The $123,000 Couple Who Have Nearly a Million Dollars in Savings

Every other Thursday, an anonymous couple will get candid with MarieClaire.com about how they split their finances. This week, we're talking to a creative couple who have configured their finances so she can pursue her passion of finance writing.

Welcome to Couples + Money, where we break through the confines of polite conversation. Forget questions about your sex life. We're getting even more personal. Let's talk about what you and your partner are doing—and not doing—with your paychecks.

Every other Thursday, an anonymous couple will get candid with MarieClaire.com about how they split their finances. We’ll break down what each person pays for individually, what they split, and all the gritty details—from who picks up the bill in restaurants to who picks fights over bank statements.

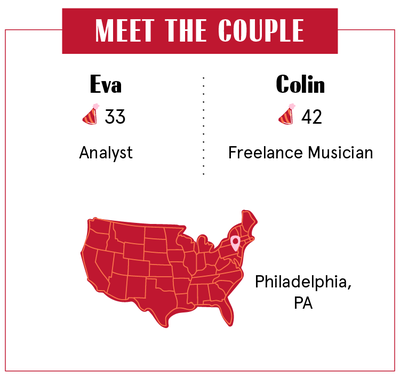

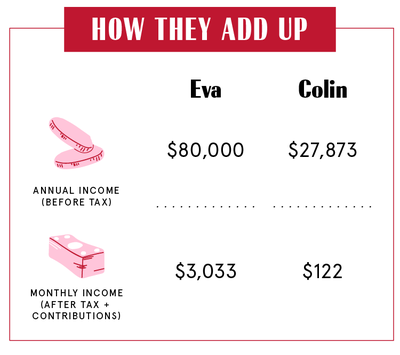

This week, we're talking with Eva, 33, an analyst, who earns $80,000 per year ($6,666.67 per month), and her husband, Colin, 42, a freelance musician, who earns $43,135 per year, which is $27,873 per year ($2,322 per month) after he takes out his business expenses. They've been together 12.5 years and live in Philadelphia, PA.

Want to be profiled with your partner in Couples + Money? Get in touch: couples.money@hearst.com.

How It All Happened

Colin: I'm a musician, and so is Eva. She replaced a musician for a concert I was playing. It was pouring rain, and I held the umbrella over her while she was unloading the car.

Eva: I made the first move. I'm several years younger, and he was actually reluctant to my advances. It took a while but we eventually got together.

Get exclusive access to fashion and beauty trends, hot-off-the-press celebrity news, and more.

Colin: She went to music school and planned on becoming a musician too. Then she realized just how hard it was. So she went to business school at night while she was working and got a pretty good job.

Eva: Then I realized in May I could potentially take a year or two off.

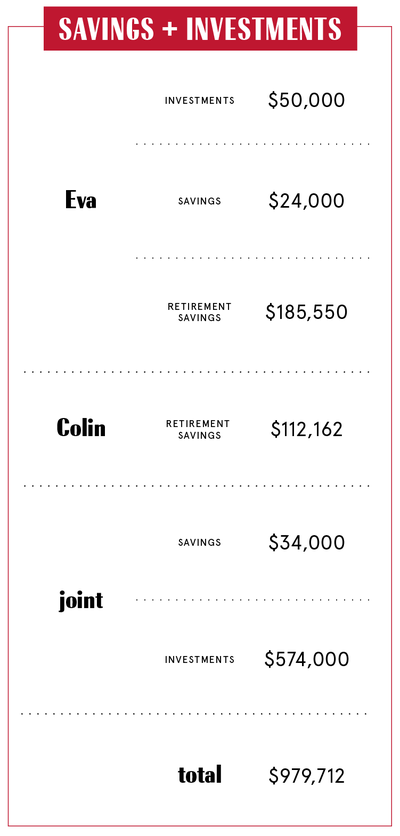

Colin: Based on the numbers, we have enough savings and investments for her to retire, and for us to live off of my meager income plus income generated by our investments. Which is incredible.

