The $390,000 Couple With a Trust Fund

Every other Thursday, an anonymous couple will get candid with MarieClaire.com about how they split their finances. This week, we're talking to a couple with two good jobs, a trust fund, and polar opposite views on money.

Welcome to Couples + Money, where we break through the confines of polite conversation. Forget questions about your sex life. We're getting even more personal. Let's talk about what you and your partner are doing—and not doing—with your paychecks.

Every other Thursday, an anonymous couple will get candid with MarieClaire.com about how they split their finances. We’ll break down what each person pays for individually, what they split, and all the gritty details—from who picks up the bill in restaurants to who picks fights over bank statements.

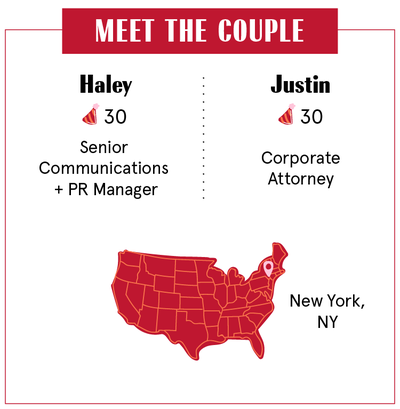

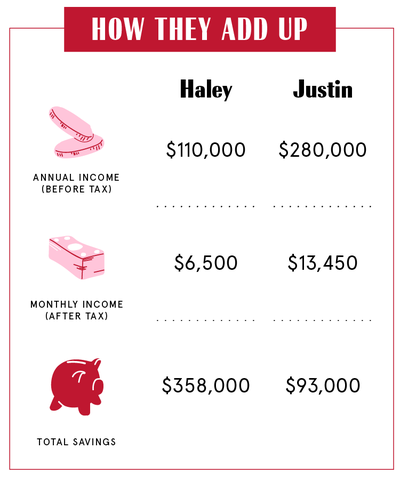

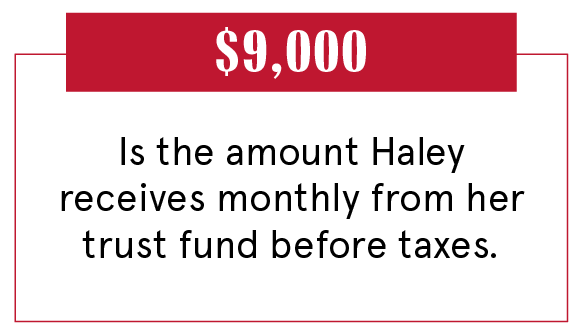

This week, we're talking with Haley, 30, a senior communications and PR manager, who earns $110,000 per year ($9,166.67 per month), and her boyfriend, Justin, 30, a corporate attorney, who earns $280,000 per year ($23,333.34 per month). They've been together over six years and live in New York, New York.

Want to be profiled with your partner in Couples + Money? Get in touch: couples.money@hearst.com.

How It All Happened

Justin: I met Haley at a July 4th party in the Hamptons thrown by one of my best friends.

Haley: I'd lost my phone—I was 24—and said, "You can have my email address."

Justin: We were supposed to go on a date that weekend, but she ended up standing me up, so I wrote her off.

Get exclusive access to fashion and beauty trends, hot-off-the-press celebrity news, and more.

Haley: I'd been seeing someone, ish. Then a few months later it was my first Thanksgiving by myself and I was lonely. I thought, I'm going to email that cute guy. He was with his family and really bored. He said, "I almost didn't respond to you." Boredom and loneliness brought us together!

Justin: And then we did go out, and the rest is history.

Our Dependents

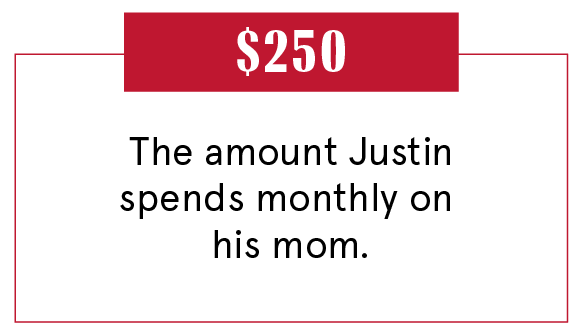

Justin: We've talked about getting a dog in the next year or two. I also give money to my mom. Currently it's $2,400 a year, plus some additional money here and there. She's from El Salvador, so I'm probably going to buy her a plane ticket—she hasn't been back since she left. And I'll give her additional money for emergencies and whatnot while she's there.

Haley: Justin teaches me to check my privilege. The world I grew up in is: Your parents give you money forever. The world he grew up is: At a certain point you start supporting your family. Then when he's caring about money too much I'll say, "Believe me, money doesn't make you happy. If you think that, you're going to be unpleasantly surprised."

