Career advice

What you need to know to build a successful career, straight from Marie Claire editors.

Explore Career advice

Career advice

-

This HR Executive Used an Intensive Money Course to Bounce Back From Bankruptcy and Pay All Cash for a $76,000 Farmhouse in Rural Maine

Years later, renovations are still going, but the financial freedom has made it all worth it.

By Marie Claire Editors Published

-

Fawn Weaver Is All About the Whiskey Business

The founder of Uncle Nearest spirits is doing more than just raising a glass—she's raising awareness.

By Kovie Biakolo Published

-

What Reverse Ambition Means to Three Multi-Hyphenates

"I tried to tell myself that if I just work a little harder, if I do a little more therapy, if I get up 30 minutes earlier and do the meditation, I can do it all. No, I can't. Nobody can."

By Brooke Knappenberger Published

-

For MAC's Newest Executive, Diversity Is a Superpower

"Every aspect of the brand needs to be touched by what the world looks like. "

By Gabrielle Ulubay Published

-

The Founder of Bearaby Wants to Bring Nap Culture to Corporate America

Kathrin Hamm encourages Bearaby employees to luxuriate in a mid-day, guilt-free snooze.

By Michelle Eigenheer Published

-

The Most Common Mistakes People Make On Their Taxes, According to Experts

"There is no shame in asking for help on your taxes."

By Danielle Campoamor Published

-

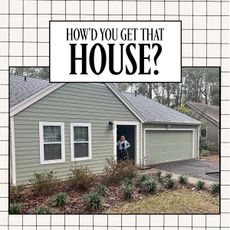

This Marketing VP Swapped NYC for Gainesville, Florida to Afford a $250,000 Two-Bedroom Cottage

"I didn't want to 'wait' until I had a partner."

By Marie Claire Editors Published

-

For Deepica Mutyala, Entrepreneurship Is Worth the Sacrifice

The Live Tinted founder talks having it all—but not all at once.

By Gabrielle Ulubay Published

-

The SoulCycle Founders' Next Act? Tackling the Loneliness Epidemic

Founders Julie Rice and Elizabeth Cutler call Peoplehood "a workout for your relationships."

By Tanya Benedicto Klich Published

-

Welcome to "The Big Stay"

The Great Resignation is over. Now, it's time to recalibrate your career priorities.

By Ellen Taaffe Published

-

Self-Doubt and Sacrifices—Dorsey’s Meg Strachan Gets Candid About Launching Her Jewelry Company

“Have we made it? From the outside, perhaps. Internally, we are working really hard to make it every single day.”

By Emma Childs Last updated

-

The Money Issue

Conversations around money, especially amongst women and people of color, can be fraught, filled with emotion and shrouded in secrecy. When planning this digital issue, we knew we had to take a different approach.

By Marie Claire Editors Published

-

The Stigma of New Money

The rules for being rich are changing. Why do some people see that as a bad thing?

By Vivian Manning-Schaffel Published

-

The Big Business of Egg Freezing

The procedure is positioned as an investment for women and their futures. But it’s also expensive—putting those who do it into serious debt, as they’re forced to finance their fertility.

By Tanya Benedicto Klich Published

-

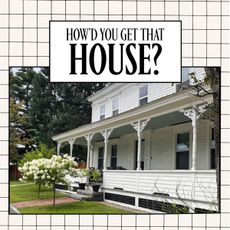

How'd You Get That House?

A cash gift from family for a down payment helped.

By Tanya Benedicto Klich Published

-

Roommates After 50

Middle age can be a time of huge change: career shifts, empty nests, relationship transformations. For some, sharing a space with a housemate can be a welcome salve.

By Lydia Horne Published

-

“There’s This Underlying Idea That if I Make It, I’ll Be Everyone’s Ticket to Never Having to Worry”

As the daughter of immigrants, Sharon Pak—who was part of the founding teams behind ColourPop and Insert Name Here—was the first person in her family to become wealthy. Here, the beauty entrepreneur describes navigating that reality.

By As told to Tanya Benedicto Klich Published

-

Can Artificial Intelligence Help You Get Rich?

Robo-advisors and algorithms are calling the shots when it comes to how you invest, save, and make money. But should artificial intelligence have a say in your wealth?

By Alexis Benveniste Published

-

Meet the AI Whisperer

Artificial intelligence has a bias issue, discriminating against women and people of color the most. Data scientist Rumman Chowdhury is on a mission to change that.

By Lorena O'Neil Published

-

What It Means to Agatha Achindu to Be a "Wellness Architect"

Achindu recently published her cookbook, "Bountiful Cooking."

By Tanya Benedicto Klich Published

-

Drybar Founder Alli Webb on the "Messy Truth" About Marriage and Entrepreneurship

Can a successful career and marriage coexist? The serial entrepreneur says this one habit could have saved her relationship.

By Rachel Burchfield Published

-

Signs It's Time to Quit Your Job and Jumpstart a New Career Path

Only one-quarter of all working women are satisfied with their full-time job, according to recent statistics. But how do we know when it’s time to make a career change?

By Ellen Taaffe Published

-

Exactly How to Talk to Higher-Ups

The way you communicate with executives can significantly impact your career, says Selena Rezvani, author of 'Quick Confidence.'

By Selena Rezvani Published

-

Meet Lidiane Jones, the Slack CEO Replacing Whitney Wolfe Herd at Bumble

The Slack CEO will replace Whitney Wolfe Herd at Bumble effective January 2 of next year.

By Tanya Benedicto Klich Published

-

How Jenni Kayne Built an Empire on California Living

One decision ushered her eponymous brand into its expansion era, says Kayne.

By Tanya Benedicto Klich Published

-

Use Artificial Intelligence to Make Your Job Hunt More Effortless

How to utilize AI to find relevant job openings, write a cover letter, prepare for an interview, and more.

By Elana Lyn Gross Published