Eva: I've never gone without a job since age 19. So, I started my pseudonymised blog Frugal Harpy because I needed to force myself to quit in a public, concrete way. I've stated: "I will be quitting on this date in the fall." Because it's public, I have to do it. I also have friends who come to me with money questions. The U.S. has such low financial literacy because it's just not taught. And we don't talk about money because it's considered taboo. So, the blog's a way for me to let people know how I got where I am.

Our Dependents

Eva: We support my mom because she doesn't have enough to get her through each month. She was an immigrant and then due to language barriers she never got good jobs. After 2008, because of the recession, she only had sporadic employment. She just never got back on her feet.

When We Told Each Other Our Salaries

Colin: She's always had an interest in finance. Whereas I was less involved in my choices.

Eva: Before we got married, we talked about money, religion, and kids. Money was really about getting a sense of debts and assets. Luckily, neither of us had any debts and we're not particularly spendy, but it was just about laying everything out.

How We Handle the Cost of Living

Eva: We don't have a budget, even though that sounds weird. It's just that we only spend X amount for the whole month. I'm constantly trying to reduce our expenses. We're also fortunate not to have housing-related expenses due to a house-sit gig.

Colin: We just consider everything both of ours jointly. There's not really anything that's mine or hers.

Eva: Expenses are mostly covered by my salary because I want him to max out his solo 401k and IRA. You get so much more tax savings that it just makes sense. We put our expenses on our credit card, and that's paid off in full each month. We look at our assets and income as one unit, so any tax savings he gets is a direct benefit. That extra tax savings gets reinvested.

Why We Have Joint Accounts

Eva: Even when we were living together, we had a joint account to pay the expenses, but everything else was separate. When we actually merged our assets a few years after marriage, that's when I felt like we were truly married.

How Often We Talk About Money

Eva: We have conversations daily because I monitor our expenses so much. Seven years ago, I got on the path of wanting to take some time off. The whole concept is about reducing your expenses as low as possible. So, I've been a bit OCD. Every time I feel like we're above a certain point, I say, "Hey, I think we're spending too much." And he's okay with it.

Colin: Budgeting's one of her favorite things to talk about. She enjoys figuring out how we can save the most money. I enjoy seeing her happy and animated, so I enjoy it too.

What We Keep Secret

Colin: We talk about everything. Once, I bought her a gift but before I got a chance to give it to her, she saw it on our statement and said, "What's this expense?" I wanted to surprise her, then I couldn't, because she already knew.

How We Learned To Budget

Colin: I had a middle-class upbringing. I remember when I was younger spending money on ridiculous things. Eating out, going to movies. At some point when I was living by myself in New York, I must have become really frugal, but I don't really know why.

Eva: I was raised by a single mom, so even though she managed to get food on the table, she made sure I knew every time she spent money how much it was. But when I requested piano or other music lessons, she would always say yes because she thought the value was there. Everything she could save went into that. So, I was taught you can have anything you want, but just not everything. You have to decide what you want and learn how to sacrifice the other stuff that's not as important to you.

Colin: Even though I've never earned a lot, I had quite a lot of savings. I bought the studio in New York in my mid-20s. It was a 30-year mortgage, but I paid it off after five years because I had the money. That was a major asset, which I sold when we moved to Philadelphia. It's just habits, I think, more than any sort of principles, but I've always been frugal naturally. Before she moved in, I'd keep the heat so low you could see your breath.

Eva: The thermoset was set to 45. I moved it to 53, and we bundled in sweaters and drank hot chocolate.

Colin: She appreciated the way I do things. On the other hand, I came into a little money when I was 14, and my father invested it for me in two mutual funds. I never touched it. When I met Eva, she was shocked by the fees. She showed me—if I'd moved it 20 years ago, how much more we'd have. It never even occurred to me.