When We Told Each Other Our Salaries

Haley: After the first dates we started splitting everything. It wasn't a big conversation—I knew he was in law school and really broke. One time I said, "Do you want to go to dinner?" He responded, "Do you want to come over and I'll make pasta?" Our first dating year was very much like that.

Justin: All the big New York law firms pay on the same salary scale. First year associates make X. Fifth year associates make Y. I'm pretty sure I knew her salary from the get-go, too.

Haley: I had a trust but it wasn't as big, then we sold the family business so it was a dramatic few months. We were dating at the time, and I told him everything that was going on.

How We Handle the Cost of Living

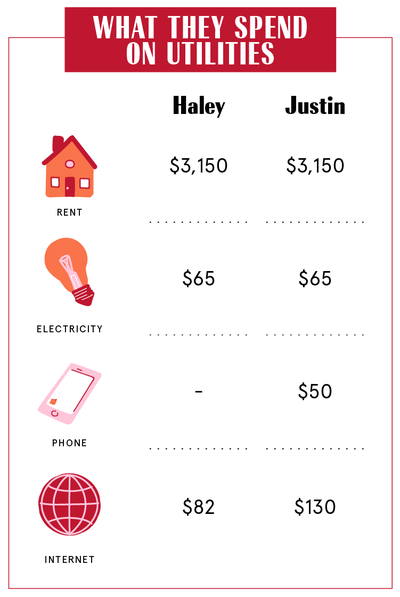

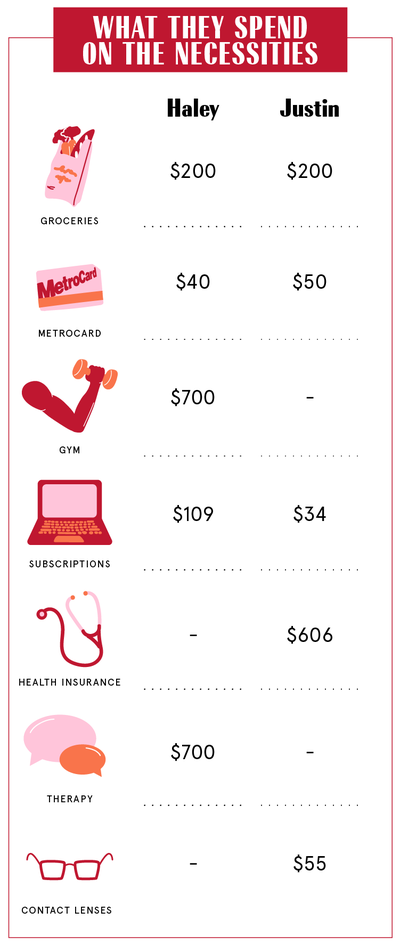

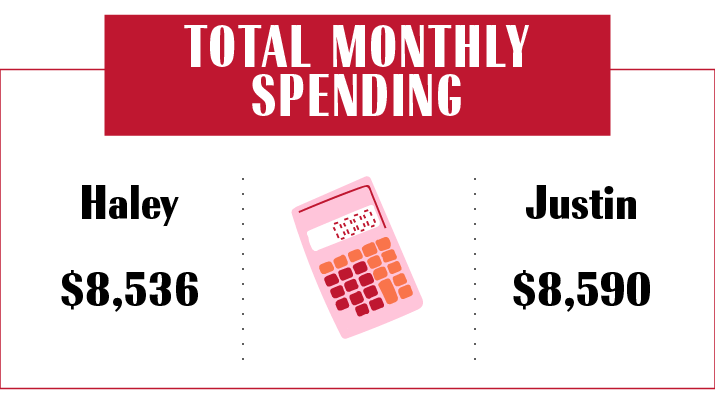

Haley: All the fixed costs like rent, utilities are split. I buy most of the groceries, Justin pays for the takeout, dry cleaning. A few years ago there were small things we stopped caring about and said, "It'll all come out in the wash." If I didn't have the trust money I'd maybe expect him to pay more rent. We have such a funny dynamic because he doesn't come from money and makes a lot, and I don't make a lot but have family money. We're polar opposites.

Justin: Actually this whole process has made me realize we hadn't settled up in a while. She wrote me a check yesterday, but it'd literally been five months.

Why We Don't Have Joint Accounts

Haley: If we have kids, that's when we'd go joint. I like being independent and value the fact that I have my money and Justin has his too.

How Often We Talk About Money

Justin: It's sort of ad hoc. I usually have a spreadsheet that says I paid for flights for this, or hotels for that. Once or twice a year, I'll say, "We should settle up for these things." She doesn't even ask to see the spreadsheet.

What We Keep Secret

Justin: Sometimes I'm more reticent than she is, so I might not talk about something because I don't readily offer up information. But if she asked me a question, I'd have no problem telling her.

