Age vs Money: How Time Changes Our Perception of Cash

$20 when you're 18 isn't the same as $20 when you're 48.

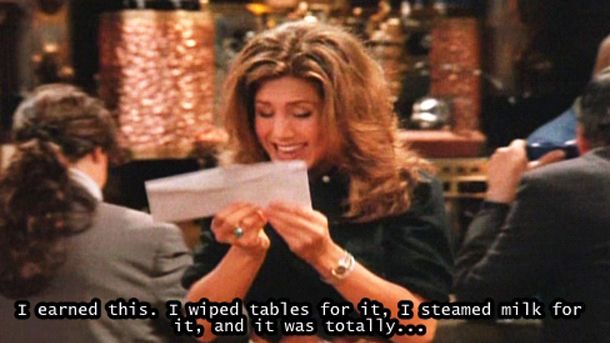

Money can't buy happiness—but there sure are a lot of things it can buy to get you pretty close. There's no denying that we all feel a bit better when our wallets are a little thicker. But what those crisp bills mean in terms of real life purchases can change drastically with your age. When you're a kid, your weekly $5 allowance may make you feel like King Midas, but ten years later, you realize that you could find that same $5 digging through your couch cushions. As time goes by, our age isn't the only thing that matures, our perception of a dollar does too. Here, we take a whimsical look at how you feel about cash through the years.

In your teens:

$20 = Dinner and a movie, better known as the perfect Friday night (with all your BFF's, of course.)

$50 = A really crazy afternoon "shopping spree" at the mall.

$100 = A weekend worth of baby-sitting earnings.

$1000 = The collective balance of the savings account your parents set up for you 10 years ago, fueled by birthday checks from Grandma.

In your twenties:

$20 = Your estimated budget for a night out.

$50 = Your actual spendings on a night out.

$100 = Too much money to throw down without some serious deliberation before hand.

$1000 = Rent (Although this barely skims the lower half of what you're paying if you live in NYC or SF. Le sigh.)

In your thirties:

$20 = Barely covers a drink at dinner.

$50 = What you've learned is the minimum charge from any worthwhile hair stylist.

$100 = About a month's worth of diapers.

$1000 = A little less than your mortgage payment.

Get exclusive access to fashion and beauty trends, hot-off-the-press celebrity news, and more.

In your forties:

$20 = The amount you hand over to your son or daughter on a (seemingly) daily basis.

$50 = The price of a night's freedom in the form of payment to your baby-sitter.

$100 = The standard amount of cash you're carrying around in your wallet—because you never know when you might need it.

$1000 = Money that will, most likely, be funneled into your child's college fund.

In your fifties:

$20 = What you're willing to throw down for a great lunch. You can't put a price on midday happiness.

$50 = The mani/pedi that is no longer just an indulgence, but is medically necessary.

$100 = A fraction of the up charge your car insurance provider will charge you once you add your kids to the plan.

$1000 = A sum of this size is going towards a well-deserved vacation—without the kids.

Related:

I'm an Associate Editor at the Business of Fashion, where I edit and write stories about the fashion and beauty industries. Previously, I was the brand editor at Adweek, where I was the lead editor for Adweek's brand and retail coverage. Before my switch to business journalism, I was a writer/reporter at PEOPLE.com, where I wrote news posts, galleries and articles for PEOPLE magazine's website. My work has been published on TheAtlantic.com, ELLE.com, MarieClaire.com, PEOPLE.com, GoodHousekeeping.com and in Every Day with Rachael Ray. It has been syndicated by Cosmopolitan.com, TIME.com, TravelandLeisure.com and GoodHousekeeping.com, among other publications. Previously, I've worked at VOGUE.com, ELLE.com, and MarieClaire.com.