The $48,000 Couple Working Abroad to Afford a Better Quality of Life

Every other Thursday, an anonymous couple will get candid with MarieClaire.com about how they split their finances. This week, we're talking to a couple who moved abroad and joined finances four months into dating.

Welcome to Couples + Money, where we break through the confines of polite conversation. Forget questions about your sex life. We're getting even more personal. Let's talk about what you and your partner are doing—and not doing—with your paychecks.

Every other Thursday, a couple will get candid with MarieClaire.com about how they split their finances. We’ll break down what each person pays for individually, what they split, and all the gritty details—from who picks up the bill in restaurants to who picks fights over bank statements.

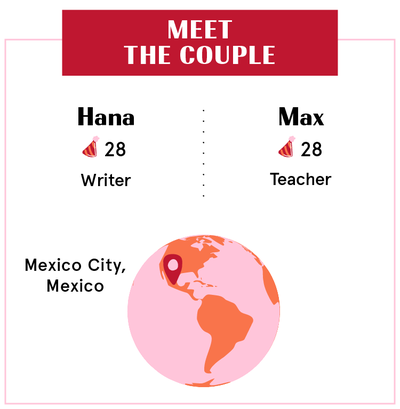

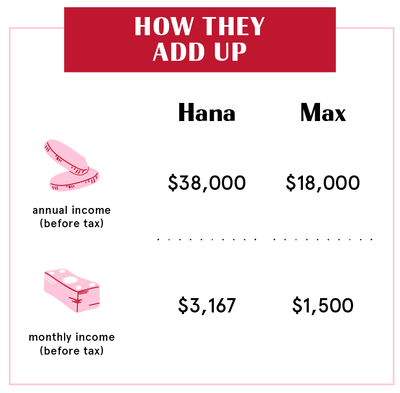

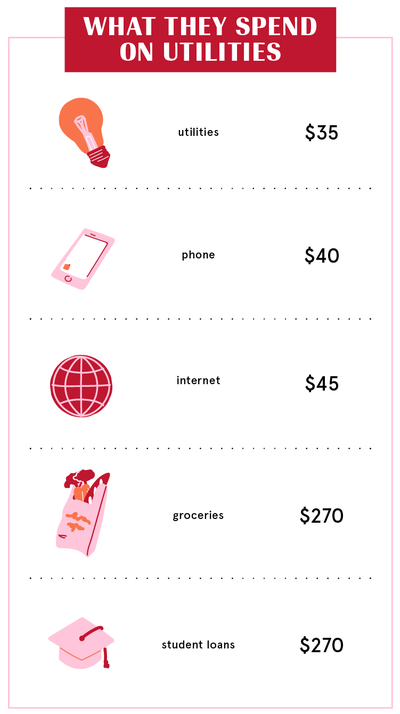

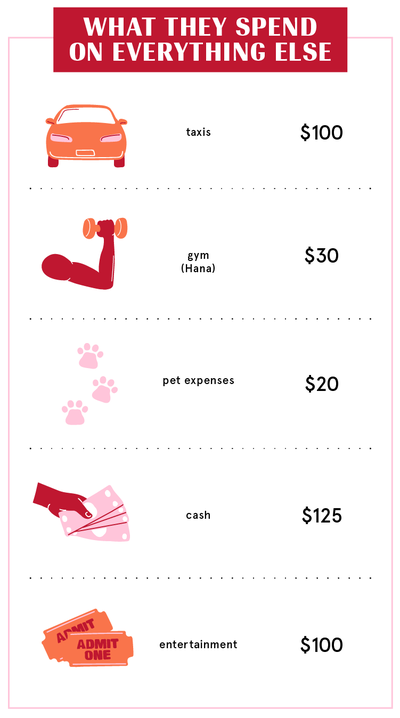

This week, we're talking with Hana LaRock, 28, a writer, who earns $38,000 per year ($3,166.67 per month), and her fiancé, Max Cordova, 28, a teacher, who earns $18,000 per year ($1,500 per month). They've been together six and a half years and live in Mexico City, Mexico.

Want to be profiled with your partner in Couples + Money? Get in touch: couples.money@hearst.com.

How It All Happened

Hana: We first met freshman year. We kept bumping into each other until two or three months before graduation, then we started dating. We moved in together four months after that, because we moved to South Korea to teach English.

Max: I never really lived with anyone ever before. Moving to a new country with someone you kind of just met was interesting. But it felt like the right decision.