How We Learned To Budget

Haley: I didn't. My parents are divorced; My mom grew up in South Georgia with a father who built the family business, and she never learned how to budget. She was kind of the queen of a small town in the South. She got more access to the family money when I was 10 and started a nonprofit when I was in high school, but it concerned me because she was always irresponsible with money. It was like, "If we have money, spend it. If we don't, don't." When I went to college in 2010, we lost a lot of money in the crash. I started thinking, "Money's not just guaranteed." We've had a lot of ebbs and flows. It gave me the perspective that money is great to have, but I should be able to live with it and without it.

Justin: I didn't come from a lot. My parents are divorced. My dad was still in the picture and paid child support. My mom's an immigrant and didn't have a lot. My dad comes from a family that has money, but he personally doesn't. If there was something big I needed, my grandma would get it. But I never had a car, and I didn't wear nice clothes in high school. All the little things I do are self-taught. I wish they'd taught personal finance in high school.

Haley: When my family was selling the business, my uncle tried to push my mom and aunt out. He was negligent with the business, so it caused a rift with me and my cousins. It's complicated because obviously I'm happy to have money—who isn't—but it has negative connotations sometimes. I think, I didn't really work for this money, and so I feel this privilege for having it in the first place.

Justin: When I hit 25, and finally had a good job, I was like, "Oh shit. I have to actually learn how to deal with a large amount."

Haley: I actually realized many of my close friends don't know about my trust. I started to make an effort to bring it up more. I think it's important for women especially to be honest about their money. It worried me that my friends might wonder, "Oh, Haley's taking all these nice trips. How does she do it?" I feel it's better to just be open.

Our Biggest Fight About Money

Haley: He works a lot. Sometimes he won't come home, or come home at 2 a.m. and leave at 6. Then sometimes work is dead. That's a really interesting part of our relationship because he comes from being the poor kid with an immigrant mom so he's trying to prove himself. I'm like, "Oh, you really need to work that hard?" I catch myself and understand where I'm coming from and he tries to do the same.

Justin: We tend to get into little fights when one person feels underappreciated. I'll say, "I always pay for dry cleaning and you don't appreciate that." And she'll say, "I always pay for groceries and you don't appreciate that."

Haley: I'm like, "Do we need to be uber-wealthy people making millions of dollars?" I don't know. I guess that has its benefits but it leads to us to talking about what sort of people we want to be. I feel like he thinks he needs to make so much because that's the world he's been in but I'm like, "There's actually happy mediums outside New York where you can make money and have a house but you're not necessarily the 1%."

How We Pay For The Non-Essentials

Justin: One of the things we still split methodically is vacations. Travel's very important to us, and we spend a lot of our disposable income on it. I tend to book flights and hotels and then just charge her. We also both like to shop so we talk about that quite a bit. "Oh, do you like this? Am I being ridiculous by shopping this much?" It's a sanity check.

What We're Banking On

Haley: We're on the path to getting engaged. We don't really talk about wedding costs because my mom has money saved for that. The trust means we need a prenup. We're both practical—it makes sense to protect my family and any assets.

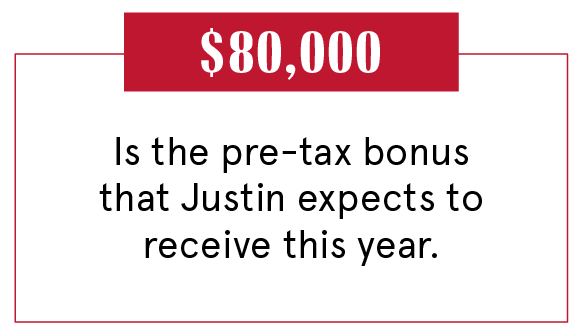

Justin: Until last year, I was still paying student debt ($200,000). That was eating up a solid chunk of my disposable income. But that's fully paid off so I'm saving more.

Haley: Now we're talking about saving for a house. We're trying to have $200-250,000 so that in two years we could buy a $2 million apartment, which, to me, sounds crazy.

Justin: There can be two ways that people who don't come from a lot think about money. Some are frugal and never want to run out. Or there's people like me who think, "I never had it, now I want to enjoy myself."

Haley: I guess we expect that we're going to make more money in the future. We try to toe the line of not being irresponsible. We never argue about it but I think everyone worries: are we making the right decisions? Are we spending too much? Should we be saving more?

Interviews have been condensed and edited for clarity. Pseudonyms have been used. Reporting and editing by Katherine J. Igoe. Design and illustration by Morgan McMullen.

For more stories like this, including celebrity news, beauty and fashion advice, savvy political commentary, and fascinating features, sign up for the Marie Claire newsletter.

RELATED STORIES

Dedicated to women of power, purpose, and style, Marie Claire is committed to celebrating the richness and scope of women's lives. Reaching millions of women every month, Marie Claire is an internationally recognized destination for celebrity news, fashion trends, beauty recommendations, and renowned investigative packages.