Eva: I didn't understood the importance of investing until I was 24, when I started following finance bloggers. Going to business school helped a lot. I realized it doesn't matter as much what you make. It's really about how efficient you are—savings rate is a huge factor on how quickly you can hit "early retirement." So, I started putting money into my 401K, IRA, and anything left over into the mortgage. For Colin, it was hard to put money in the market because as a freelancer you always want extra cash on hand. But we slowly worked through that.

Our Biggest Fight About Money

Colin: What she does isn't that much fun, and it's stressful, whereas what I do is incredibly rewarding. Even if we won the lottery, I'd still do exactly what I'm doing. Sometimes I think Eva can feel like she's sacrificing herself to make us financially okay. Whereas I'm living easily, and doing what I love. It's unfair. Sometimes I feel she resents this a bit; I could get a job that would pay a lot, but I'd be miserable.

Eva: Earlier on, because I was more focused on salaries than savings, I felt like if he were to get a full-time job it'd be much easier for us. But, over time I realized as my savings went up and the market's been doing well, our portfolio generates income in such a way that I'm not as worried. So, over time I nagged him less.

Colin: Her retiring suddenly puts pressure on me, because I'm the one who's really earning the money. She's showing me the numbers and they look okay. It's easy to start worrying: What's the market going to do? But I think there's some breathing room there too. Plus, I don't think she's thinking she'd never work again.

How We Pay For The Non-Essentials

Colin: Every year we go on a vacation somewhere. Some of our happiest memories have been from these trips.

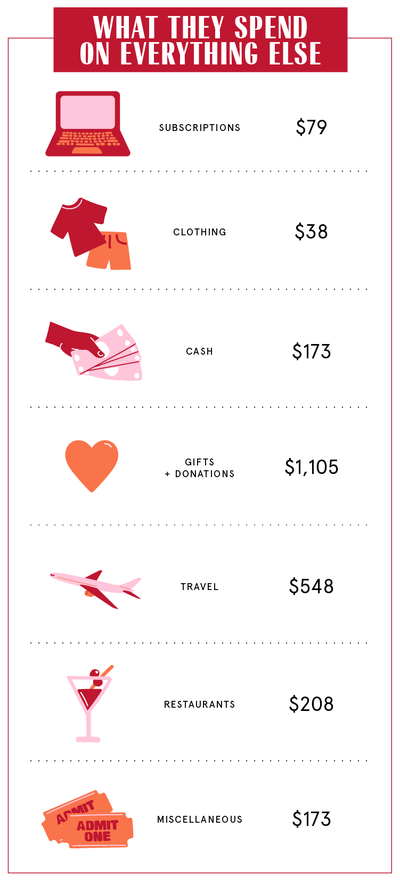

Eva: I look at things holistically over the year. If overall spending is lower, we can spend a little extra on vacation. We barely went out to restaurants the past three months, and that's an extra X hundred dollars to stay at a nicer place.

What We're Banking On

Colin: We'll probably visit her mom for Thanksgiving. Then we're spending Christmas and New Year's in Europe.

Eva: After that I'll try different things. I know I'll need structure, so I'll do dog-walking or a part-time position. All the while, I'll focus on my blog. I want to do things that bring me joy, because I haven't done that for a while. If for some reason I absolutely hate it, I can always get a 9-5 job. It would be amazing if I could make enough money to just do the blog. I have to face the fact that it might not go anywhere, but when I write, I enjoy it. I'm going to respect that process—and if it goes somewhere, it goes somewhere.

Interviews have been condensed and edited for clarity. Pseudonyms have been used. Reporting and editing by Katherine J. Igoe. Design and illustration by Morgan McMullen.

For more stories like this, including celebrity news, beauty and fashion advice, savvy political commentary, and fascinating features, sign up for the Marie Claire newsletter.

RELATED STORIES

Dedicated to women of power, purpose, and style, Marie Claire is committed to celebrating the richness and scope of women's lives. Reaching millions of women every month, Marie Claire is an internationally recognized destination for celebrity news, fashion trends, beauty recommendations, and renowned investigative packages.