The $115k Couple Who Paid Off 21 Credit Cards in 14 Months

The latest edition of Marie Claire's Couples + Money series.

Welcome to Couples + Money, where we break through the confines of polite conversation. Forget questions about your sex life. We're getting even more personal. Let's talk about what you and your partner are doing—and not doing—with your paychecks.

Every other Thursday, an anonymous couple will get candid with MarieClaire.com about how they split their finances. We’ll break down what each person pays for individually, what they split, and all the gritty details—from who picks up the bill in restaurants to who picks fights over bank statements.

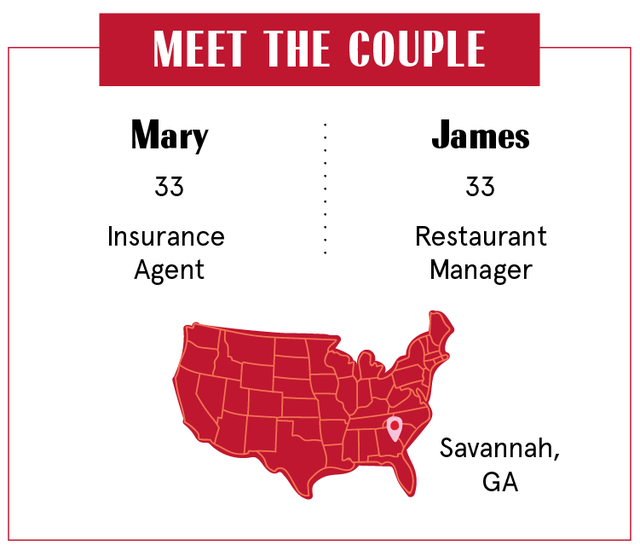

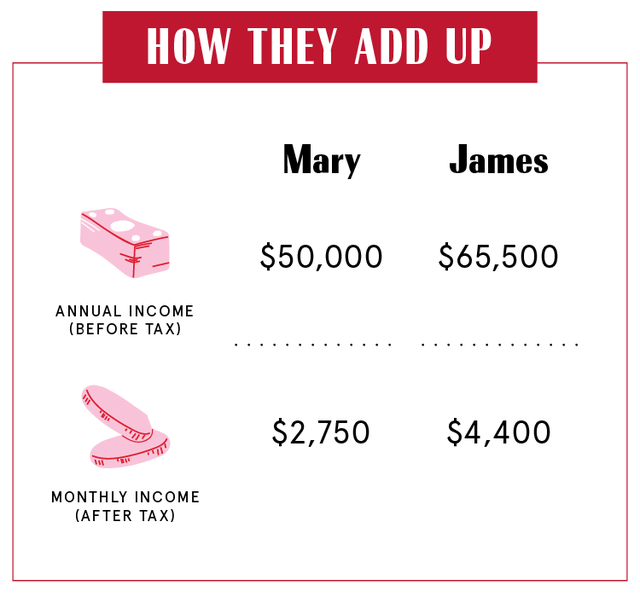

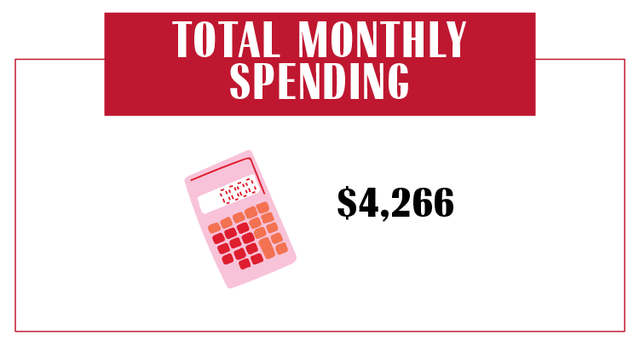

This week, we're talking with Mary, 33, an insurance agent, who earns $50,000 per year ($4,200 per month), and her husband, James, 33, a restaurant manager, who earns $65,500 per year ($5,450 per month). They've been officially together 6.5 years and live in Savannah, GA.

Want to be profiled with your partner in Couples + Money? Get in touch: couples.money@hearst.com.

How It All Happened

James: We had a real short seven-months courtship. We decided to get married on a whim—I need health insurance, so let's get this going. We were going towards marriage anyway: "We might as well go ahead because it's going to save us some money."

