Sex and Love

The Marie Claire guide to your sex life, your love life, and everything in between.

-

The Most Discreet (and Effective) Sex Toys for Everyone

Sponsor Content Created With LoveHoney

Give the gift of pleasure.

By Emma Walsh Last updated

-

According to a Sex Expert, These Are the Best Toys to Gift Yourself

Pleasure is the best present.

By Emma Walsh Published

-

16 Toys That'll Reignite Your Sex Life, According to an Expert

Sponsor Content Created With Adam & Eve

Because pleasure shouldn't be taboo.

By Emma Walsh Published

-

Sex Experts and Therapists Stand by These Vibrators

The vibes are immaculate.

By Gabrielle Ulubay Last updated

-

The All-Time Favorite Sex Positions of 11 Real Women

Features "It makes me feel like the sexiest woman on earth."

By The Editors Published

Features -

Non-Phallic Sex Toys to Take Your Pleasure to the Next Level

Pleasure and penetration don’t always go hand-in-hand.

By Gabrielle Ulubay Published

-

Tired of Dinner and a Movie? Try One of These Unique Date Ideas

From bowling and botanic gardens to cooking classics and flea markets.

By Katherine J. Igoe Last updated

-

Sex Toys That Double As Perfect Gifts

Make the holidays sexy this year.

By Gabrielle Ulubay Published

-

Channel Your Inner '50 Shades' With One of These BDSM Toys

Maybe you're kinkier than you think.

By Gabrielle Ulubay Last updated

-

The 15 Best Rabbit Vibrators of 2023

No bunnies were harmed in the making of this list.

By Gabrielle Ulubay Last updated

-

The 16 Best Vibrators On Amazon, Hands Down

Good vibes, delivered straight to your door.

By Gabrielle Ulubay Last updated

-

The 16 Best Sex Toys On Amazon, According To Experts And Reviews

Pleasure, meet convenience.

By Gabrielle Ulubay Last updated

-

Keep The Spark Going With These Non-Cliché Second Date Ideas

You can do better than dinner and a movie.

By The Editors Last updated

-

This CBD-Infused Lube Has a Relaxing Effect, and It Can Be Used With All Toys and Condoms

Good sex should always go smoothly.

By Gabrielle Ulubay Last updated

-

Lovehoney Is Having a Rare Sale on Its Best-Selling, Crazy Popular Sex Toys

The rare sale ends on Sunday.

By Gabrielle Ulubay Published

-

Iconic Sex Toy Brand Velvet Co. Is Throwing a Huge Sale

The brand, known for its beloved thruster toys, is celebrating Masturbation Month in May.

By Gabrielle Ulubay Published

-

A Great Date Doesn't Have to Be Expensive—These Date Ideas Are Fun *And* Affordable

"Love don't cost a thing." —J.Lo

By The Editors Last updated

-

This Luxury Dildo Is Perfect For Easy, Safe Anal Play

You're in for a fant-ass-tic time.

By Gabrielle Ulubay Last updated

-

Anal Vibrators for Every Experience Level

Ass-k and you shall receive.

By Gabrielle Ulubay Last updated

-

Sex Toys For Couples

If you thought toys were just for me-time, think again.

By Gabrielle Ulubay Last updated

-

Woman-Owned Brand Babeland Is Celebrating Women's History Month With A Huge Sale

It turns out that you can save money, treat yourself, and support abortion access all at the same time.

By Gabrielle Ulubay Last updated

-

The 13 Best Bullet Vibrators of 2024

These toys are right on target.

By Gabrielle Ulubay Last updated

-

The 16 Best Sex Toys for Beginners

If you don't start somewhere, you'll never know how to finish.

By Gabrielle Ulubay Last updated

-

Found: Dildos for Every Penetrative Preference

These products are hard to resist.

By Gabrielle Ulubay Last updated

-

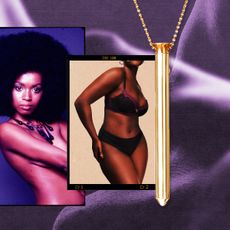

A Vibrator Necklace Is the Ultimate Feminist Accessory

Show the world that you always put yourself first.

By Gabrielle Ulubay Published

-

Save Hundreds On Sex Toys, Lingerie, And More With Lovehoney's V-Day Sale

High-quality orgasms, low budget.

By Gabrielle Ulubay Published