Home

Welcome to Marie Claire, the brand women turn to for style guides, beauty tips, award-winning features, celebrity news, and more.

-

I Found the Ultimate Luxury Cleaning Tools—and They're on Major Sale Right Now

Sponsor Content Created With Dreame

If you need a little spring cleaning motivation.

By Emma Walsh Published

-

Finding These Luxury Candles On Sale Is Like Snagging a Birkin at Half-Price

Run, don't walk, to stock up on your favorite scents this Cyber Monday.

By Brooke Knappenberger Last updated

-

Why Yes, I Do Want My Home to Smell Like a 5-Star Hotel

These luxury candles can make it happen.

By Samantha Holender Last updated

-

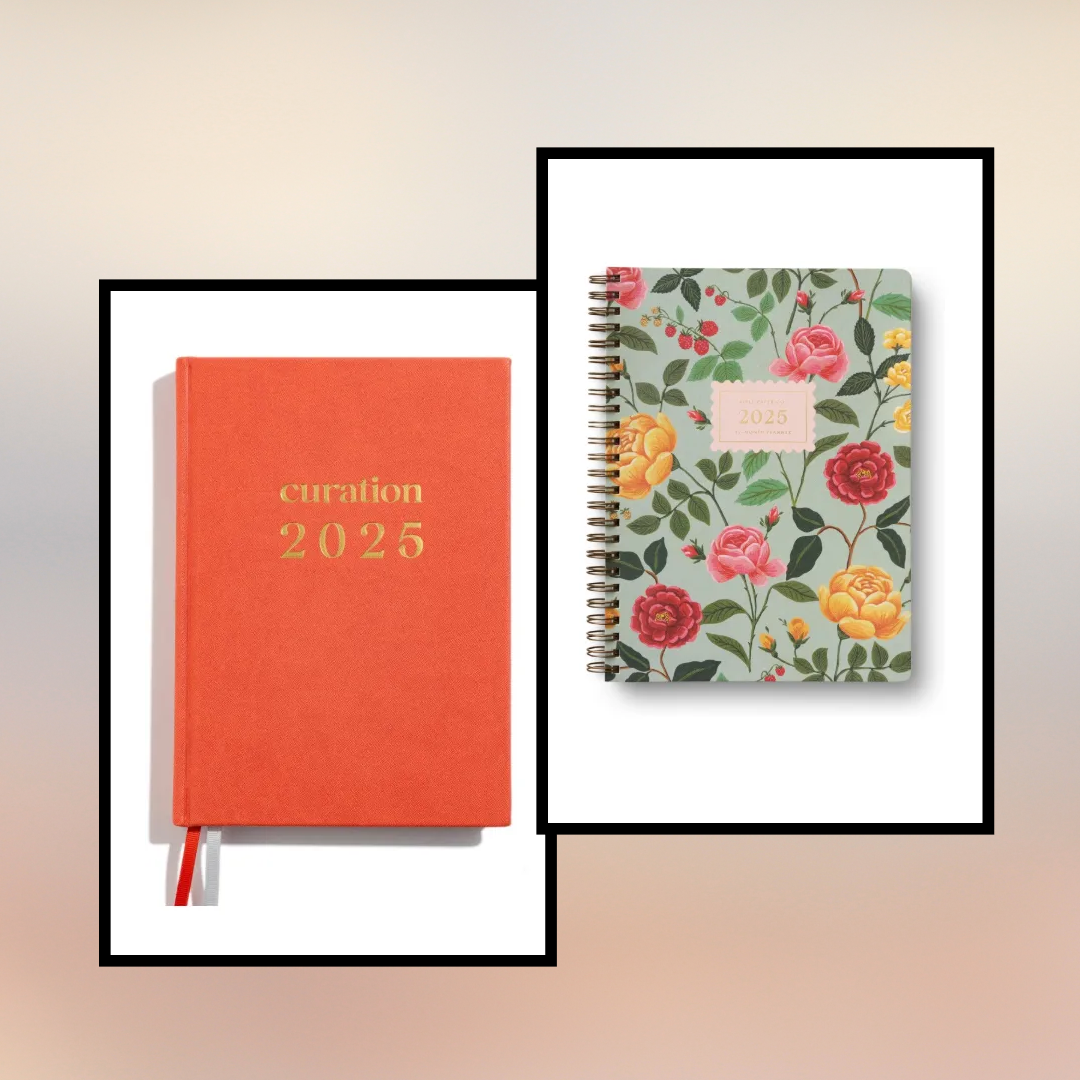

The Best 2025 Planners to Keep You Perfectly Organized All Year

You'll never want to leave home without yours.

By Brooke Knappenberger Last updated

-

62 Gifts on Amazon For Everyone on Your Shopping List

Editor-approved finds in fashion, beauty, home, and more.

By Brooke Knappenberger Last updated

-

This Projector is the Reason I Stopped Going Out on Weekends

And it made my TV obsolete.