Mary: James has gotten super into podcasts, and we did the Dave Ramsey program. We paid off $80,000 in debt: $28,000 student loan, $18,000 auto loan, $9,000 personal loan from a previous card consolidation, and $25,000 credit cards. We don’t use any form of debt anymore except for our mortgage, which we plan to pay off in 15 years, if not before.

James: We took all 21 of our paid credit cards and cut them all up. We bought cheap, clear plastic ornaments, opened them up, and put them in there. That's what decorates our Christmas tree now. It's a constant reminder of where we came from.

Get exclusive access to fashion and beauty trends, hot-off-the-press celebrity news, and more.

Our Dependents

Mary: We have two dogs. I think we're at a sweet spot—their health hasn't started declining and they've stopped tearing stuff up.

James: Mary'd been talking to her sister about adoption. She said, "Would you be open to doing this?" I said, "You know what? We thought about having kids. I told you I don't have a lineage thing where I need to have my own kid. Let's do it." Then she mentioned the cost of it and I said, "Well, we're already in debt at this point. Who cares? Let's add it on." It ended up being our first big accomplishment—the $15,000 for our daughter. That was a big learning curve. I remember going to Walmart and dropping $300. "Oh my God. Do we really need all this?" Then you start figuring out ways to buy even more because, oh man, this is awesome. It's not about me anymore. It's about her.

When We Told Each Other Our Salaries

Mary: Four months after we started dating, we went to a college football game and he told me how much student loan debt he had. I don't own the family business, but I will at some point. So I've always had to have my money "together," or at least a good credit score. I didn't have student loans—I used credit cards in college. That's my favorite thing in the world, a credit card. But I just said, "Oh that sucks." It wasn't any worse than my credit card picture, probably.

James: It was Mary trying to get me to get on board with the rest of our life. I used to be really carefree. Once I met Mary we started having conversations: "What's going to happen in five years? If we don't get serious with money we're not going to get to those goals." We had a lot of fights that first year; 99 percent of them were money-related.

How We Handle the Cost of Living

Mary: We don't split anything. I've literally had his debit card since we were dating. We'd go out and he'd leave it at the end of the night; He finally confessed he didn't always know if he had enough money to cover it. I've always known exactly how much he makes. He wasn't paying his student loans, and we got that taken care of. So I've always had control of everything.

James: I remember lying in our bed one night. I was so angry, I knew we had to change something, and I couldn't make myself change. I woke up and said, "I just can't do it anymore." She said, "You know what? If we get on the same page, if we're a team, we're going to look out for each other." I've always been an athlete, so I bought into that. It's worked gangbusters ever since.

Why We Only Have Joint Accounts

James: I take my check and I deposit my check. That's pretty much it. I don't see that money ever again. She handles every bit of it. She's awesome at it.

How Often We Talk About Money

James: Daily. If I need gas, "Hey, I need the debit card today. Do you need gas so we get this all done at once?" Then once a week we'll have a big conversation about money.

Mary: We also have a monthly meeting about our budget and how that plays into our goals.

James: She did make a big mistake this week. She forgot that the power and mortgage payment would come out, and we had $16 in the account. The money was all there, it was just in different places. It was one of those fun things—she tried to get cute and messed up a little bit.

What We Keep Secret

Mary: Nothing.

James: If it comes in and goes out of this house we're going to be on the same page. I'm actually able to surprise her with something for her birthday but I had to say, "I'm going to surprise you. It's $80. I need you to Venmo your sister so that she can buy it because I'm not running it through the bank where you'll see it."

How We Learned To Budget

Mary: My dad started an insurance agency and my mom worked in insurance. They also had some rental houses. So we always had the mindset that you were going to work. I'd always thoroughly enjoyed spending money and I never really learned to save. I've always tracked what I spent, but I didn't plan and stay within a budget. A credit card was always part of my existence.

James: It's funny. I grew up in a very wealthy family. My dad was CEO of a nursing home corporation. Money was something we never really talked about. We always had a lot of it, but we didn't buy things like crazy either. He did instill in me that I was going to work. He brought me in as a janitor at 13 for his nursing home. It's not a great place to start, but it's a humbling experience.

Mary: I graduated in 2009 with an education degree: "You'll always have a job and healthcare and retirement." And then not only did I graduate the middle of the school year, but the guaranteed job was not there. My family's business happened to need help almost simultaneously. I made pretty shit money for a while because it was tough for small businesses too.

