-press celebrity news, and more.

Delois: Whew, chile, the first real conversation we had about it was very nerve-wracking for me. Being a black woman with a child and a whole different socioeconomic status and lived experience making and losing money...It was really hard breaking down all the nuances of my then-really traumatic relationship with money.

Nathan: I had been a financial aid counselor for about three years, so I’d had literally hundreds of conversations with individuals and families all across the socioeconomic spectrum about their money situations, money problems—all that.

Delois: I felt vulnerable explaining my financial life with him. Feeling inferior was common because I was working in a restaurant and making money earning tips. While I earned and paid bills and stuff, some of the extra things in life weren’t necessarily super-accessible to me, and I had to kinda explain why that was.

Nathan: I had learned a lot about how to guide people in productive and frank conversations on the topic of their money.

Delois: Also...and this might be misunderstood, but...it was almost embarrassing? For me, in a way, to navigate him through my finances. He’s white and educated with a very good job and he makes a good living doing it. Though he didn’t necessarily come from money or anything, his relationship with it was different than mine.

Nathan: I don’t remember the details of that conversation. I just remember using a lot of the tools I had developed—and Delois appreciated that, I think.

Delois: I was terrified of it becoming something that would ruin our relationship. But once the conversations started happening, honestly, they just got easier and easier. It’s actually one of the things I love about my partner the most. It was important to us to have the best understanding of where we both stood before agreeing to a mortgage together. Now, we talk about it, and everything else, all the time.

Why We Have A Joint Account

Nathan: We just opened a joint checking and savings in August. We opted for a credit union because banks...eww, gross.

Delois: I’m pretty f**king stoked on it. We did it for the house, and personally it’s a huge symbol of commitment and trust for me.

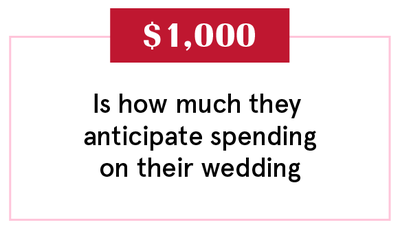

Nathan: There’s, like, $1,000 in our account right now. The idea is that we’ll both chip in a fixed amount to pay for the cost of housing, including home furnishings and improvement.

How We Handle The Cost Of Living

Nathan: Honestly, at some level, this whole thing works because we both want it to—and because the mutual benefits we get from our relationship dwarf whatever our combined annual income is. Right now, I make more money than Delois, so I spend more money on our family than Delois.

Delois: For now, he pays more because he makes more. I pay what I can. We both buy groceries. We both put in for bills.

Nathan: We try to balance our savings so that she—as a mother and a Black femme—isn’t locked into our relationship by financial dependence.

Delois: We both contribute. We just do what we can.

Nathan: But as long as there is a pay disparity between us, there is going to have to be a spending disparity for the sake of an equitable outcome. And that’s okay, as long as we continue to build that trust, pursue that integrity, and practice that good communication.

What We Keep Secret

Delois: Truthfully, I don’t keep anything from my partner, and I don’t believe they keep anything from me.

Nathan: Buying a house together means you’re in each other’s business.

Delois: We both look at each other’s credit scores all the time.

Nathan: My financial life is a little more complex than Delois’. She has a savings account, a checking account, a secure credit card, and a 401(k). I have a checking, two savings, two 403(b) plans, two life insurance policies...Jesus.

Delois: One of the sexiest things about our relationship is the fact that we talk about everything. I was always taught to like, be really private about some things, especially money. It’s incredible to be with a person who knows me and loves me and accepts me for who I am completely. Finances and all. His support and never-ending encouragement got me to a place where I was able to buy a home. Like, Big Stuff.

How We Learned To Budget

Nathan: Geez. As a kid, my grandma sent me Money magazine before I even understood what the f*** a paragraph was. My mom set up a full-term life insurance policy that matured and increased itself on an annual dividend.

Delois: I am still in awe that I was able to purchase a house at this time in my life.

Nathan: My parents had an estate plan and that life insurance popping.

