Welcome to Couples + Money, where we break through the confines of polite conversation. Forget questions about your sex life. We're getting even more personal. Let's talk about what you and your partner are doing—and not doing—with your paychecks.

Every other Thursday, an anonymous couple will get candid with MarieClaire.com about how they split their finances. We’ll break down what each person pays for individually, what they split, and all the gritty details—from who picks up the bill in restaurants to who picks fights over bank statements.

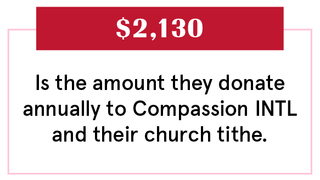

This week, we're talking with Emily, 25, a marketing creative who earns $45,000 per year ($3,000 per month), and her husband, Christopher, 26, a software support consultant, who earns $41,000 per year ($2,800 per month). They've been together seven and a half years and live in Tampa, Florida.

Want to be profiled with your partner in Couples + Money? Get in touch: couples.money@hearst.com.

How It All Happened

Christopher: It's actually a subject of discussion in our house. I think that we met at the mall once—we bumped into my cousin's friends, and she was one of them. That was the first time we ever saw each other, but she thinks we met a little later at that same friend's house. Basically, we met as high schoolers, and we were both in youth group together.

Emily: We actually didn't move in together until we got married, which I know is crazy. But we got married super young, in 2016, and so we waited until then. So that was an interesting choice.

Our Dependents

Emily: I'm pregnant—other than that, it's just us.

Stay In The Know

Marie Claire email subscribers get intel on fashion and beauty trends, hot-off-the-press celebrity news, and more. Sign up here.

Christopher: We've definitely thrown around the idea of modifying the budget to work that in, because Emily works for herself and will probably have to put fewer hours in.

Emily: I have this very naïve idea that I'm going to be able to watch my baby and work from home. But we do have some time, since I'm on my first trimester.

When We Told Each Other Our Salaries

Emily: We knew each other for so long, but didn't really have jobs or any idea how the world works. And I knew very early on that we have very different experiences. My parents spent money freely and always had enough to spend, and that wasn't his experience at all.

Christopher: We probably decided early on, here's a budget that we'll try to stick to.

How We Handle The Cost Of Living

Emily: I feel like I'm relatively independent and knowledgeable about how the world works, but Christopher pretty much handles all finances, pays our mortgage and budget, tells me if there's no money in our account. It works, and he's not controlling, so I didn't have any qualms about it. I don't know that I'd recommend it to other people. Sometimes if I'm talking about it, people will be a bit horrified. I don't want to pay the bills myself, I just spend the money and he takes care of it.

Christopher: I'm a person that worries a bit more about money. It's worked for us. So I ended up being the one that made sure that bills are taken care of.

Emily: I don't spend crazy amounts of money and we're both responsible, but he's the one who makes sure we don't starve.

Why We Only Have A Joint Account

Christopher: We made that decision a few months before we got married, I think.

Emily: We got a lot of advice for me to keep my savings separate. And I can see it, but I personally didn't want to go in with a mindset of it being my money, because I knew that I'd get resentful if we had to spend it in a way that I didn't approve of. So for me, making it all joint was a blank slate. I didn't want to feel like I was punishing him for not having well-off parents who could afford to pay for his college.

Christopher: We have all of our money in one place and then we divvy it up as needed, except for her account for business expenses and income—she takes a certain amount of that for her own salary, and leaves the rest for taxes and expenses.

How Often We Talk About Money

Emily: I think that it's not that I'm fiscally irresponsible, I just prefer not to think about it. So, we both just put what we make into our joint account and then he does the rest.

Christopher: There's not really anything that we haven't talked about. There are smaller purchases we don't run by each other. We try to just be as upfront and honest with each other about it as possible.

What We Keep Secret

Emily: At first, Christopher wanted to know where our money was going, which is valid. So if I spent $80 at Target, he'd be like, "What did you buy?" We've now reached a point where we'll sit down and discuss big purchases. But I'm not going to pull up every receipt. In general, we're open about how we're spending our money, but we try to give each other the freedom to spend it as needed and just trust each other.

Christopher: Before we were married, I tried to make it seem like I wasn't as poor as I was, because I was trying to pay for my own school, and my bills, and working two jobs to make it all work out.

Emily: I've gotten lucky that I have a caring partner who's always said, if this is something that stresses you out or that you don't get, I'll do it. But it's not how I want to raise my children.

How We Learned To Budget

Christopher: I come from an immigrant family, and we were struggling a lot when I was growing up. So I think I'm a bit more tight-fisted with my money, and she's always been a bit more liberal with it. I think her parents are amazing people, and they're hard workers and gave their kids a great life. So that was probably some of the difference.

Emily: For me, it was a little bit more of a privileged thing. It's like, whatever. There's always enough money, which obviously isn't true.

Christopher: Growing up, my parents worked really hard to make sure that we always had food on the table. We really didn't go out to eat very much, or go on vacations. My family's always like: Trim the fat. Just stick to the essentials, so that we can survive and live well enough. They also made poor financial decisions that I saw growing up out of lack of knowledge. When you're an immigrant couple coming to the U.S., you don't really know how things work—and people will take advantage of that.

Emily: I think that my parents probably taught me budgeting; I had an allowance and all of that. But I'm not very good at telling myself no. So there's a lack of discipline.

Christopher: Certain things I always wanted growing up I went out and bought when I first started making money: a TV, a video game system. But very soon, as the expenses came down, I started feeling—oh, this is what my parents went through. So I started hoarding, and became very hesitant to spend. Sometimes even now, any time money leaves my account and I didn't expect it, I feel this dread.