Hana: It's so crazy, the things that kids with debt have to go through when they get out of school. That's really why we lived abroad. We both didn’t want to live a life where we were working nine to five, miserable, and still not have anything to show for it.

Get exclusive access to fashion and beauty trends, hot-off-the-press celebrity news, and more.

Our Dependents

Max: We have a dog that we adopted in Mexico. It's been a struggle with him lately as he's gotten older. Luckily having a dog in Mexico is super affordable.

When We Told Each Other Our Salaries

Hana: We applied to jobs together so we knew right away. Things started to get complicated because we sent money home every month for loans. It became easier to just do it together to avoid the fees.

Max: At first we didn't start off on the right page in terms of finances, and it's so important. For the most part I think we agree on the right course of action but also living life a little.

How We Handle the Cost of Living

Max: Usually Hana makes more than I do. So we usually combine everything into one account.

Hana: Both of us are hired as an LLC. We don’t live in the U.S. so we don’t pay income tax.

Max: This year will actually be the last year I pay social security too.

Hana: I handle sending money from the U.S to our Mexican account. He handles cash for paying bills in Mexico.

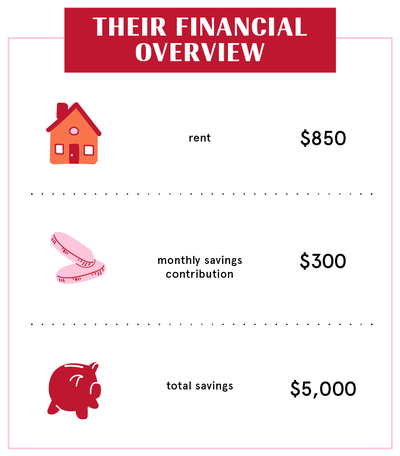

Max: Between two people, we spend maybe max $1,200.

Hana: Everything is so cheap that it's never an issue. If I go out to lunch, it's $3.

Why We Have Joint Accounts

Hana: When we moved to Korea, Max’s loan was $800 a month. He couldn't afford it by himself, and I wanted to travel. I knew that I’d have to help him pay them off. And he'd helped me too. We paid off two of our private loans. That's how it started, this completely joint situation.

Max: I think we should have some sort of separate savings account, because Hana makes more than I do. But we've been together for so long, it works for us.

Hana: Last time we went home, we checked about separate accounts because I'm not trying to be controlling. But he needed to hold a certain balance so he said, "Nah."

Max: We also have different PayPals because we get paid by different people. So in a sense we do have our own bank accounts.

How Often We Talk About Money

Max: Once a week, we check the account and see how we’re doing.

Hana: Almost every day. But not a fight—what we want to do, what's feasible. If I'm having a slow work week, I'll probably be complaining about it.

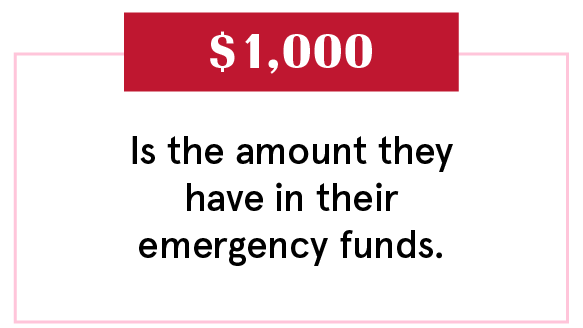

Max: We come from two different philosophies. I was taught to pay all your debts and then save. But she came from a philosophy of have a cushion, pay off some debt. So, over time we took the good parts from both of our philosophies to have a cohesive financial plan we can agree upon.

What We Keep Secret

Hana: Max's parents own property in the U.S. and Ecuador. When they talk about family, in their culture, it's more relatives instead of spouses. I know everything about the properties, but I'm not there for detailed conversations. It's not because I can't be: "Talk about what you need to and let me know." That was a little hard to get used to. I was raised with the idea that spouses share everything, and I don't share anything with my family. But he's good about keeping me in the loop. I just want to know if it's going to affect our finances. He might want to buy a property with his family. So when he says "we" I'm like, "Can you clarify what that means? Are you going to invest your knowledge or do we need to sit down?”

Max: As we're getting married, I'm going to have to involve her more. None of my cousins are married; I'm the only one dealing with this. How do I involve her when it's always been the system? Her say is going to grow over time, obviously. We're both American, so it's not under the Ecuadorian system.