Delois: Growing up as a black child in a single-parent home, money was always tight. Additionally, money was used as a manipulation and power tool within my family unit, so I grew to have a visceral dislike for conversations surrounding it or topics broaching it. While I developed a tenacious work ethic, I grew to know nothing about managing my money.

Nathan: As a kid, I got the impression my family were living check-to-check, and had to be diligent and clever. So I definitely grew up in a WASP nest.

Delois: I learned and am still learning about budgeting. My black woman-ness in the United States of America, my black motherhood, my socio-economic status, are all HUGE factors in how much access I have to earning money. Period. I had to unlearn that my self-worth and...I had to unlearn that while money controls so much of the world around me and is necessary and evil and delightful and all the things....it doesn’t have to control me.

Our Biggest Fight About Money

Nathan: We’ve had several deep discussions about money which include a fight. But those fights sort of morph into hearings—grievances aired, context disclosed, perspectives explained and vetted—all that.

Delois: So, full disclosure, the one I can recall in most recent memory was about how much I was spending for booze and weed. It was a one-off thing that happened towards the beginning-ish of our relationship. I’m glad it happened because it really helped us learn each so much about others’ lives and helped to shape our boundaries together.

Nathan: One of our first fights was her asking me how she could save money. I guessed she was spending $500 a month on wine and weed. I told her dropping those costs could help. That was a great discussion.

Delois: I kept lamenting to him about how I was having trouble making ends meet and it’d be nice to actually save some money and whatnot. He flat-out looks at me and says, “You could save $500 a month if you just stopped smoking and drinking.” WHEW, CHILD. I LOST IT. BECAUSE DON’T TELL ME WHAT TO DO WITH MY MONEY AND YOU AIN’T LIVED MY LIFE AND WEED IS MY MEDICINE and so on and so forth.

This blowout led to what’s now this beautiful road we travel together to learn each other. And it led to me un-learning so many things to move forward. It led to him un-learning things he’s learned through his privilege and access.

Nathan: Recently, we fought about when to start making deposits in our new, joint account. Delois needed to hear from me that she could both put money in and take money out as she saw fit—that there would be trust, trust, trust, and no judgment in that area of our shared life.

How We Pay For The Non-Essentials

Nathan: We don’t insist on splitting each bill in half.

Delois: We honestly trade off whenever we can.

Nathan: Sometimes she pays for things, sometimes I do.

Delois: Keeping this thing going seems totally and completely doable and possible, and I know we’re gonna do so good at it cause we’re a hell of a team.

Nathan: We’ve been so focused on making this move that we’ve been blindly chipping into long-term future plans. And we just accomplished a medium plan in getting this house, and a short-term plan in supporting this family.

What We're Banking On

Delois: Next plans? I see small things for a bit. Little family trips here. Little savings there. Maybe another kid. Maybe we’ll get married or whatever. Who knows?

Nathan: It’s just a question of which order. I think we both value travel and education–all sorts–very highly. The wedding will be freaky as hell but probably not exceptionally lavish nor expensive. So hopefully we can just roll out those commas.

Delois: I do know that with my partner by my side and walking through this life with me, whatever we have ahead of us we can accomplish. We really make an incredible team and with him life seems more possible in ways I could only imagine it being. It’s really f***ing sappy but it’s really f***ing true.

Nathan: We’ve established one the best rapports I’ve had with anyone in my life. I think we’ll be able to work out whatever.

Interviews have been condensed and edited for clarity. Pseudonyms have been used. Reporting by Amanda Mitchell. Design and illustration by Morgan McMullen. Animation by Hayeon Kim and Colin Gara.

For more stories like this, including celebrity news, beauty and fashion advice, savvy political commentary, and fascinating features, sign up for the Marie Claire newsletter.

RELATED STORIES

Dedicated to women of power, purpose, and style, Marie Claire is committed to celebrating the richness and scope of women's lives. Reaching millions of women every month, Marie Claire is an internationally recognized destination for celebrity news, fashion trends, beauty recommendations, and renowned investigative packages.