By Julia Marzovilla Published

-

Here's the Best Way to Improve Your Sleep Quality

Sponsor Content Created With Sleep Number

By Raina Mendonça Published

-

Every Pet Owner Needs This Holy-Grail Service

Sponsor Content Created With Dutch

By Emma Walsh Published

-

If You Want to Type Comfortably All Day Long, You Need This Keyboard

I'll never use a flat keyboard again.

By Quinci LeGardye Published

-

Power Pick: Smart Mirror InstaView Counter-Depth MAX Refrigerator

"I've officially entered refrigerator heaven."

By Deena Campbell Published

-

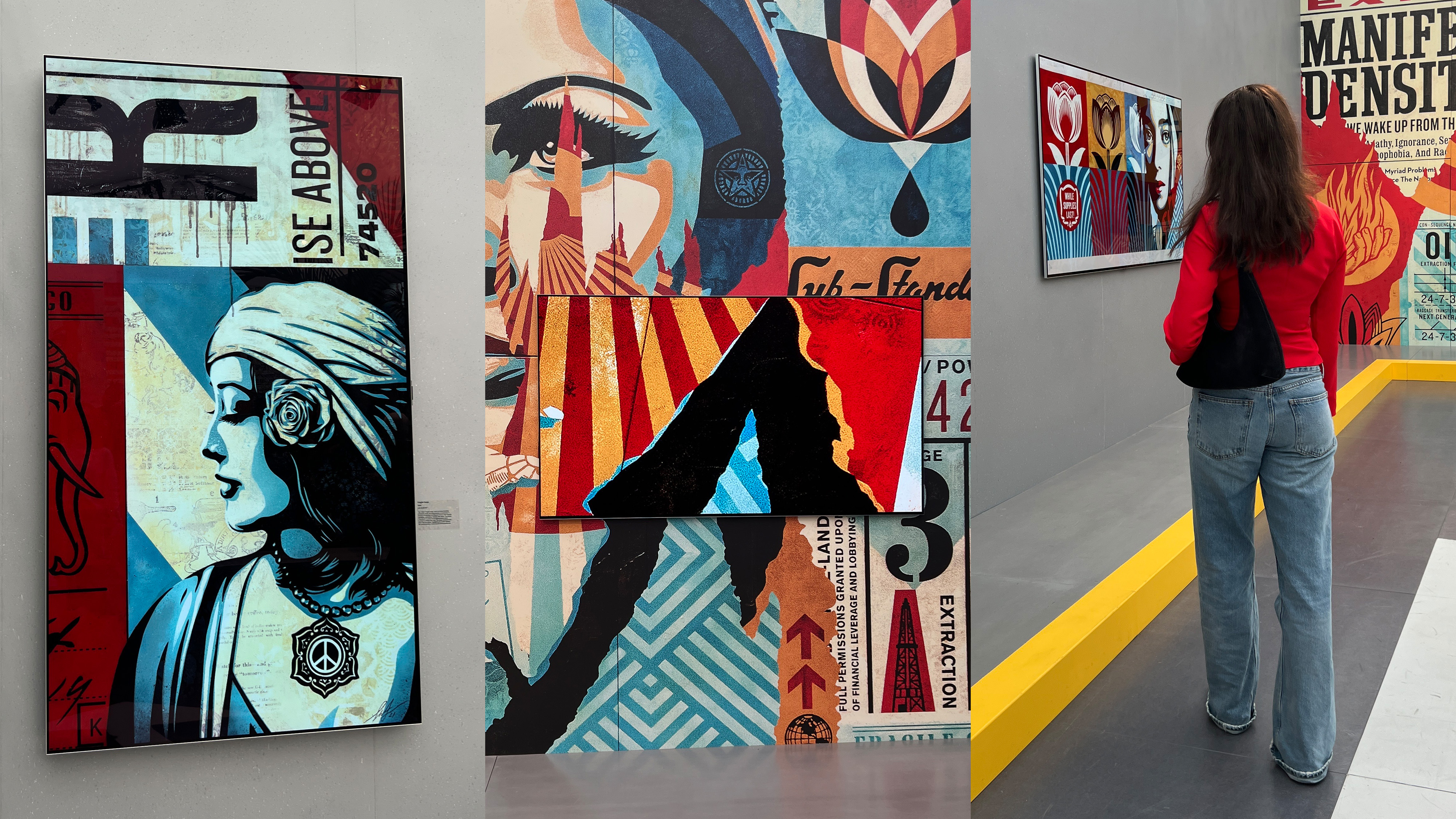

The Art-Meets-Tech Piece That Will Completely Transform Your Living Space

Sponsor Content Created with LG

By Anneliese Henderson Published

-

Virtual Gifts for When You Can't Be There IRL

Show someone how much they mean to you (without leaving your couch).

By Bianca Rodriguez Last updated

-

Le Creuset’s Legendary, 10-Piece Cookware Set Is Over $450 Off For Black Friday

Cook like a professional, at a fraction of the price.

By Gabrielle Ulubay Last updated

-

The Best Dog Gifts for Your Good Boy (or Girl)

You're not a regular dog mom, you're a cool dog mom.

By Jenny Hollander Last updated

-

16 Top-Tier Items to Gift With This Holiday Season

Get a head start this year.

