Welcome to Couples + Money, where we break through the confines of polite conversation. Forget questions about your sex life. We're getting even more personal. Let's talk about what you and your partner are doing—and not doing—with your paychecks.

Every other Thursday, an anonymous couple will get candid with MarieClaire.com about how they split their finances. We’ll break down what each person pays for individually, what they split, and all the gritty details—from who picks up the bill in restaurants to who picks fights over bank statements.

This week, we're talking with Stacia, 34, a research administrator who earns $68,500 per year ($5,708 per month), and her partner, Craig, 36, a dental technician in Plymouth, who earns $50,000 per year ($4,166 per month). They've been together six years and live in Brockton, Massachusetts.

Want to be profiled with your partner in Couples + Money? Get in touch: couples.money@hearst.com.

How It All Happened

Stacia: We met six years ago now, through a friend at a restaurant. We all went out together and met that night.

Craig: I never thought I'd be with somebody who I felt like I'd known my entire life, having known her for a week. She's the best person I know. She really is.

Stacia: I feel like we moved in a year later.

Stay In The Know

Marie Claire email subscribers get intel on fashion and beauty trends, hot-off-the-press celebrity news, and more. Sign up here.

Craig: I was working basically opening packages, making very little money. I told her about [a new position] and said, "I really want to apply." She was super positive about it, and told me, "You know what? Really, you should." So I did [and got the position]. Then she said, "Oh, well why don't we try moving in together?" I said, "Yeah, that might be a good idea."

Stacia: Two years later, we bought a house. Even now, he says he never thought he would own a house in his life.

Craig: Ten years ago I thought, "Oh, I'm going to be working in a factory all my life." Now I've worked in a few different departments and a few different companies doing really interesting work. That was all due to her and that first job transition.

Our Dependents

Craig: We have two furry dependents—hound dogs. There was one point, when I was working the lower paying dead-end jobs, where I was helping out my family financially. I don't do that anymore. Now, it's just me and her.

When We Told Each Other Our Salaries

Craig: I think when we first moved in together. Obviously she then had a more vested interest in how I was spending my money.

Stacia: When I met him, he had nothing. He had no money, he didn't know what budgeting was. His credit score was not zero, it was nonexistent.

How We Handle The Cost Of Living

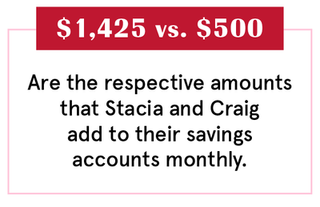

Stacia: We have what I call a Lucy and Desi arrangement for expenses, which means the only thing we actually pay together is the mortgage. We have a set agreed upon amount individually that goes into savings, and then after that we can each spend what we want on everything else, so long as the bills are getting paid.

Craig: We split the bills basically down the middle. She does electricity, Hulu, the dog's medical care. Then I do dog food and the internet.

Stacia: We also try to set up the other household bills in a way that we're each paying for one in an equivalent way.

Why We Don't Have A Joint Account

Stacia: I've never felt like we needed to share that. It goes back to the Lucy and Desi thing. Pay the bills and then whatever's left over is yours.

Craig: We [only pay into accounts] for the mortgage. I guess Stacia's thing is, as long as she trusts that I'm not being negligent with money, we like doing our own thing.

How Often We Talk About Money

Craig: We talk about it pretty regularly, but it's not a source of anger. I don't really have a lot of vices. I think my greatest monthly expense is gas.

Stacia: I'd say almost weekly. It might even just be, "Did you pay that bill?" Or "I want to go out to dinner. Do you have enough money left?"

What We Keep Secret

Stacia: We talk about everything and constantly. If anything, I might have a little bit more money than he's aware of.

Craig: We're pretty honest and up front with each other. She does this thing where she'll come up and say, "I'm really sorry. I bought new running shoes." I'm like, "I don't care!" I have implicit trust in her that she's not going to go buy a $6,000 boat or something.

How We Learned To Budget

Stacia: We both came from backgrounds of knowing that anything can change at any time.

Craig: I didn't grow up with a lot of money. My parents have been on both sides of being financially very stable and also exceedingly poor. Basically, there wasn't a lot of talk about how to properly manage finances.

Stacia: My mom's always been the budgeter for the family. She's also a huge Lucille Ball fan—all these old tropes of a guy who comes home with a set of golf clubs and his wife is mad at him—but my parents never got mad at each other about money. Then I read [Lucille Ball's] autobiography, and basically, they bought the house and he put his amount into the mortgage and she put her amount in. He could spend whatever he wanted, and they never fought about money.

Craig: Stacia had an ability to grasp abstract and literal concepts in terms of statistics and dollars and all of that. I wish I had that ability. She's super organized and from the very beginning, I thought, "I trust this person."

Stacia: In my family, money was never a secret. And it was also never a bad thing, like "We can't afford that." So, I just think I knew it was something you had to do.

Craig: When we first moved in together, I would think, "Oh something shiny. I'll buy it. Not a big deal. There'll be money in the future." She really taught me about budgeting, about making sure that I wasn't doing that. But she's never been over my shoulder telling me what I should or shouldn't buy. Having somebody in your life who is responsible and stable—if you're not that person and if you take it upon yourself to listen—can change everything.

Our Biggest Fight About Money

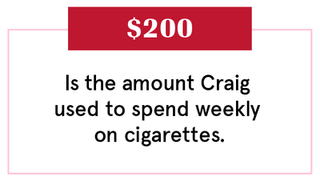

Craig: I was smoking cigarettes when we first started dating. Because she doesn't smoke, she asked, "Oh, how much do you spend?" I told her, and it was something in the realm of $90 a week or something ridiculous.