How We Learned To Budget

Hana: My family and I were evicted when I was 13—it was a very traumatic experience. I think they may have known it was going to happen but they didn't tell my brother and me. I came home from school one day and everything from inside my house was on the front lawn. I realized, Shit, we really don't have money.

Max: I'm first generation. It's a very different mentality to be an immigrant. You work your butt off and save everything. You buy a house, and then another one. A lot of budgeting comes from my grandparents. My grandma would always say make five, spend three, save two.

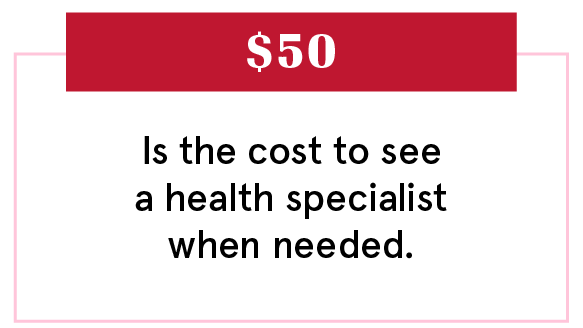

Hana: When I was young I was still under my mom's medical insurance. Bills that my parents were supposed to take care of because I was a minor weren't. When I turned 18, that went to me, and I had no idea. My credit was shot. Once I became an adult and started doing things on my own, I made that a priority. My grandfather also helped pay off some lingering debt.

Max: My family did pretty well for themselves. I try to replicate that as best I can, but Hana came from the opposite situation. Savings-wise I'm a little more intense—we've got to save 100 percent.

Hana: If I asked for something, my mom didn't really deny me. I'm not blaming them. But my parents were horrible with money. They know it, I can say it out loud. I don't want to be like that. I was never taught about budgeting. Pretty much everything I know about managing money is through Max. Not that he taught me, necessarily, but we did it together.

Our Biggest Fight About Money

Hana: He had more in private loans than I did. His mom gave him a cash loan, and 18 months for him to pay it off. But then his mom needed money, so she said, "Max, you need to pay this off in two months.” I was really mad. Not that she held it over him, but it's not on your terms. He was scrambling and said if we didn't travel, it wouldn't have been an issue. And I said, "That's not fair. I work hard. How was I supposed to predict this?" We have this joke—if we ever break up he owes me ten grand.

Max: A one-off was managing loans in the beginning. A recurring thing every couple months is the amount we could be saving.

How We Pay For The Non-Essentials

Hana: The only time we discuss budget is if he or I want to buy something or go on a trip. It used to be—go someplace, worry about details later. But because Max wants to invest in real estate, we're looking at how much everything's going to cost.

Max: We just book it and deal with it later, because we know how to find really good travel flights. At home, we’re homebodies. We go out maybe once a month.

What We're Banking On

Hana: We’re eloping in December. We even talked about signing a prenuptial agreement. We don't think we're going to get divorced, but I've seen people get so blinded by love that they don't think about what could happen. And we're like—we already know who's going to owe what. If we need to put it down on paper, we'll put it down on paper.

Max: We have a travel business called Strait Up Travel. We have over five years of experience traveling. People always ask us, "How do you get an apartment abroad? How do you deal with money, currency exchanges, and other things people don’t know how to do?" We're helping people through one-on-one guidance to transition to a digital nomad lifestyle. Or live abroad and frugally so they can pay bills back home and be financially flexible.

Hana: We want to move next year to Spain, maybe, so we're trying to think strategically. We'd booked a flight this coming January because it was cheap. Why not? But then Max says, "Let's talk about this." I think he wants to talk about it too much sometimes.

Max: Eventually I'd like to use real estate as a vehicle to help us not work as much.

Hana: Because of my history with losing my house, it took me a while to see what he was getting at. But he’s very knowledgeable. He's been looking at auctions and other ways to get a house for cheap.

Max: Let our money work for us, not the other way around.

Interviews have been condensed and edited for clarity. Reporting and editing by Katherine J. Igoe. Design and illustration by Morgan McMullen. Animation by Hayeon Kim.

For more stories like this, including celebrity news, beauty and fashion advice, savvy political commentary, and fascinating features, sign up for the Marie Claire newsletter.

RELATED STORIES

Dedicated to women of power, purpose, and style, Marie Claire is committed to celebrating the richness and scope of women's lives. Reaching millions of women every month, Marie Claire is an internationally recognized destination for celebrity news, fashion trends, beauty recommendations, and renowned investigative packages.