James: I went to school to be a teacher. When I graduated there was no work. I struggled, I made minimum wage, I applied for food stamps. I think that gave me a lot of fight.

Mary: When we got together, I worked three jobs, he did two. I think that's another reason why the credit cards got to where they were because every single month there wasn't enough money.

James: Our daughter got a Barbie cash register for Christmas and it came with a credit card. We made sure that we threw that out. "We don't pay with plastic. We pay with cash."

Our Biggest Fight About Money

James: I'm a huge golfer. Before we even got married, "I'm going to have $100 a month and me and my buddies are going to go play at a different course." We fought about that like cats and dogs. Then I finally wised up and thought, "Why?"

Mary: He has to mobile deposit his check every Friday or it's not available until Tuesday, and I have to pay bills. It's so stupid—but that used to happen quite a lot. And I'm like, "Dude, I feel like your mom."

James: I had a bad habit of every day going to the gas station and buying a pack of cigarettes, a Coke, a bag of peanuts. I was getting super-fat from eating all that garbage, I was 260 pounds. But it was also bad emotionally because it wasn't making me any better.

How We Pay For The Non-Essentials

James: If I go to work for 48 hours a week and buy something with all that hard-earned money, it better be something I can hold onto really strongly. When I dropped 100 pounds I cleaned out my closet. I got down to three shirts, a couple pairs of shorts, a pair of jeans and that was it. We had yard sales. Sold everything. It allowed us to really value the things we had. If you're just chasing something that's cool you'll never get that good feeling.

Mary: We didn't have a budget for that while we were doing the debt stuff. Now we have a category. We typically do go over it. We went to Disney World and just picked a random amount to be the cap. But together we decide what that's going to look like.

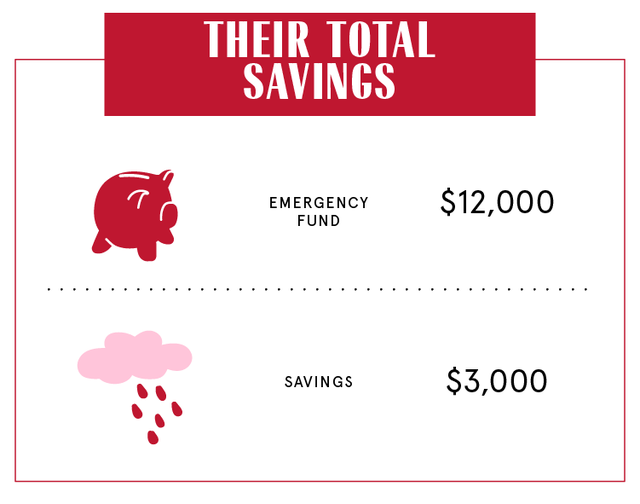

What We're Banking On

James: We're in talks of maybe another kid down the road. If we do that it's probably going to be adoption or something like that. We're setting aside six months of my income if anything happens to either of us. We're both trying to get new vehicles—we're probably going to lose one or both in the next couple of months, the level they're at. We're just now getting our retirement set up. Hopefully, we'll have our daughter's college at least half-funded this year.

Mary: This is our year of catching up. Beyond that, I particularly want to travel as much as I can. We're both motivated for giving—pay for somebody's bill. Tip really well for a waitress. Something that's good and meaningful. We've talked about maybe building a new house. We'd both love to get to the point where we can retire early so we can do things that we want to do, that we get paid for.

James: Be receptive to learn. Mary has conversations with people through the Dave Ramsey Facebook and I have conversations with my customers. Even if they're strangers, you'll find out a lot more people are in the same boat than you'd ever imagine.

Interviews have been condensed and edited for clarity. Pseudonyms have been used. Reporting and editing by Katherine J. Igoe. Design and illustration by Morgan McMullen.

For more stories like this, including celebrity news, beauty and fashion advice, savvy political commentary, and fascinating features, sign up for the Marie Claire newsletter.

Related Story

Related Story

Dedicated to women of power, purpose, and style, Marie Claire is committed to celebrating the richness and scope of women's lives. Reaching millions of women every month, Marie Claire is an internationally recognized destination for celebrity news, fashion trends, beauty recommendations, and renowned investigative packages.