Stacia: It was $200 a week. When I found out how much cigarettes cost, I was enraged.

Craig: She knew the math didn't work for that. She said, "Yeah, you really need to change that." So, I did. I use an e-cigarette now. I spend less way less than half of that per month.

Stacia: I think that's when the whole thing started rolling, where I started doing budgets for him and going, "Do you realize how much money you'd have if you didn't do this and that?"

How We Pay For The Non-Essentials

Stacia: Typically, we try to alternate. For example, we really don't go out to eat that often; We've actually been trying to go out to eat a little bit more. I think, we have it, we can afford it. I try to go on one small trip a year, and we're actually maybe trying to look into going on vacations in the future.

Craig: We kind of overestimate, I think, what we're going to be spending for fun stuff. Then we just roll that extra over to the next month. So, when it comes down to it, we basically are always operating at a gain. We don't do a lot of spontaneous "we're going to be spending a lot today."

What We're Banking On

Craig: I think someday we want to try to have a larger house with a bigger yard for the dogs. Because I'm not a long-term planning person, I roll with the punches as things come at me. But Stacia's a planning person. We're happy where we are, so anything extra that we do, we'll discuss it and plan it out for the coming time.

Stacia: Right now we're both on the cusp of a career change. Craig is accepting a job offer, and I'm going to be laid off from my job. He has insurance and money for us, and I'm becoming a full-time dog walker and boarder. I'm going to take this opportunity to try something that I really want to do. I realized I've been putting a lot in savings and we can live on less. I'm going to try to just be good to myself for a while and not stress out about money.

Craig: There are times where we're like, "How do people do this? How do people have children? And afford daycare and go out for all these lavish and extravagant vacations and buy homes in extremely affluent areas?"

Stacia: How do people do that? I think, are we doing something wrong? Are we way worse off than everyone else? Does everyone else have a trust fund?

Craig: We're playing it safe for the long game. There are instances where I say to myself, it'd be really nice to have a $3,000 gaming computer. But I think we have realistic expectations of the things we need and the things we want. Is it worth mortgaging off the things that we need for later for things that we want now? It's just not for us.

Interviews have been condensed and edited for clarity. Pseudonyms have been used. Reporting and editing by Katherine J. Igoe. Design and illustration by Morgan McMullen. Animation by Hayeon Kim, Colin Gara, and Danny Ratcliff.

For more stories like this, including celebrity news, beauty and fashion advice, savvy political commentary, and fascinating features, sign up for the Marie Claire newsletter.

RELATED STORIES

-

Suki Waterhouse Wore Adidas SL 72 Sneakers to Coachella

Suki Waterhouse Wore Adidas SL 72 Sneakers to CoachellaGet a pair before they're sold out everywhere.

By Allyson Payer Published

-

Taylor Swift Works a Low-Key Necklace Into Her Gala Outfit

Taylor Swift Works a Low-Key Necklace Into Her Gala OutfitAnd, maybe, a 'Reputation' Easter egg.

By Halie LeSavage Published

-

Emily Blunt's Cuyana Tote Is Already an Editor's Must-Have

Emily Blunt's Cuyana Tote Is Already an Editor's Must-HaveIt's a workwear staple.

By Julia Marzovilla Published

-

Where Did All My Work Friends Go?

Where Did All My Work Friends Go?The pandemic has forced our work friendships to evolve. Will they ever be the same?

By Rachel Epstein Published

-

So You Want a Postnup

So You Want a PostnupNo, they’re not planning to divorce, yet more couples are facing the awkwardness of getting their marital finances in order—after they say “I do.”

By Emma Pattee Published

-

The Two Moms Who Took a Year Off to Travel—Then COVID-19 Happened

The Two Moms Who Took a Year Off to Travel—Then COVID-19 HappenedEvery other Thursday, a couple will get candid with Marie Claire about how they split their finances. This week, we're talking to a couple who decided to travel full-time just before COVID-19.

By Marie Claire Published

-

Warning Working Moms: Your Partner Is Your Glass Ceiling

Warning Working Moms: Your Partner Is Your Glass CeilingBestselling author and essayist Caitlin Moran warns in her new book More Than a Woman that a mother’s career is only as good as the man or woman she marries.

By Jo Piazza Published

-

The Unemployed Couple Squatting in Their Brooklyn Apartment

The Unemployed Couple Squatting in Their Brooklyn ApartmentEvery other Thursday, a couple will get candid with Marie Claire about how they split their finances. This week, we're talking to a couple who haven't paid rent on their apartment in months.

By Marie Claire Published

-

The Blogger Couple Who Made $20,000 When the Pandemic Hit

The Blogger Couple Who Made $20,000 When the Pandemic HitEvery month, a couple will get candid with Marie Claire about how they split their finances. This week, we're talking to a couple who lost revenue during the pandemic, but invested wisely.

By Marie Claire Published

-

The Couple Who Used a Health-Share Ministry for a $1,000,000 Surgery

The Couple Who Used a Health-Share Ministry for a $1,000,000 SurgeryThe latest edition of Marie Claire's Couples + Money series.

By Marie Claire Published

-

The $266k Couple Whose Wife Created an App to Track Their Spending

The $266k Couple Whose Wife Created an App to Track Their SpendingThe couple make $266,000 a year.

By Marie Claire Published