Culture

Marie Claire’s pop culture obsessives offer their insight into the movies and TV shows you need to see, the books worth adding to your TBR stack, and catch up with the rising talent who should be on your radar.

-

'Single's Inferno' Season 5 Isn't Over Yet. Here's What to Know About the Super-Sized Reunion

Expect all of your lingering questions—including which couples are still together—to be answered.

By Quinci LeGardye Published

-

If You Miss the Russells, Fear Not: 'The Gilded Age' Will Return in 2026

Here's what we know about the next installment of the hit period drama.

By Quinci LeGardye Last updated

-

'Bridgerton' Season 4 Returns for Part 2 Soon. Here's What to Know Before the Social Season Resumes

Dearest readers, Sophie and Benedict's swoon-worthy romance will continue.

By Quinci LeGardye Last updated

-

11 Books About Forbidden Love to Read If You're Spending Valentine's Day Yearning

In these classics and contemporary, complex romances, the heart wants what the heart wants.

By Liz Doupnik Published

-

Why Vic and Christine Are the Most Likely 'Love Is Blind' Couple to Get Married—Even If They Didn't Go to Cabo

The professor and the language pathologist's journey is set to continue back in Ohio.

By Quinci LeGardye Published

-

Are 'Single's Inferno' Sweethearts Kim Jae-jin and Lee Joo-young Still Together? Fans Sure Think So

The modern dancer and the ceramic artist were couple goals on the Netflix dating hit.

By Kayti Burt Published

-

Your Guide to the 'Love Is Blind' Season 10 Cast—From How to Follow the Ohio Singles to Who Got Engaged

This installment of the Netflix hit features former professional athletes, several doctors, a single mom, and more.

By Quinci LeGardye Published

-

Calling All Hockey Romance Fans: Here's Everything We Know About the 'Off Campus' TV Series

Elle Kennedy's beloved book series is receiving the Prime Video treatment.

By Quinci LeGardye Last updated

-

How to Tell If You're Actually Passionate About Something, According to Tibi Founder Amy Smilovic

The fashion entrepreneur chats with editor-in-chief Nikki Ogunnaike on "Nice Talk".

By Lia Beck Published

-

Did 'Single's Inferno' Stars Park Hee-sun and Lim Su-been Follow Through With Their Plans to Keep Dating?

Fans are convinced they could be the Netflix reality hit's longest-lasting couple.

By Quinci LeGardye Published

-

Will Bri and Connor From 'Love Is Blind' Season 10 Be Able to Make It Work—Despite Her Curiosity About Former Flames?

The couple had a strong connection in the pods, but it's unclear if it can last IRL.

By Megan Wahn Published

-

Will 'Love Is Blind' Season 10 Stars Amber and Jordan Make It to the Altar, Despite Their Major Hurdle?

The account executive never expected to find such a strong connection with a single mom.

By Radhika Menon Published

-

'Love Is Blind' Season 10 Star Emma Constantly Braces Herself for Heartbreak, But Could Mike Be the One?

After making it out of a love triangle in the pods, it's been so far so good for the pair...

By Megan Wahn Published

-

All About the 'Single's Inferno' Season 5 Cast—From Their Ages and Careers to Their Pre-Show Fame

Pro athletes, pageant queens, models, and more are looking for love on this installment of the Netflix reality hit.

By Quinci LeGardye Last updated

-

Did Kim Go-eun's Love Triangle With Woo Sung-min and Jo I-geon Continue After 'Single's Inferno' Ended?

Here's what we know about the Netflix reality stars's relationship now.

By Kayti Burt Published

-

Love Is in the Air This Spring as Netflix Sets an April 'XO, Kitty' Season 3 Premiere Date

Kitty and Min Ho's will-they-won't-they isn't over yet.

By Quinci LeGardye Last updated

-

Why 'Single's Inferno' Fans Think Mina Sue Choi and Samuel Lee May Still Be an Item

The couple made it out of the friend zone on season 5—but are they still together?

By Quinci LeGardye Published

-

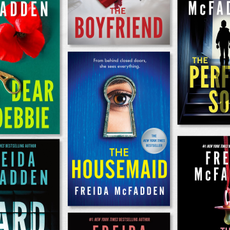

Attention All McFans: We Ranked the 15 Best Thrillers by Freida McFadden

If you were obsessed with the book-to-movie adaptation of 'The Housemaid,' read these next.

By Nicole Briese Last updated

-

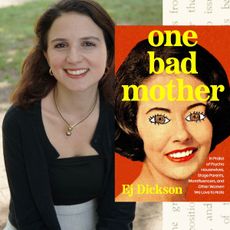

I Grew Up With a Stage Mom. I Can’t Help But Love Them

In an excerpt from her book 'One Bad Mother,' Ej Dickson explores our love-hate relationship with notorious momagers.

By Ej Dickson Published

-

The 'Red, White & Royal Blue' Sequel Is Currently Filming—Prepare for a 'Red, White & Royal Wedding'

We can't wait to see the next chapter in Alex and Henry's love story!

By Quinci LeGardye Last updated

-

12 Upcoming Dramas Every Cinephile Is Going to Want to See This Year

Directors like Greta Gerwig, Christopher Nolan, and Steven Spielberg all have movies coming out in 2026.

By Quinci LeGardye Published

-

Get Ready to Return to Your Favorite Small-Town: 'Virgin River' Season 7 Premieres This Spring

Jack and Mel may have tied the knot, but there's still more melodrama to come from the Netflix hit.

By Radhika Menon Last updated

-

Buzz Buzz! 'Yellowjackets' Season 4 Is Officially Happening

Here's what to know about the showrunners's plans to get the girls out of the wilderness.

By Quinci LeGardye Last updated

-

Why All Eyes Are on 'Single's Inferno' Star Kim Go-eun Heading Into the Finale

The former pageant queen (with a wild dating history) has become season 5's sleeper star.

By Quinci LeGardye Published

-

'The Lincoln Lawyer' Season 5 Is Confirmed, and We Already Know What Book It's Adapting

Here's everything to know about Mickey Haller's next case—and where the Netflix drama could go after that cliffhanger.

By Jessica Derschowitz Published

-

'The Lincoln Lawyer' Is Back Season 4—Get to Know the New Cast Members and Returning Stars

The legal drama led by Manuel Garcia-Rulfo is one of Netflix’s most popular shows.

By Quinci LeGardye Last updated