Your Guide to Getting Benefits as a Freelancer

Three steps to getting your you-know-what together.

The pandemic has catapulted capitalism into a future unknown—and the gig market into center focus. Pandemic-related layoffs have created intense need and competition for contract jobs, and women especially are on the market: During March and April, 11.7 million women lost their jobs, compared with 9.6 million men. But the freelance space, one of the few sectors to thrive as a result of the national crisis, saw a surge of openings. This year, two million people joined the nearly 57 million Americans who already called themselves freelancers. And the shift doesn’t show signs of slowing. So if you’re a recent free agent, don’t panic. We’ve got you: Here, our guide to going freelance.

Step 1: Figure Out Your Health Plan.

If you can’t extend the insurance provided by your former employer via COBRA (some have the option), you have 60 days to apply in the individual marketplace; miss the window and you typically have to wait until the next open-enrollment period. With the Affordable Care Act, you might get a better deal through the federal government’s health-insurance marketplace. And you could qualify for coverage through Medicaid.

Step 2: Insure (and Ensure) Your Future.

No, it’s not morbid; it’s called being prepared: You need to consider life insurance, plus disability insurance (which can help with expenses if you’re unable to work). Visit the Insurance Information Institute’s website or check out Bankrate to learn the basics.

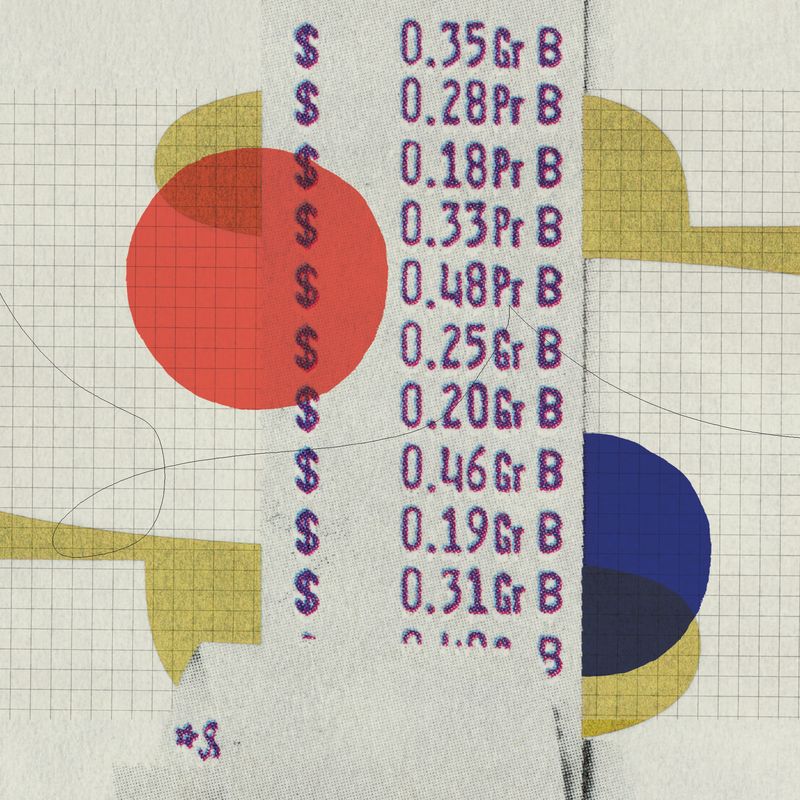

Step 3: Save, Save, and, Oh Right, Save.

First, set aside money for taxes (remember, 30 percent of your pay). Then prioritize emergency funds. To plan for retirement, explore tax-advantaged accounts like an individual retirement account (IRA), a solo 401(k), or a Simplified Employee Pension (SEP) IRA. Provided you don’t have debt (other than a mortgage), 10 percent of your monthly income should go into nonretirement savings; put another 10 percent into a retirement plan—especially if you want to be sipping margaritas on the beach by the time you’re 65.

Sources include Kimberly Palmer, a personal-finance expert at NerdWallet, and Laura Adams, author of Money Smart Solopreneur.

Read the Rest of our Guide to Going Freelance:

This article originally appeared in the Winter 2020 issue of Marie Claire.

Get exclusive access to fashion and beauty trends, hot-off-the-press celebrity news, and more.

Maria Ricapito is a writer who lives in the Hudson Valley.