By Raina Mendonça Published

-

Thuma's Cult-Favorite Bed Frame Is the Best Thing I Bought for My New Apartment

Spoiler: It requires no tools to build.

By Julia Marzovilla Published

-

The Key to a Barbie-Girl Summer? A Fun Inflatable Pool

This Barbie beats the heat in style.

By Julia Marzovilla Last updated

-

I Just Moved—These 21 Small Apartment Essentials Are Going in My Cart on Prime Day

Filling your cart on Prime Day = the ultimate small-apartment hack.

By Julia Marzovilla Last updated

-

The Vitamix Blenders With a Cult-Like Following Are 30 Percent Off for Prime Day

Making gourmet easier than ever.

By Gabrielle Ulubay Last updated

-

I'm a Stationery Fiend—10 Must-Haves Are On Sale at Papier This Weekend

Staying organized never looked so pretty.

By Gabrielle Ulubay Published

-

Kylie Jenner and I Share The Same Favorite Phone Case Brand

The serotonin-boosting case I can't go a day without.

By Gabrielle Ulubay Published

-

The Best Home Items From Nordstrom's Winter Sale

Nesting, made simple.

By Gabrielle Ulubay Published

-

Power Pick: NOUHAUS Classic Massage Chair

The chair that turned me into a homebody.

By Gabrielle Ulubay Published

-

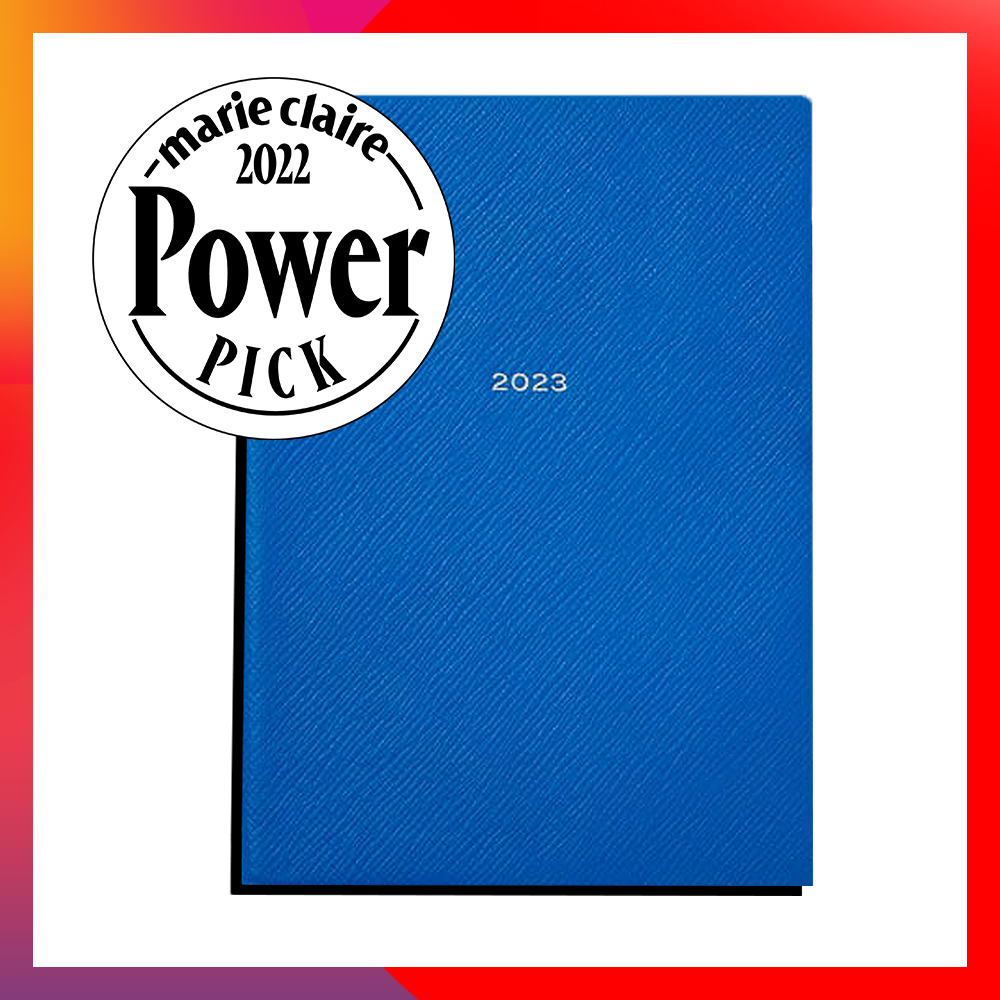

The 2022 Power Pick Awards

Features Our editors talk about the products that powered their days all year long.

By Gabrielle Ulubay Published

Features -

Coffee Carafes That Will Keep Your Coffee Warm for Hours (We Promise)

Plus, an expert breaks down the differences between glass and thermal carafes.

By Julia Marzovilla Last updated

-

Why I Love My Smythson Soho Agenda

Without it, I'd be lost.

By Jenny Hollander Published