Our Biggest Fight About Money

Emily: We were at Target, and we had a belated wedding gift card. I viewed it like a starting point for how much money we're going to spend. We hadn't talked about it on the way over, and then I hit and surpass the card amount. Christopher's behind me, panicking, and he decides, "This is too much, you have to put everything else back." I was so furious. I make a point for the next week, telling him anything that I purchased. "I just wanted to let you know that I'm stopping to get a coffee. Is that okay?" We both grew from that, and learned how to communicate.

Christopher: It led to a deeper conversation about trust. I didn't trust that she was going to be able to keep the budget. I had to learn that this is both of us. It's not just me that'll make this work. And I have to know that she has our best financial interest at heart, she's not spending just to spend money. She's responsible too. At the bottom of every financial discussion for a couple is trust. Because trust is really the currency you're working with.

How We Pay For The Non-Essentials

Emily: We have what we call a fun checking account that's basically money earned from freelance assignments that we use to pay for things we want to spend money on but don't necessarily need. I probably use it just to justify purchases more than he does.

Christopher: I see my upbringing in my budget, because it's just bare essentials. There's not a whole lot budgeted for travel, entertainment, or shopping. But when we don't have a great month spending-wise, I know why.

What We're Banking On

Christopher: I'm trying to figure out how to save some money on the front end so that when the baby comes, we'll have enough money. It's a learning curve, but we're definitely thinking about it. We probably should be thinking about it more, if I'm honest.

Emily: I got worried because we were talking to a couple of friends that are expecting, and they're setting aside $1,000 each month. And I'm like, oh my God, maybe we need to start really thinking about it. Right now it's still very new for us.

Christopher: Right now we're not super worried about the bigger stuff: college or serious medical bills. We're mostly trying to figure out the day-to-day, like diapers and baby clothes. In a couple months, we'll head into the more long-term planning. Maybe in a couple years we'll have another kid, so we're thinking we'll have to get a bigger house.

Emily: We could get better at like thinking about things like retirement, and we also want to have money to renovate our current house a little bit.

Christopher: I don't think that I would be as giving or fun of a person if I wasn't with her. I think one of the reasons Emily sometimes spends money more than I do is because she works very hard. I love and admire that about her. I'm more steady. I work very hard to keep things the way that they are and save money where we can. I like to think I've helped her be more careful and thoughtful about her spending, and she's made me more trusting and relaxed. So I think the balance is huge—we balance each other out, and I think it makes us stronger.

Interviews have been condensed and edited for clarity. Pseudonyms have been used. Reporting and editing by Katherine J. Igoe. Design and illustration by Morgan McMullen. Animation by Hayeon Kim, Colin Gara, and Danny Ratcliff.

For more stories like this, including celebrity news, beauty and fashion advice, savvy political commentary, and fascinating features, sign up for the Marie Claire newsletter.

RELATED STORIES

-

Kate Hudson Says It was “Very Dramatic” On the ‘Glee’ Set

Kate Hudson Says It was “Very Dramatic” On the ‘Glee’ Set“… when you’ve got all of those personalities and all that talent and all that youth and a lot of hormones…”

By Danielle Campoamor Published

-

The Most Iconic Hats and Fascinators Worn by Royal Wedding Guests

The Most Iconic Hats and Fascinators Worn by Royal Wedding GuestsThe bigger, the better.

By Katherine J. Igoe Published

-

Zendaya Says Her Experiences at the Met Gala Have Been “Exciting”—But Also “Terrifying” and “Daunting”

Zendaya Says Her Experiences at the Met Gala Have Been “Exciting”—But Also “Terrifying” and “Daunting”After a five year hiatus, Zendaya will return to the Met this year as a co-chair of the event.

By Rachel Burchfield Published

-

Where Did All My Work Friends Go?

Where Did All My Work Friends Go?The pandemic has forced our work friendships to evolve. Will they ever be the same?

By Rachel Epstein Published

-

So You Want a Postnup

So You Want a PostnupNo, they’re not planning to divorce, yet more couples are facing the awkwardness of getting their marital finances in order—after they say “I do.”

By Emma Pattee Published

-

The Two Moms Who Took a Year Off to Travel—Then COVID-19 Happened

The Two Moms Who Took a Year Off to Travel—Then COVID-19 HappenedEvery other Thursday, a couple will get candid with Marie Claire about how they split their finances. This week, we're talking to a couple who decided to travel full-time just before COVID-19.

By Marie Claire Published

-

Warning Working Moms: Your Partner Is Your Glass Ceiling

Warning Working Moms: Your Partner Is Your Glass CeilingBestselling author and essayist Caitlin Moran warns in her new book More Than a Woman that a mother’s career is only as good as the man or woman she marries.

By Jo Piazza Published

-

The Unemployed Couple Squatting in Their Brooklyn Apartment

The Unemployed Couple Squatting in Their Brooklyn ApartmentEvery other Thursday, a couple will get candid with Marie Claire about how they split their finances. This week, we're talking to a couple who haven't paid rent on their apartment in months.

By Marie Claire Published

-

The Blogger Couple Who Made $20,000 When the Pandemic Hit

The Blogger Couple Who Made $20,000 When the Pandemic HitEvery month, a couple will get candid with Marie Claire about how they split their finances. This week, we're talking to a couple who lost revenue during the pandemic, but invested wisely.

By Marie Claire Published

-

The Couple Who Used a Health-Share Ministry for a $1,000,000 Surgery

The Couple Who Used a Health-Share Ministry for a $1,000,000 SurgeryThe latest edition of Marie Claire's Couples + Money series.

By Marie Claire Published

-

The $266k Couple Whose Wife Created an App to Track Their Spending

The $266k Couple Whose Wife Created an App to Track Their SpendingThe couple make $266,000 a year.

By Marie Claire Published