Three Kids and a Health Crisis on One Paycheck

The latest edition of MarieClaire.com's 'Couples + Money' series.

Welcome to Couples + Money, where we break through the confines of polite conversation. Forget questions about your sex life. We're getting even more personal. Let's talk about what you and your partner are doing—and not doing—with your paychecks.

Every other Thursday, an anonymous couple will get candid with MarieClaire.com about how they split their finances. We’ll break down what each person pays for individually, what they split, and all the gritty details—from who picks up the bill in restaurants to who picks fights over bank statements.

This week, we're talking with Rosie, 27, a homemaker in Great Mills, Maryland, and her husband Sam, 28, a dentist with the military who earns $96,000 per year ($8,010 per month). They've been together nine years.

Want to be profiled with your partner in Couples + Money? Get in touch: couples.money@hearst.com.

How It All Happened

Rosie: We met right after my graduation from high school. The summer of 2009. We both worked at a Bible conference in Harvey Cedars, New Jersey.

Sam: The next two years, we dated long-distance before getting married and moving in together.

Our Dependents

Sam: Three crazy children. And two cats.

Get exclusive access to fashion and beauty trends, hot-off-the-press celebrity news, and more.

Rosie: We also have four friends we are supporting right now. Three of them are in full-time...ministries, I guess you would call it? They are doing work in their community, and they feed people and get to know people, and that’s just kind of what they do.

When We Told Each Other Our Salaries

Rosie: I think we might have lived off wedding gifts (worth about $3,000) for like, six months.

Sam: When we first met, we were so young that neither of us had ever worked full-time. But we knew I was on track toward a lucrative career, and that when I was done with school it would start paying off. But we were half wrong.

Rosie: The first conversation was probably, like, “Oh, shoot, we’re running out of money from our wedding gifts and what are we going to do? Because I haven’t been able to find a job.”

Why We Have a Joint Account

Rosie: Our checking account is a joint account. The balance is low right now—only $700.

Sam: All of our accounts are joint.

Rosie: I think it was easier.

Sam: If something ever happened to me, my wife would need easy access to our money.

Rosie: He's the one who has the money in his name—it just makes it easier, logistically. I wouldn’t have anything in my bank account.

Sam: We don’t conceptualize our money as “mine” and “yours." We both came together as broke teenagers with little to no assets, and for the past eight years we have lived on a single income.

How We Handle The Cost Of Living

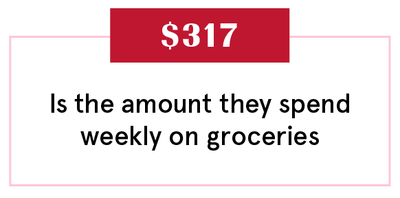

Sam: My income as a military dentist is currently well below the income of most dentists (the average dentist's income is $154,000). And raising three children is far more expensive than I had ever realized.

Rosie: We’ve been in different phases of how we’ve had to deal with money. In dental school, Sam was given a scholarship through the military. So we had a monthly stipend of $2,100 a month. He was being paid to go to school, but the income was only meant for a single male. It wasn’t meant to support a family.

Sam: In our first or second year of marriage, we were so broke we realized that we needed to learn how to budget ASAP. An older friend sat down with us and showed us her family’s system of budgeting.

Rosie: I don’t have a degree. So I would be working retail, or working in the food industry, and that would cover the cost of one child…maybe two, in school or a daycare. So it didn’t make sense for me to go to work, because it would be more expensive for me to go to work. Then, as more health problems have arisen—I have a connective tissue disorder—it’s been more of an issue.

How Often We Talk About Money

Sam: We don’t talk about money a ton, but when we do, it’s painful. Because it requires me to face the truth that I’m very undisciplined with our money.

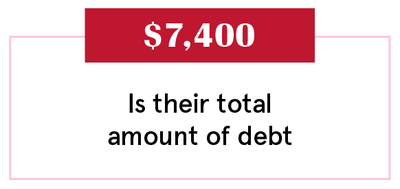

Rosie: We’re getting to this point of realizing, “Okay, we have really gotten into some really unhealthy habits with money. And a lot of my medical bills have been put on the credit card." My medical expenses are anywhere from $600-$2,000 per appointment—we find out when we get there how much it will be. There’s no notice ahead of time, and all of it is paid upfront. Right now, all of our credit card debt is medical. So I think that’s around $15,000 out-of-pocket in medical expenses in the last two-ish years, and probably more when you add in food, gas and hotel costs. Almost all of my appointments are two hours away. Some insurance companies reimburse for travel, but ours does not.

Sam: We sit down and talk about money in-depth once or twice a year, but that fluctuates. We have often said we want to sit down monthly to talk about budgeting, but it rarely happens.

What We Keep Secret

Rosie: I don’t think we really keep much from each other. We didn’t have enough money to do anything extra before, and because we didn’t have credit cards, we really got in the habit of asking each other, kind of, for permission.

Sam: I’m still waiting for the right moment to talk about just how much money we have lost from my bad stock market investments (about $1,000).

Rosie: I know he sometimes likes spending money, going out to lunch or something at work, instead of bringing lunch with him. That seems really, like...He didn’t plan to have a break, or everybody at work is going out together. He doesn’t tell me every single time.

Sam: I guess I haven’t talked about it yet because it’s embarrassing. I’m open about everything else, but this is a big one I’ve been avoiding for about six months. The irony is that the whole point of getting involved in investing was to get us from a bad financial spot to a better one, but all I did was take us from bad to worse.

How We Learned To Budget

Rosie: I started working at 14. Once I started working, I was the one who was buying my own school supplies and my own clothes. So, kind of out of necessity, I learned, in a sense, how to budget.

Sam: My bills and expenses were always quite low until my wife and I started thinking about our future marriage and starting a family. I would occasionally hear people recommend methods of budgeting and, at least in my memory, it always had a cheesy, conservative Christian spin on it. Maybe that’s partially why in years since, I shy away from discipline in my budgeting.

Our Biggest Fight About Money

Rosie: I don’t think we’ve ever really had a fight about money. We don’t really fight.

Sam: Maybe it’s just our personalities, but we have never had any fights about money. Or anything, for that matter.

How We Pay For The Non-Essentials

Sam: We ask if the other person is okay with it before making any non-essential purchase.

Rosie: We haven’t really gone on vacation, except for when our parents plan it. So then it’s just us paying for gas to get there, about $70 round-trip. His parents own a cabin up by a lake in the mountains, and that’s probably where we "vacation" the most often. And that’s just adding extra money to the gas budget.

What We're Banking On

Rosie: My hope is to eventually get registered as a doula. And then do that for a couple of years, and then go onto midwifery school. But I don’t know if that will happen.

Sam: I’m looking forward to taking a better-paying job after my obligated time with the military is over. In a few years I can switch jobs and possibly double my income (to roughly $180,000-$220,000).

Rosie: There are a couple of other things we would like to get done to our house before we can rent it or if we decide to sell it. We’ll need new floors, countertops, and bathroom upgrades, which will cost around $10,000.

Sam: We would also like to get to the point where we both can bring in some income, but, unfortunately, that’s not currently an option.

Rosie: I think that we need to talk more about what our long-term goals are. But it’s times like now that...You don’t really know anything that’s going to be happening.

Sam: We need to get an emergency savings fund going, then possibly college funds for the kids. $25,000 would be a good start...but we aren’t at a point where we can even make a dent in that.

Rosie: We might kind of be stuck in the military because of health issues and the GOP trying to dismantle the Affordable Care Act. I might not be able to get health insurance. And now, two of my other kids might likely have that same disability. For health care reasons, we might be stuck.

Interviews have been condensed and edited for clarity. Pseudonyms have been used. Reporting by Amanda Mitchell. Design and illustration by Morgan McMullen. Animation by Hayeon Kim and Colin Gara.

For more stories like this, including celebrity news, beauty and fashion advice, savvy political commentary, and fascinating features, sign up for the Marie Claire newsletter.

RELATED STORIES

Amanda Mitchell is a writer and podcaster with bylines at Marie Claire, OprahMag, Allure, Byrdie, Stylecaster, Bon Appetit, and more. Her work exists at the apex of beauty, pop culture, and absurdity. A human Funfetti cake, she watches too much television, and her favorite season is awards season. You can read more of her work at amandaelizabethmitchell.com or follow her on Instagram and Twitter @lochnessmanda.